China Evergrande plans to build a HK$4 billion Versailles-like mansion on wetland near Hong Kong’s border with Shenzhen

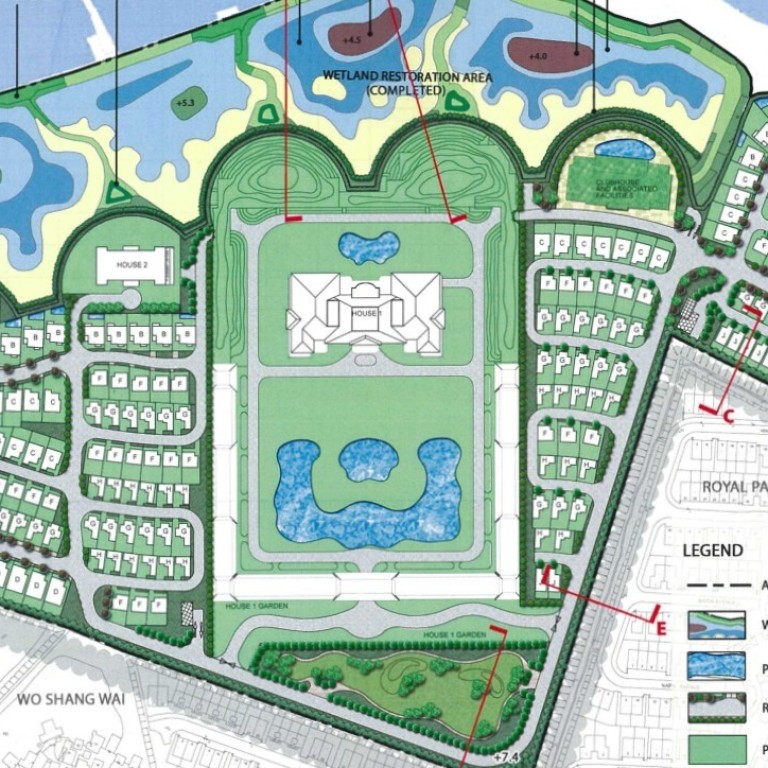

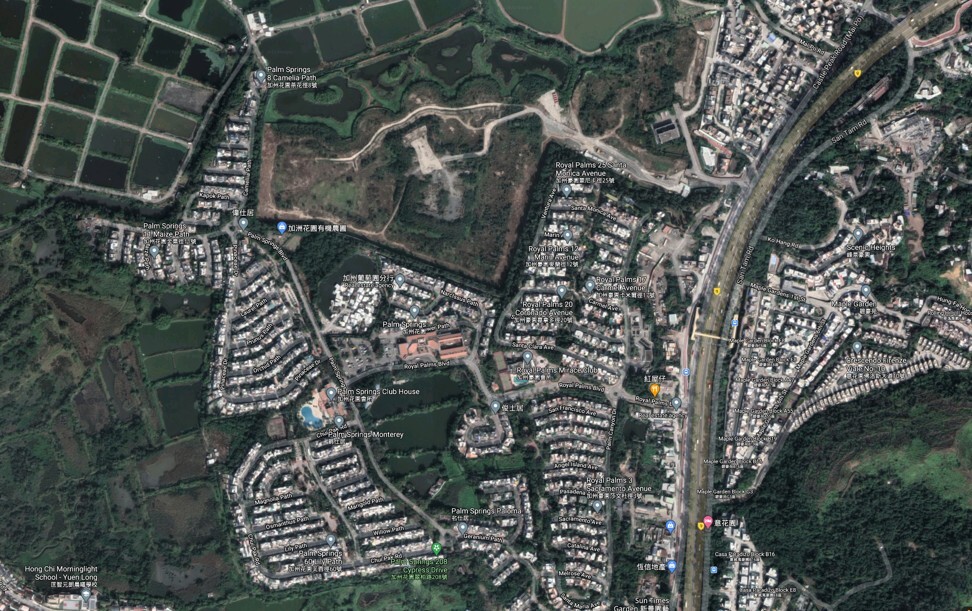

- China Evergrande has converted a 2.4 million sq ft plot near the Mai Po Wetlands in Yuen Long

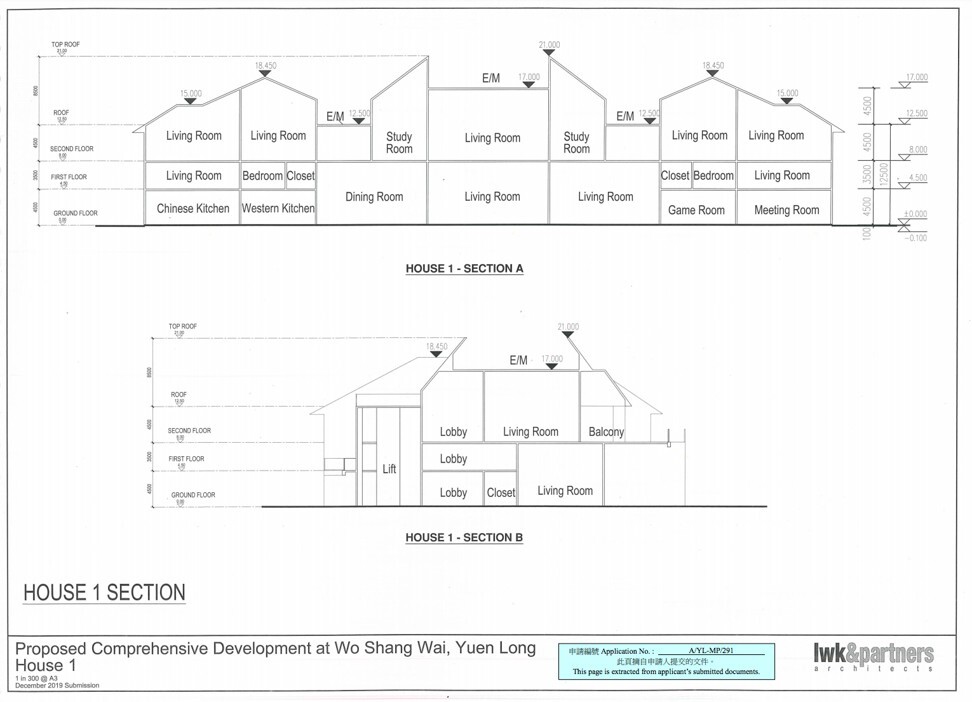

- At 240,000 sq ft, House 1 will be as big as 180 of the flats in Taikoo Shing, Hong Kong’s most popular mass-market residential project, put together

The company, which is chaired by Hui Ka-yan, one of China’s richest tycoons, has converted a 2.4 million sq ft plot – about the size of New York’s Grand Central Terminal – in Yuen Long, according to people familiar with the matter. It bought the farmland, located near the Mai Po Wetlands, in 2019 from Hong Kong developer Henderson Land Development for HK$4.7 billion.

There was no rush to convert the farmland and Evergrande could have made the switch later too, said Vincent Cheung, the managing director of Vincorn Consulting and Appraisal. “Its bold decision shows that it is highly positive about the market,” he said.

Evergrande did not respond to inquires made by South China Morning Post.

“We have never seen such a giant home in Hong Kong, and its price will definitely set a record,” Cheung said.

Evergrande has now invested HK$8.9 billion into the plot, and surveyors said it would need to sell the villas at HK$20,000 per square foot for reasonable returns. That would put a price tag of HK$4 billion on the biggest villa.

Such a huge house will definitely attract mainland China’s richest people, said Leo Cheung, the executive director of surveying company Pruden Holdings. “The design shows its garden will be like the Palace of Versailles. It has a spa, a theatre. The owners will probably use it for entertaining instead of living,” he added.

Property consulting firm JLL said it expected the city’s market for luxury homes to bottom out soon. Data it has complied shows a high correlation between luxury residential prices and the movement of the Hang Seng Index since 1997.

“On the back of the Hang Seng Index hitting the 30,000 point level for the first time since May 2019, the rate of decline of luxury residential [prices] is expected to moderate in 2021 from 2020,” JLL said in a report issued on Thursday.

Still, that did not stop the Shenzhen-based company from reporting a 20 per cent increase in its 2020 revenue to 723 billion yuan, giving Evergrande some breathing room on its 835.5 billion yuan of debt. Evergrande has set a target of selling 750 billion yuan of homes this year.

The company’s chairman, also known as Xu Jiayin in China, is also spinning off valuable assets from his portfolio to raise funds in the equity market. Its subsidiary Evergrande Property Services Group raised HK$14.27 billion in a November initial public offering (IPO) in Hong Kong, while its Evergrande New Energy Vehicle Group unit raised HK$4 billion in a top-up offering two months earlier. Last month, the electric car maker raised HK$26 billion from six of Xu’s tycoon friends through selling new shares.