Vanke sells all flats at Hong Kong development, defies worsening Goldman Sachs forecast for property sector

- More than 46 buyers were competing for each flat on sale at The Campton

- Home prices will fall 25 per cent from mid-2019 levels if the impact of the coronavirus lasts until the third quarter and anti-government protests intensify

Vanke Holding (Hong Kong) sold all 188 flats on sale at its The Campton development in Hong Kong’s Cheung Sha Wan area on Wednesday. The outcome defied a forecast by investment bank Goldman Sachs, which revised down its estimates for local housing prices, office and retail rents by 5 to 15 percentage points this week.

One buyer even splashed out HK$30 million (US$3.87 million) for four flats, according to Centaline Property Agency.

With 8,700 registrations of intent received, more than 46 buyers were competing for each flat on sale. The flats, a first batch, cost HK$16,411 (US$2,117) per square foot on average after discounts, the lowest price recorded in the city’s Kowloon district for four years for new projects. Vanke Holdings (Hong Kong) is held by Hong Kong-listed Vanke Overseas Investment Holding, a subsidiary of China Vanke, one of mainland China’s biggest property developers.

“Over the near term, we expect developers to take advantage of the current window of pent-up demand and hasten their pace of releasing primary units,” said Henry Mok, senior director of capital markets at JLL in Hong Kong. “Asking prices are likely to stay reasonable, with a view to reducing inventories and taking advantage of the recovering market sentiment.”

The sale went ahead despite citywide protests against a proposed national security law and the controversial National Anthem bill. In fact, two police officers visited the sales venue in Tsim Sha Tsui and even questioned the staff in the morning.

02:22

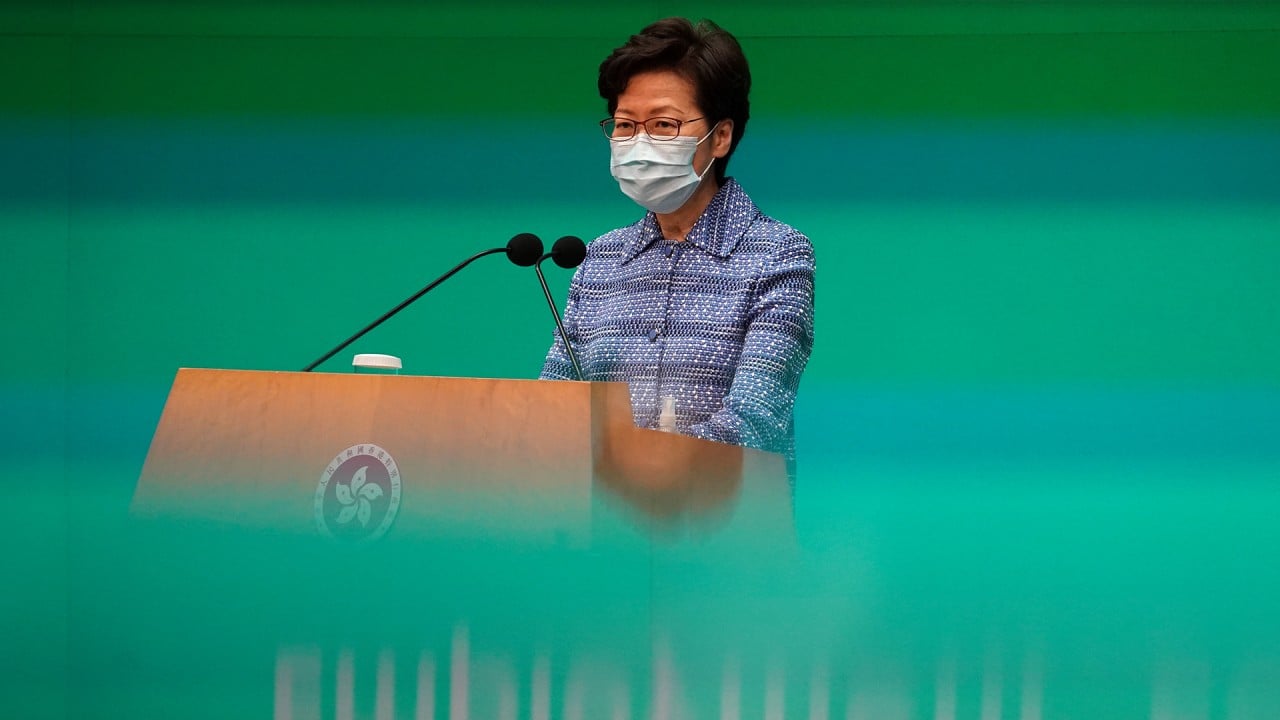

Hong Kong freedoms will not be eroded by Beijing’s national security law, Carrie Lam says

A young buyer, who only gave his surname as Yeung, said he was worried the national security law would dampen the housing market sentiment. But in the long term, “cash will depreciate” while housing will still see strong demand, he said, explaining his decision to buy a two-bedroom flat for HK$6 million for leasing purposes. He said The Campton was cheaper than other new projects.

Other buyers seemed unperturbed by the proposed law, which Beijing said during the ‘two sessions’ last week it would enact for Hong Kong. A buyer who only gave her surname as Lee, said the proposed law would not affect the housing market very much. She added that, as she was unfamiliar with the stock market, she was investing in property. Lee bought a two-bedroom flat for HK$8 million.

Tam, a middle-aged buyer, said he would seek a mortgage with a 80 per cent loan-to-value ratio for a HK$8 million flat, and did not let the proposed law colour his decision.

Hong Kong homebuyers forfeit US$1.5 million in deposits, walk away from purchases

Goldman, in a report on Monday, said home prices will fall 25 per cent from mid-2019 levels if the impact of the coronavirus pandemic lasted until the third quarter and the city’s anti-government protests intensified. In April, it had forecast a 20 per cent decline.

In the worst-case scenario, wherein the impact of the outbreak lasts until the first half of next year, home prices will be down 40 per cent from the mid-2019 levels, while office and retail rents in prime locations will fall by half.

“We see renewed concerns on heightened social disruption, and increased uncertainties on international assessments of the situation in Hong Kong,” the report said. “We see heightened macro uncertainties as potentially leading the physical real-estate market towards another bumpy period ahead, and thus we expect risk premia for property stocks to remain elevated in the near term.”

Developers use forced auctions to snap up Hong Kong’s older buildings for redevelopment

The turnout for The Campton came less than a week after Sun Hung Kai Properties, Hong Kong’s biggest developer, sold 192 units out of the 200 available for sale at its Wetland Seasons Park development on Saturday, May 23.

Elsewhere, Tai Cheung Holdings won the tender for a plot of residential land in Ap Lei Chau. Sold for HK$1.33 billion, according to the Lands Department, the plot went for a price at the upper end of market estimates, which ranged between HK$769 million and HK$1.6 billion. The site can have flexible gross floor area depending on whether retail space is included. Its price translates to HK$14,448 per square foot, if retail space is included. If it is only a residential building, its price will be HK$15,097 per square foot, according to Midland Surveyors.

The plot attracted 16 bidders. The four other residential sites the government has sold through tender this year have all attracted an average of 14 bids. Developers appear to be more positive about the residential market. The only commercial site put up for tender this year, at Kai Tak, attracted only four bids, and none of them met the government’s reserve price.

“We remain cautious about the sector, as downside risks appear to be building up. With the latest unemployment rate reaching a 10-year high at 5.2 per cent, and likely to increase further, the economic well-being of prospective buyers as well as owners will inevitably be affected,” said Nelson Wong, head of research in Greater China at JLL. “Housing prices may soften along with the weakening broader economy and other property sectors.”