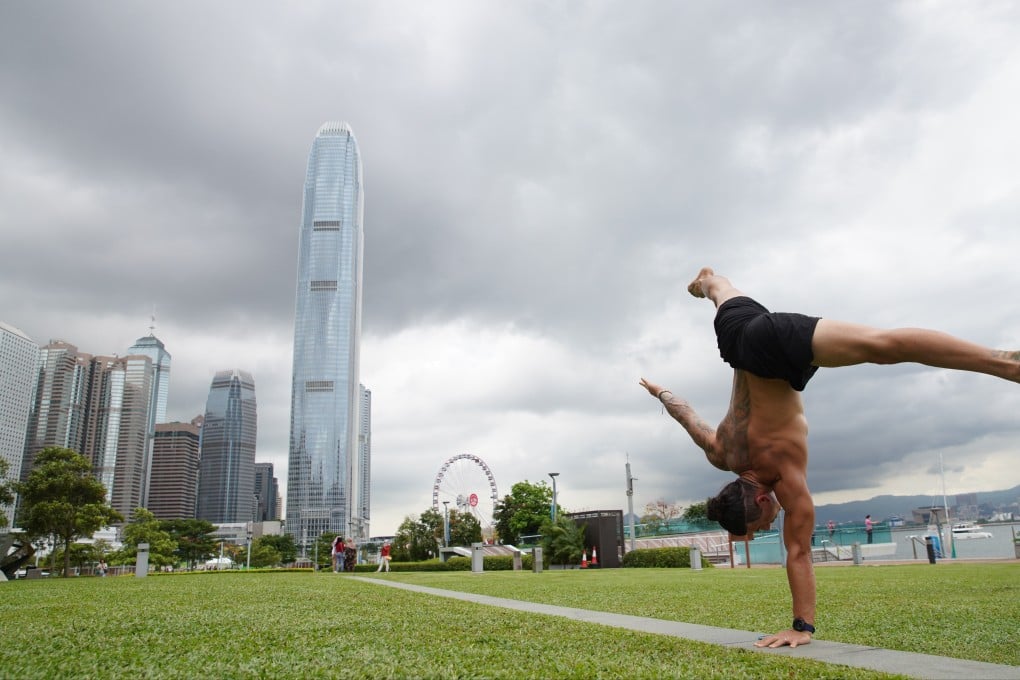

Lexington Partners snaps up Two IFC office space left vacant by earlier tenant as New York fund expands in Hong Kong

- The fund has taken up units 2903 through 2909, totalling 8,900 square feet (827 square metres) at the Two IFC office tower in Central

- The fund’s office had been at York House at Landmark in Central for the past 10 years

Lexington Partners, a New York-based manager of secondary private equity funds, is moving into one of Hong Kong’s tallest office towers as it scooped up prime commercial real estate left vacant in the world’s most expensive city.

The fund has taken up the units 2903 through 2909, totalling 8,900 square feet (827 square metres) at the Two IFC office tower in Hong Kong’s Central business district. The fund’s office had been at York House at Landmark in Central for the past 10 years, a company spokesman said.

The previous occupant at the Two IFC space had surrendered units 2903 through 2905 slightly earlier, allowing Lexington to scoop up the space.

“Lexington Partners is moving to a larger space due to growth,” the spokesman said, declining to provide financial details.

Lexington’s relocation is a rare bright spot in a market blighted by the coronavirus pandemic. Office vacancy rates rose to 9.3 per cent, or 5.7 million sq ft in the second quarter, higher than the 8.9 per cent recorded in the first three months of the year, according to Savills.

Premium office space rents fell 2.6 per cent in the April to June period, slower than the 3.5 per cent decline in the previous quarter. Last year, the city’s main business district of Central saw a number of multinationals leaving for other business districts to cut costs amid the coronavirus pandemic.