Data centres, logistics assets to gain more allocation from investors as Covid-19 amplifies supply deficit

- Data centres and suburban offices will appeal to investors in 2021 as people get accustomed to working in remote offices, M&G Real Estate says

- Hong Kong remains a top financial hub as its role is enhanced by facilitating capital flow in and out of mainland China

Faster adoption of e-commerce has boosted the appeal of logistics properties as supply deficit grows, especially in markets with large populations such as Australia, Japan and South Korea, according to M&G Real Estate in Asia, part of UK-based group with about £271 billion (US$371 billion) of assets globally.

“Working remote will be much more acceptable and people will start doing that,” said Richard van den Berg, a Singapore-based fund manager at M&G. “What we can see is that central business districts (CBDs), centre locations, for core strategies will remain important … while high quality, suburban locations in residential areas will see some growth there as well.”

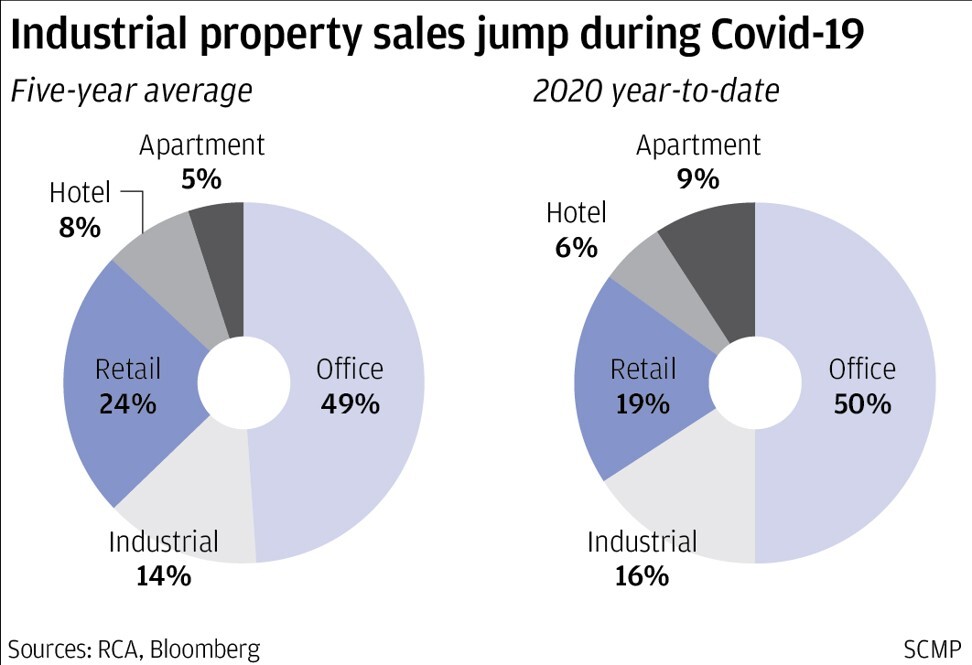

Offices, logistics and industrial assets as well as data centres were the top three asset classes to invest in 2021, according to a report by real estate consultancy Colliers International, based on a survey of 74 investors in 18 cities in Asia-Pacific in late last year. Appetite for data centres was aided by the growth of e-commerce, especially in Shenzhen, Seoul and Tokyo, where the network infrastructure is mature, the report showed.

Underscoring that trend, Mapletree Investments earlier this month won an auction for an industrial site in New Territories for HK$812.9 million (US$104.9 million), which at HK$3,750 per sq ft is a record high for the market segment in northern New Territories. The site could be used as a data-centre facility. China Mobile, the world’s biggest telecoms group by subscribers, offered HK$5.6 billion for a site in Sha Tin in July.

More hybrid properties with retail and logistical functions can be expected to come to the market over the next 10 years as e-commerce becomes more entrenched, van den Berg said. Growing e-commerce during the pandemic had elevated consideration for environmental, social and governance (ESG) issues in investment strategies, he added.

In the retail segment, lockdown fatigue has caused consumers to shop and dine at malls located in suburban areas, said Jonathan Hsu, head of research at M&G Real Estate, citing Singapore as an example. As such, physical retail stores should not be overlooked despite the online shift, he said.

While short-term down cycle from the pandemic and street protests had affected investments towards the city, Hong Kong’s status as a financial hub would remain intact, according to M&G. While other cities in the region may take over part of Hong Kong’s historical role as a leading international financial centre, the growth of China will compensate for that, said van den Berg.

“Hong Kong has a great long-term future, and clearly that long-term future is going to be intertwined much more with China than historically it was,” he added.