Number of bids for Kai Tak residential plot falls below 2017 market peak, as recession, pandemic weigh on developer appetite

- Bids could be conservative, given the recent economic environment, Knight Frank executive says

- 10 bids have been submitted by developers such as Sun Hung Kai Properties, CK Asset Holdings and Sino Land, among others

The first residential plot at the site of Hong Kong’s former airport put on sale by the government this year has drawn a less than enthusiastic response from developers.

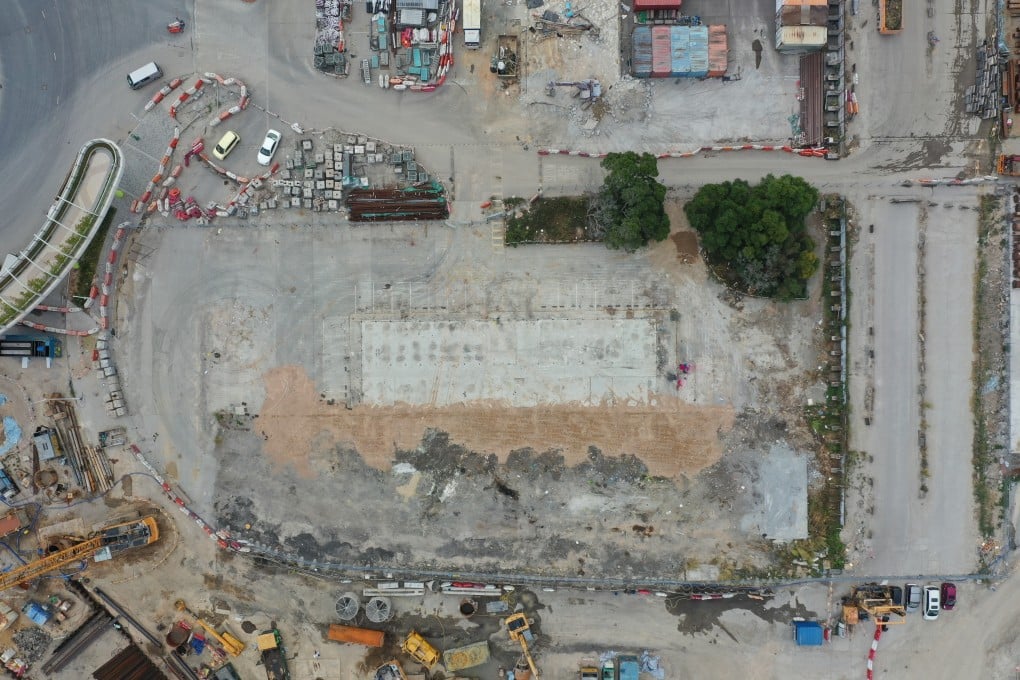

The tender of Area 4E Site 1 at Kai Tak closed on Friday and drew 10 bids, according to the Lands Department. Residential plots at the former airport drew on average more than 16 bids during a market peak in 2017, according to JLL data.

The 59,719 sq ft site can yield up to 328,453 sq ft in gross floor area, and can accommodate 500 to 1,000 flats depending on their sizes. Lam estimated that the project would need an investment of HK$6 billion to HK$7 billion and could yield flats worth about HK$28,000 per square foot.

Amid a general decline in home and land prices, the market valuation of the plot ranges from HK$3.28 billion to HK$3.94 billion, or HK$10,000 to HK$12,000 per square foot. Land prices at Kai Tak peaked at HK$19,636 in May last year.