Hong Kong shopping centre landlord Wharf Reic reports 10 per cent increase in first-half revenue, rues absence of tourists

- We see downward pressure on rents in the second half for us, chairman Stephen Ng says

- ‘What we – and the retailers – lack right now is tourist consumption’

Vacancies and weaker market rents continued to depress rental incomes, the company said in a results filing to the stock exchange on Thursday.

Wharf Reic’s revenue in the first half of this year rose 10 per cent year on year to HK$7.49 billion (US$963 million). Its underlying net profit for the period dropped 15 per cent to HK$3.27 billion. Taking valuation into account, its net profit amounted to HK$2.97 billion, compared with a loss of HK$4.45 billion last year. An interim dividend of 67 Hong Kong cents will be paid, it said. The company’s stock dropped 3.6 per cent to HK$38.8 on Thursday.

04:10

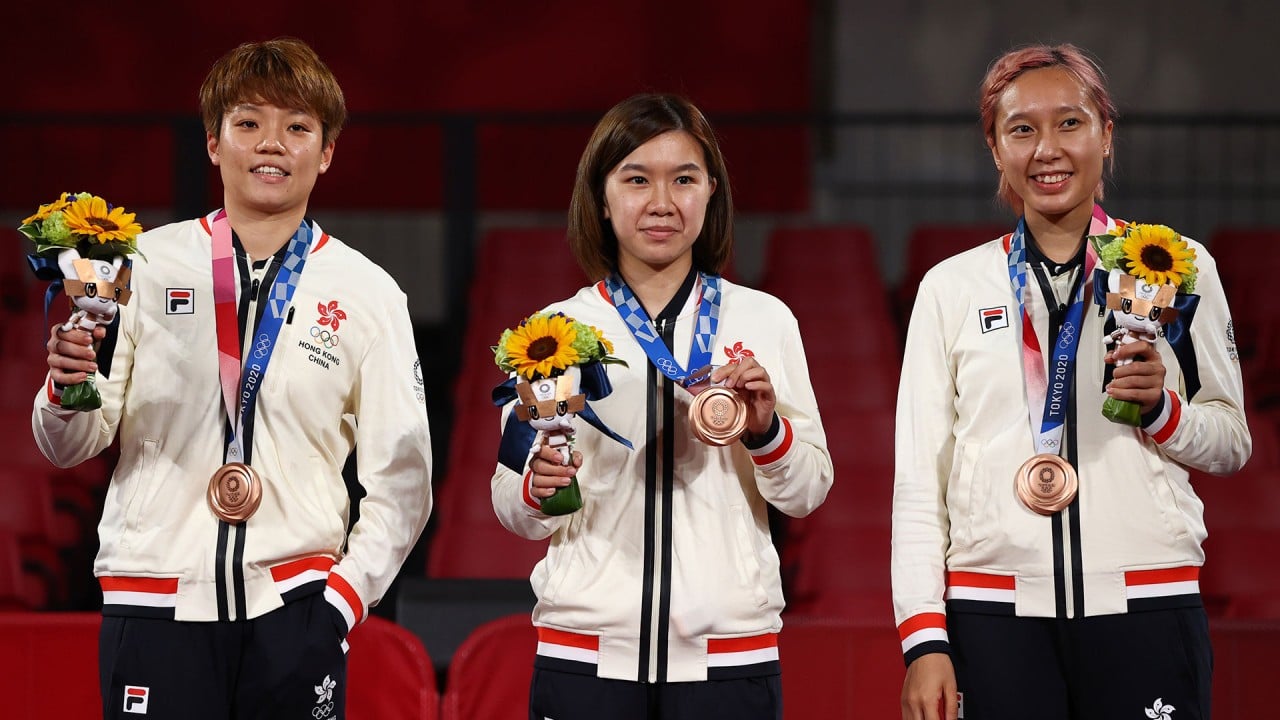

Hong Kong’s greatest Olympics get even better with 2 bronze medals in table tennis and karate

But sales had not yet recovered to levels seen two years ago, he added. “What we – and the retailers – lack right now is tourist consumption. As long as the border is not reopened, there will be no tourist consumption.”

A full opening will take place only later this year or the next, which will weigh on retailers, Ng said.

02:18

Hong Kong celebrates Olympic win as Cheung Ka-long takes gold in fencing

Overall shopping centre rents in the second quarter of this year were down 10.2 per cent year on year and 45.2 per cent from a peak seen three years ago, according to Savills.

“Rents are close to bottoming out after a long period of adjustment since 2014. For rents to rise, borders [reopening] are key and the return of mainland spending,” said Simon Smith, regional head of research and consultancy in Asia-Pacific at Savills. Many multinational brands, especially fashion brands, had frozen their budgets for expansion this year, which had inevitably contributed to slower take-up, he added.