Investors shun commercial real estate as Hong Kong grapples with coronavirus impact, political fallout

- Cross-border commercial property deals in Hong Kong fell to 5 per cent of total transactions in the second quarter, the lowest since 2007, according to RCA

- Investors to focus on data centres, while avoiding retail and hospitality assets

Hong Kong’s commercial real estate market is expected to be hobbled by uncertainty surrounding the controversial security law, with transactions already growing at the slowest pace since the global financial crisis, analysts said.

“It’s twofold with Hong Kong. There were the political issues, and then the virus, and then back to political issues,” said David Green-Morgan, managing director at RCA, which tracks deals worth at least US$10 million. “It’s been a pretty rough nine months or so.”

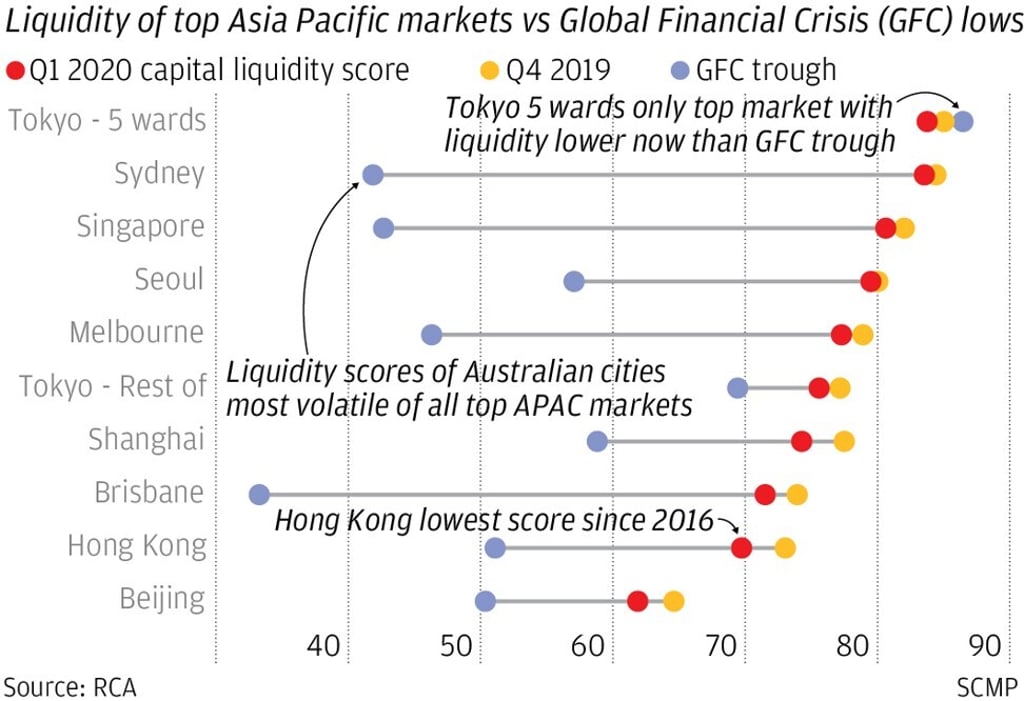

This year, cross-border commercial property deals in Hong Kong have dwindled to 5 per cent of total transactions in the second quarter, the lowest since RCA began collecting data on the local market in 2007. No deal was recorded in the first quarter, making it Asia-Pacific’s second least liquid market after Beijing.

There were 19 deals involving properties valued at least HK$100 million (US$13 million), according to data compiled by property consultancy Cushman & Wakefield. It represents a 71 per cent retreat from a year earlier, with investment volumes at their lowest since the 2008 crisis.