Veteran Hong Kong investor proposes public-private partnership to fund controversial Lantau Tomorrow Vision plan

- The proposed scheme involves setting up a company with an equity of HK$100 billion, with three-quarters to be owned by Hong Kong residents

- The overall proposal involves raising a total of HK$1.1 trillion, with plans to eventually list the public-private company on the Hong Kong stock exchange

The “Popular Public Private Partnership” put forward by Sing Wang involves setting up a company with an equity of HK$100 billion, with three-quarters to be owned by Hong Kong residents on a “one person one share” basis.

“If the government fortunately does approve it, and fortunately my private company can participate … I will donate 70 per cent of profits to Hong Kong,” said Wang. “I need to make some money for the work. [But] I’m not doing this not for maximising personal wealth. This is not my goal.”

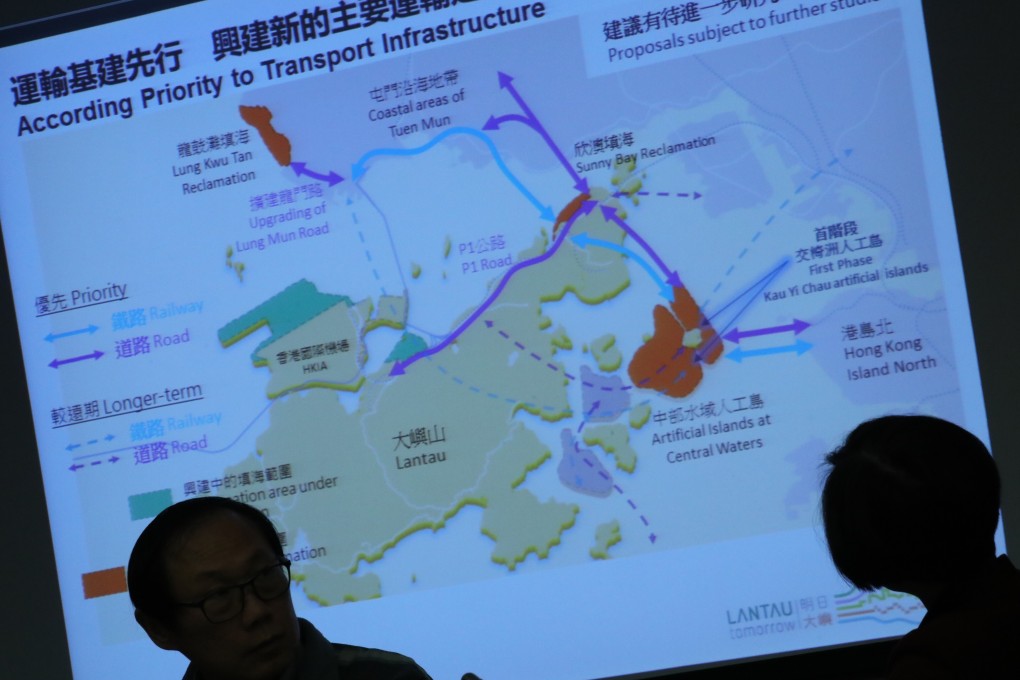

The Hong Kong government’s ambitious plan involves building 1,700 hectares (4,200 acres) of artificial islands – an area equivalent to one-third of Kowloon – in the waters around Kau Yi Chau and Hei Ling Chau between Lantau and Hong Kong Island. But the scheme has drawn criticism for its massive cost and potentially irreversible environmental damage.