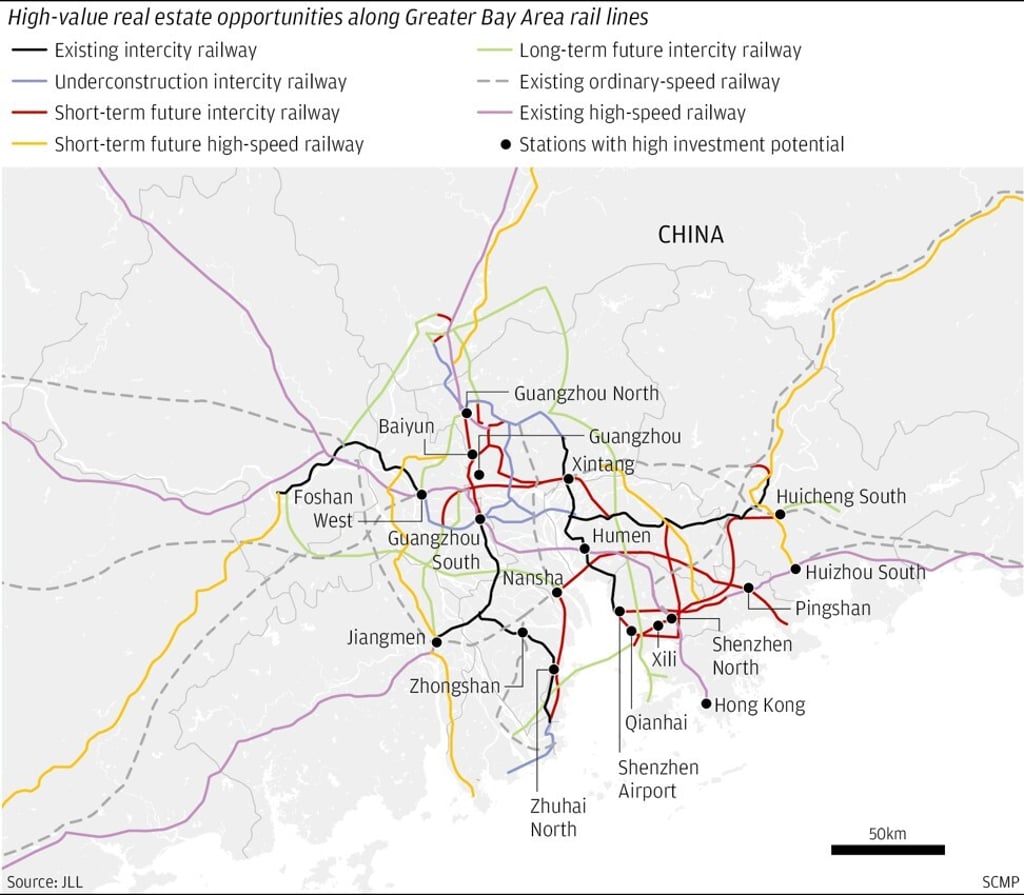

Competition heats up as Hong Kong developers take on mainland Chinese rivals to buy land next to bay area’s high-speed railway stations

- In the next three to five years, 18 stations will be offered for tender, with potential to be developed under the so-called transport-oriented-development (TOD) model

- Competition is becoming fierce as Hong Kong property giants join their mainland Chinese rivals in bidding for projects with TOD concepts in the bay area

In the next three to five years, 18 stations – some under construction, some already operating – will be offered for tender, with high potential to be developed under the so-called transport-oriented-development (TOD) model. This model, likely to be promoted by local governments in the bay area as the preferred basis of development, places an emphasis on making maximum use of mass transport facilities.

China’s high-speed rail network will nearly double in length to 700,000km by 2035, according to a new blueprint published on Thursday by the China Railway Group, the state-owned railway builder.

He said competition was becoming fierce as local property giants joined their mainland Chinese rivals in bidding for projects with TOD concepts in the bay area, Beijing’s ambitious plan to integrate Hong Kong, Macau and nine cities in Guangdong province to create a huge business and innovation hub.