Victor Li’s CK Asset scores first win at Kai Tak, bags last residential plot on former airport’s runway

- Developer wins plot for HK$10.28 billion (US$1.33 billion), or HK$15,861 per square foot, Lands Department says

- Price reflects confidence in Kai Tak residential market, surveyors say

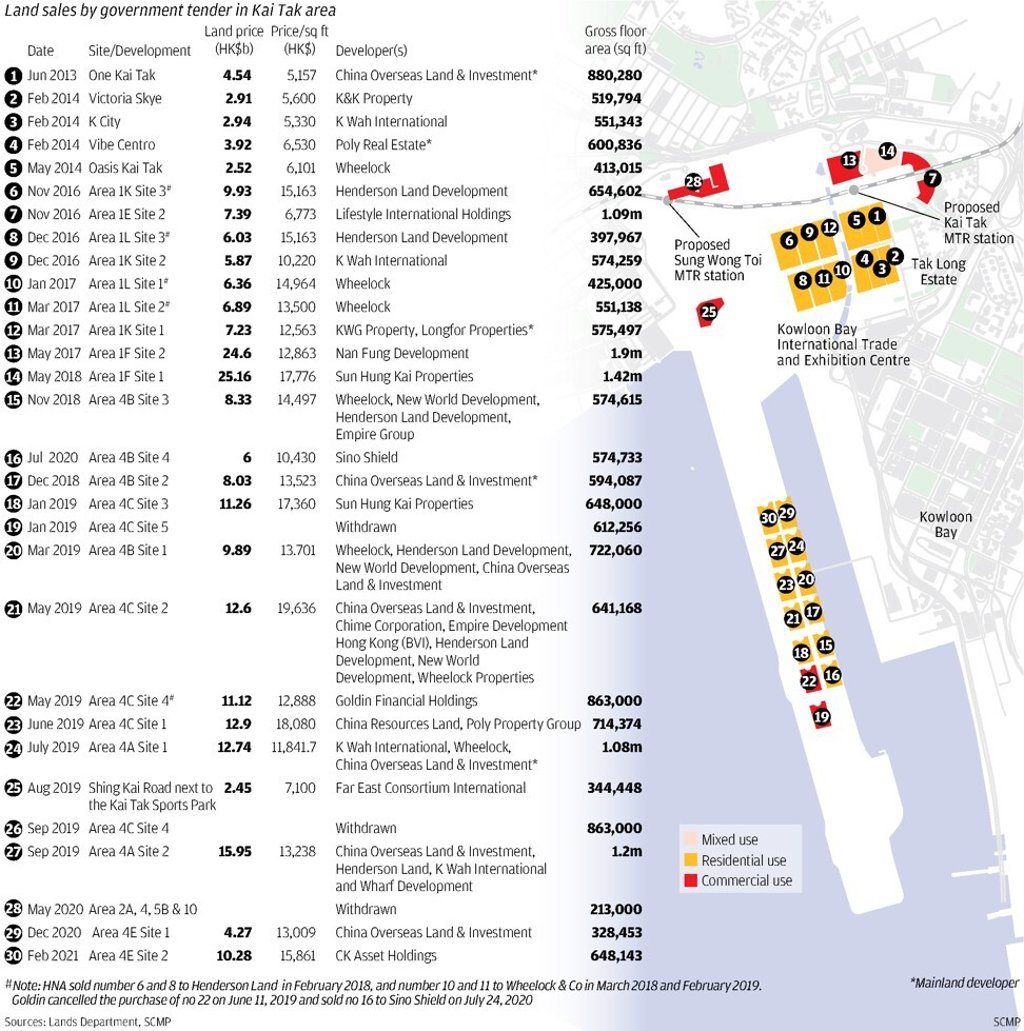

The developer won the plot for HK$10.28 billion (US$1.33 billion), or HK$15,861 per square foot, the Lands Department said. Its price, at the upper end of market expectations, reflected confidence in the Kai Tak residential market among the city’s developers, surveyors said.

“The winning bid is a little higher than [what we] expected, and the price is very satisfactory. It shows that major developers are confident in the outlook for Kai Tak’s residential market,” said Thomas Lam, executive director at Knight Frank.

The sale comes despite Hong Kong’s worst recession on record and rising unemployment. Market activity has, however, increased recently as the coronavirus outbreak is brought under control. For instance, Wheelock Properties sold more than 300 flats at its Monaco project at Kai Tak in half a month, underlining high demand for apartments in the area.

The tender attracted five bids, a number lower than market expectations, on Thursday last week. CK Asset beat K Wah International, Sino Land, Sun Hung Kai Properties and a joint venture of Wheelock Properties and Hysan Development. The price it paid is the highest on a per square foot basis since China Resources Land and Poly Property Group won Area 4C Site 1 at HK$18,080 per square foot in June 2019.