CK Asset postpones sale of luxury flats estimated to cost more than US$12.7 million citing social turmoil

- The developer said that it would find it tough to sell the luxury residential project in Hong Kong’s upmarket Mid-Levels district

CK Asset Holdings, the second largest developer by market value in Hong Kong, has become the latest builder to defer the sale of its luxury residential project, as 10 weeks of social turmoil has severely hurt consumer sentiment.

The as-yet unnamed project at 21 Borrett Road, in Mid-Levels, was originally expected to be released for sale this month.

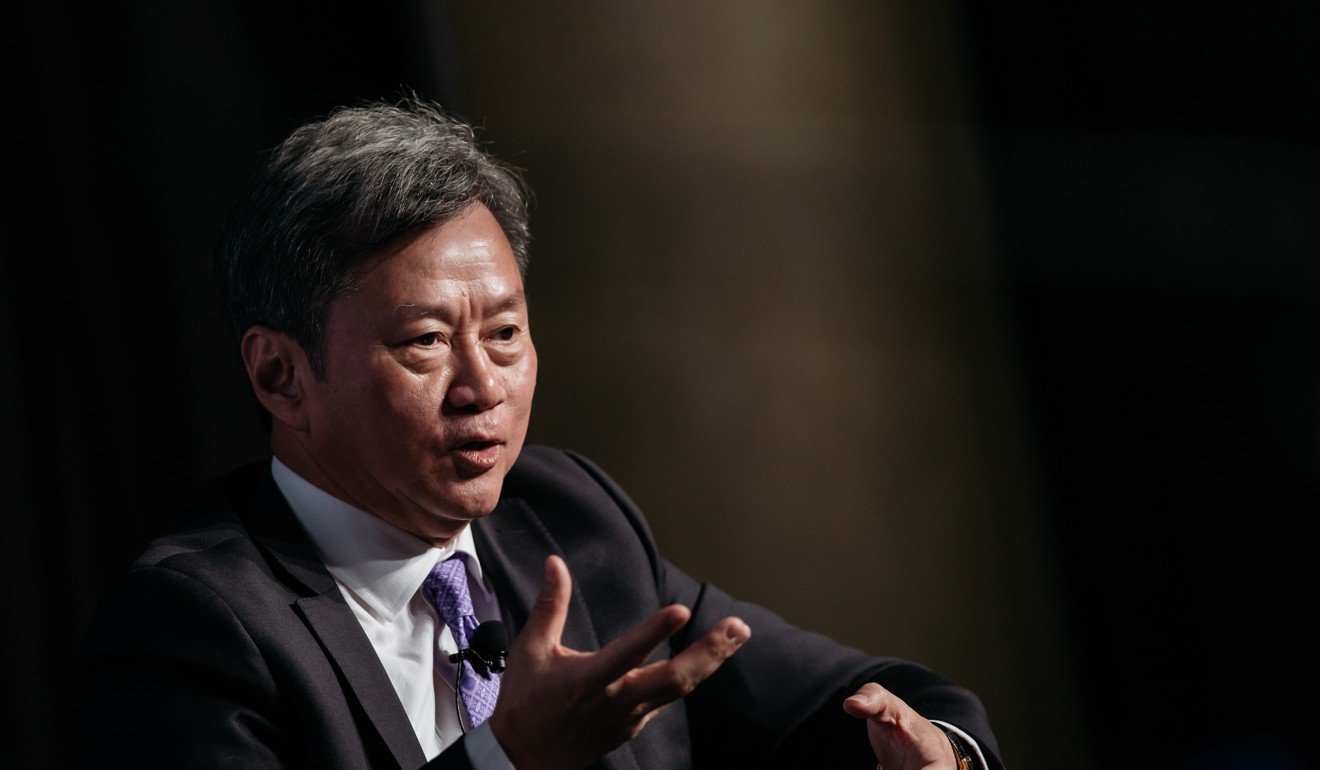

Executive director Justin Chiu Kwok-hung said on Tuesday that the group had decided to postpone the sale of the luxury flats that would cost more than HK$100 million (US$12.7 million) each.

“We will have difficulties in selling such luxury apartments right now,” Chiu said.

Hong Kong’s economic growth, which shrank in the second quarter from the first, had been in a downbeat mood this year, squeezed as it has been by the year-long trade war between the United States and China. The sentiment has deteriorated further after protests against the now-suspended extradition bill started on June 9.

Chiu noted that there was a growing risk of an economic downturn in Hong Kong in the second half as he did not expect the trade war to be easily resolved and saw the protests hurting consumer spending.

The first phase of the project’s sale would have seen the release of 115 units out of a total of about 180, with an estimated value of HK$14 billion, according to agents.

Sun Hung Kai, MTR defer sale of 1,172-flat Cullinan West III project as Hong Kong’s protest rallies take their toll on market mood

CK’s decision to postpone the sale comes a day after Sun Hung Kai Properties, the city’s largest developer by market value, deferred the launch of Cullinan West III.

The 1,172 flats at the mega project atop Nam Cheong MTR station will now be released upon their completion instead of this month, said David Tang, property director of MTR Corporation, the project’s joint partner.

The project is expected to receive the occupation permit by the year-end.

The cautious mood is rubbing off on buyers as well, who have walked away from a number of deals recently.

On Tuesday, five transactions at the L’aquatique residential development in Tsing Lung Tau, western Tsuen Wan were aborted, with the buyers forfeiting a total of HK$3 million to the developer MCC Real Estate Group.

Far East picks up ‘smallest’ land plot at Kai Tak at discount, as public unrest deters developers from long-term investments

Chui, however, said CK Asset would release other mass residential projects for sale as soon as possible “even if the market accepts a price lower than our expectation”.

“Developers have a responsibility to addressing [the city’s] housing needs.”

He said that he expects the 876-unit Seaside Sonata housing project in Sham Shui Po, its first project of 2019, to receive pre-sale consent this month. The project, jointly developed with the Urban Renewal Authority, is expected to pull in sales of HK$8 billion.

Separately, Swire Pacific, the parent of Swire Properties, said in a statement on Tuesday that it was deeply concerned by the ongoing violence and disruption impacting Hong Kong.

“We resolutely support the Hong Kong SAR Government, the Chief Executive and the police in their efforts to restore law and order. We condemn all illegal activities and violent behaviour, which seriously undermine the fundamental principle of “One Country, Two Systems” as enshrined in the Basic Law.”