Exclusive | Hong Kong luxury hoteliers to delay 1,000-odd new rooms in market at disastrous levels due to pandemic and protests

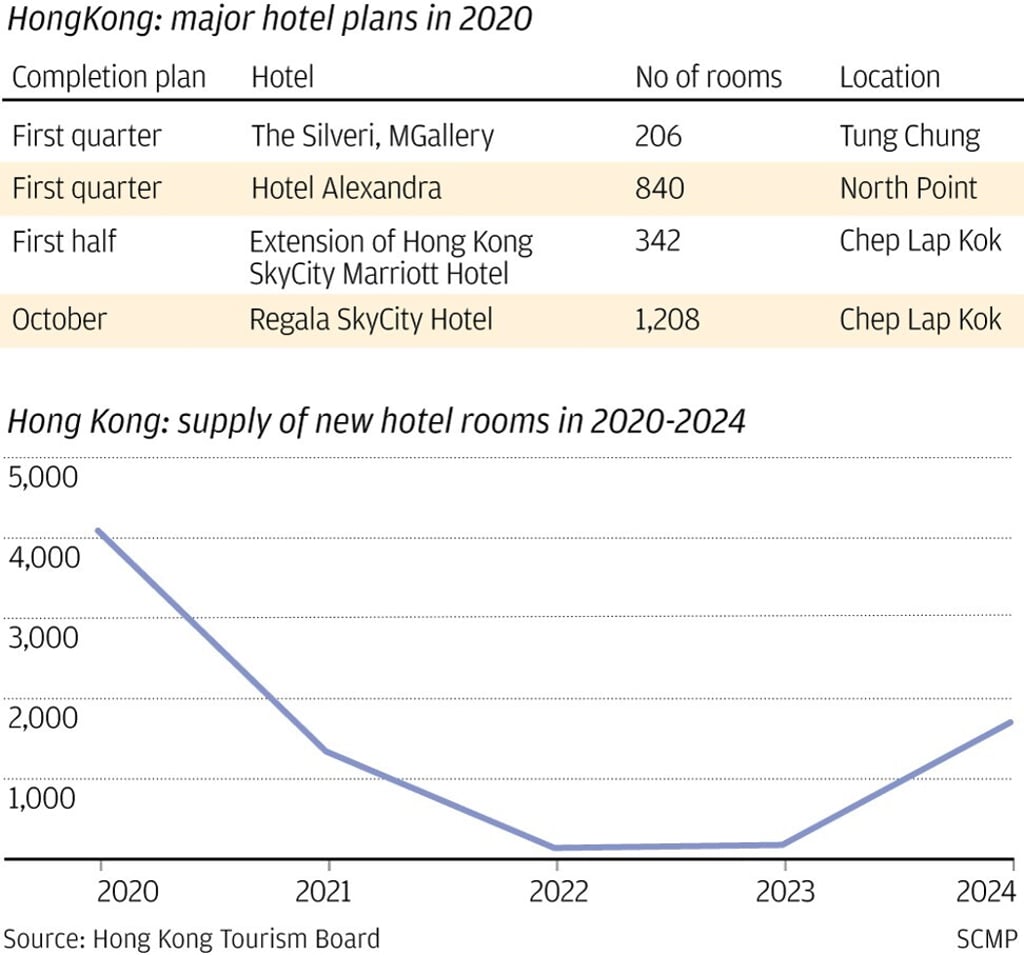

- CK Asset Holdings has deferred the opening of its 840-room Hotel Alexandra in Fortress Hill to a later date

- A consortium has pushed back the 206-room The Silveri Hong Kong MGallery in Tung Chung by at least six months

CK Asset Holdings has deferred the opening of its 840-room Hotel Alexandra in Fortress Hill to a later date while a consortium of Hong Kong’s biggest developers has pushed back the 206-room The Silveri Hong Kong MGallery in Tung Chung by at least six months.

“The hotel opening is postponed due to the current virus situation,” Christina Cheng, general manager of Hotel Alexandra, said in an email. “There’s no confirmed opening date at this stage.”

The Silveri Hong Kong will open by June 30 instead of its original plan for the end of 2019, citing delay in construction schedule, according to a spokeswoman at Citygate Development, whose owners are Swire Properties, Henderson Land Development, Sun Hung Kai Properties, New World Development and Hang Lung Properties.