Primavera’s founder splashes US$55 million on Hong Kong mansion after year of blockbuster deal making

- Primavera Capital’s founder Fred Hu paid HK$428 million for a 4,755-square foot mansion in Tai Tam

- Hu, who turns 58 next month, paid HK$89,634 per square foot for the mansion, and HK$18.19 million in tax as a first-time homebuyer in the city

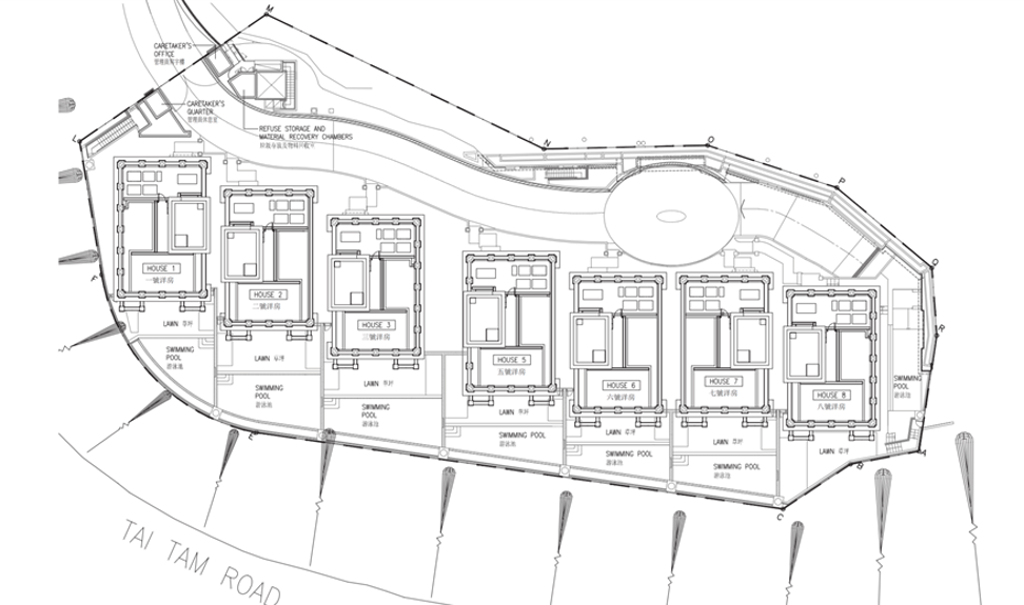

The founder of Primavera Capital Group paid HK$428 million (US$55 million) for House 3 at 45 Tai Tam Road, located between the American Club and the Turtle Cove Beach near Stanley in the south-eastern corner of Hong Kong Island, according to Land Registry records.

“Many of those who come to Hong Kong are bankers, or [executives of large technology companies] like Alibaba,” said Centaline Property Agency’s senior regional sales director Eric Lee. “Those who do fundraising really made a lot of money, especially in the past few months.”

The vast majority of the most noticeable, big ticket real estate transactions in Hong Kong over the past 10 years featured buyers with names spelt in pinyin, the romanisation system used in mainland China, said Lee. There has been a high number of migrants from mainland China since the 1997 handover, so “even if only 1 per cent of them” bought these mansions, that’s still a lot of transactions, he said.