Hong Kong’s biggest land auction attracts three bids as Kowloon site near protest flashpoint loses value

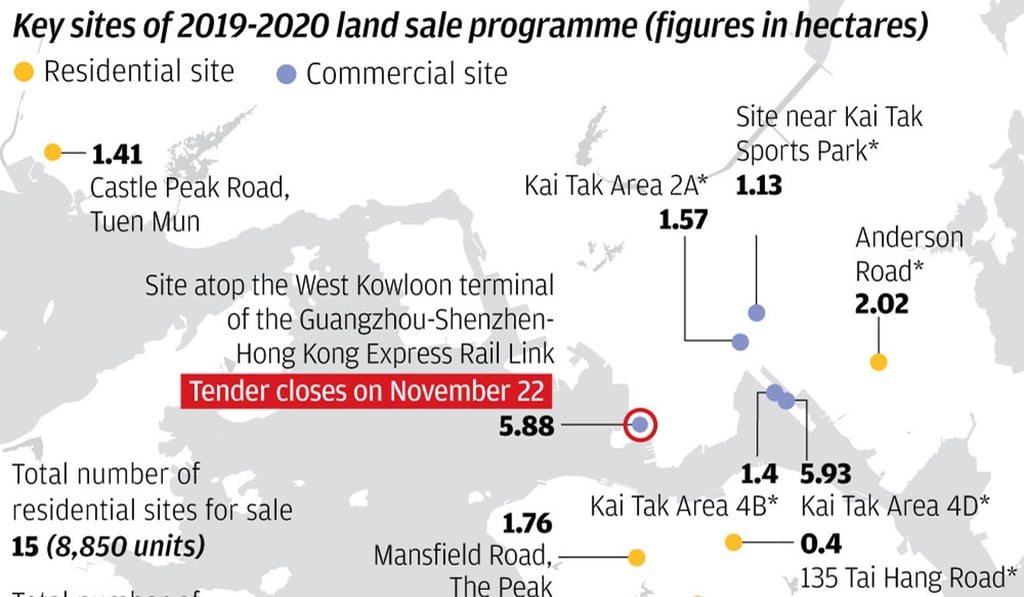

- Sun Hung Kai Properties, CK Asset have submitted bids for the 5.88-hectare commercial site atop the West Kowloon high-speed rail terminus

- Wharf and four other developers are making a joint bid for Kowloon site near recent protest flashpoint

Hong Kong’s biggest land auction, involving a site that became the latest flashpoint in more than five months of anti-government protests, has attracted three bids from among the city’s richest developers.

Sun Hung Kai Properties and CK Asset Holdings have submitted bids for the 5.88-hectare commercial plot atop the West Kowloon high-speed rail terminus, company officials told the South China Morning Post. A consortium comprising Wharf Holdings, Sino Land, Henderson Land Development, Chinese Estate Holdings and Lifestyle International Holdings also lodged a bid. The Lands Department spokesperson confirmed the number of bids by phone when contacted by the South China Morning Post.

The auction may test investor appetite and underline the extent of damage to market valuation over the past six months as anti-government protests turned off buyers and pushed the economy into a recession. Since the government unveiled the site as part of its 2019-2020 auction programme in March, the value of the site has shrunk by as much as 63 per cent based on analyst estimates.

“Although Hong Kong is clouded by uncertainties, it would be short term,” said Stewart Leung Chi-kin, vice chairman of Wheelock & Co, which controls Wharf and confirmed the bid. “It is hard to say that we can take the poor market sentiment to pick up a bargain. Everyone has a different view.” Wheelock Properties is a unit of Wheelock & Co Sun Hung Kai Properties is going in alone, while CK Asset Holdings declined to say if the group is joining hands with others in the auction, according to their spokespersons.

The size of the site is the largest to be put up for sale in state auctions thus far. It equals the surface area of 47 Olympic-size swimming pools and is located in the vicinity of Tsim Sha Tsui tourist attraction and Poly University, where police laid siege on the campus last week amid the fiercest battle yet with radical protesters.

Property consultants expected the site to fetch between HK$27,000 and HK$35,000 per square foot or HK$79 billion and HK$110 billion in January, before a controversial extradition bill led to months of social unrest. Alex Leung, a senior director at CHFT Advisory and Appraisal, today pegged its value as low as HK$13,000 per square foot, or HK$41 billion.