Bad news for Shenzhen housing speculators as officials steer home prices below market levels

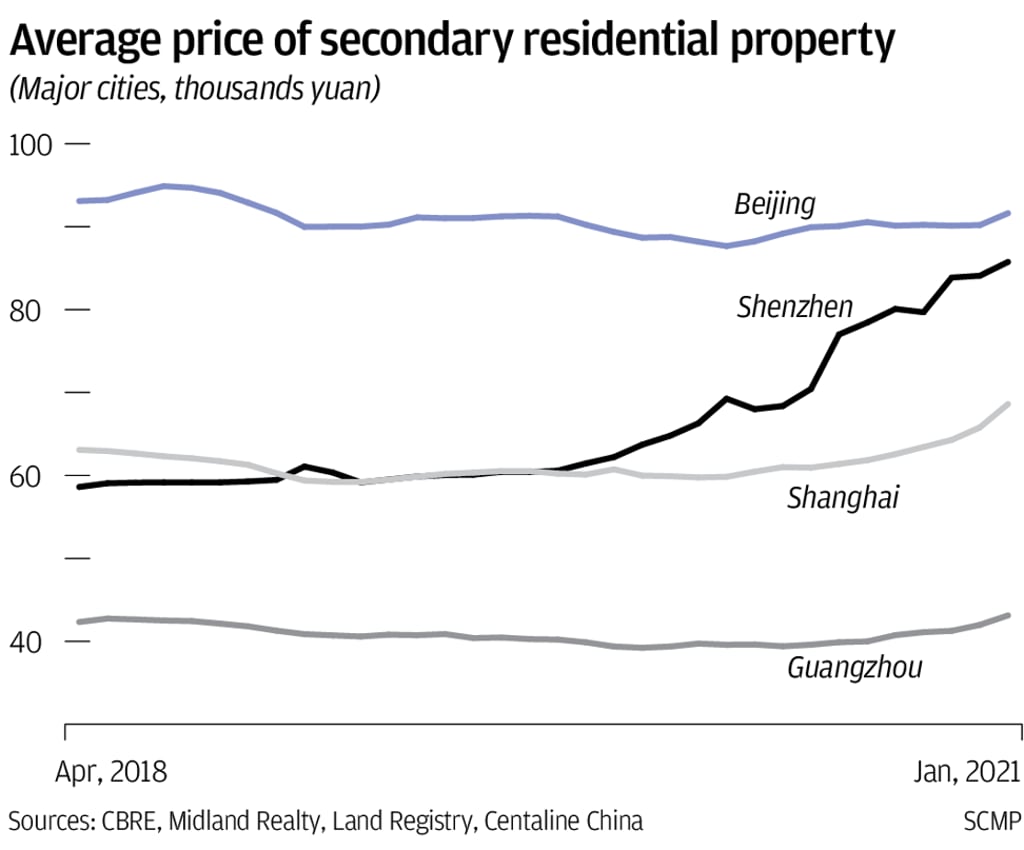

- Shenzhen recorded a 48.4 per cent jump in prices over the past two years in February, outpacing gains in major Chinese cities

- Some banks are said to have adopted the city’s reference prices for lived-in homes, potentially squeezing mortgage loan valuations and chilling demand

The reference prices are about the same levels as those marked in new launches, and about 10 to 40 per cent below those cited in the secondary market, analysts said. This may chill demand as banks tighten mortgage loan financing based on lower valuations and homebuyers are forced to come up with higher down payment, they added

“This policy is quite hawkish to the Shenzhen’s housing market,” said Raymond Cheng, a managing director at CGS-CIMB Securities. “In the short term, secondary market transactions will be frozen.”

China’s economic recovery from the Covid-19 pandemic has also underpinned confidence in spending. New home prices in 70 major cities rose 0.28 per cent in January from December, the government said on Tuesday. Secondary market prices rose 0.37 per cent, the most in 18 months.