Climate Change: China’s Sinopec builds world’s biggest solar hydrogen plants in bid to achieve carbon neutrality a decade before national target

- The plants in Ordos, in the Inner Mongolia autonomous region, and in Tahe, in the Xinjiang Uygur autonomous region, will be powered by solar energy

- Sinopec Engineering, unit in charge of developing the projects, reports increase in revenue and profit

The company is banking on Beijing’s decarbonisation policies to boost the economic viability of and demand for the zero-carbon fuel and the equipment and facilities needed to produce it, according to the chairwoman of its engineering and technology unit, Sinopec Engineering (Group).

“It is normal for any new technology to require big cost reductions to achieve mass adoption,” Sun Lili told analysts and reporters on Monday. “We will do much more research and development, and welcome cooperation with partners to achieve these objectives.”

01:24

Inside the Daxing International Hydrogen Energy Demonstration Zone

The plant in Ordos is expected to be completed by next year, Sinopec said in May. It will supply hydrogen to a coal-to-chemicals plant there run by Zhongtian Hechuang Energy, Sinopec’s joint venture with power generator Shenergy and miners China Coal Energy and Nei Mongol Man Shi Coal Group.

The second plant will supply Sinopec’s oil refinery in Tahe. Both plants have an annual output capacity of 10,000 tonnes.

Although the expected carbon dioxide reduction by introducing hydrogen into the Zhongtian and Tahe projects will not be big relative to their total emissions, it will represent a change as burning hydrogen emits no carbon dioxide, Sun said.

02:38

China launches world’s largest carbon-trading scheme as part of 2060 carbon neutrality goal

While the investment per tonne of annual production capacity to produce the so-called green hydrogen from electrolysis of water using renewable energy is comparable to conventional carbon-intensive methods using naphtha and natural gas as feedstock, the unit operating cost of green hydrogen, while falling continuously, is two to three times that of traditional ways.

The higher cost of low-carbon green hydrogen should be understood in the context that the cost of carbon emissions has not yet been reflected in prevailing production methods, Sun said. “Once the environmental cost of carbon emissions is fully accounted for in the cost equation, we will have a different understanding of the relative costs,” she added.

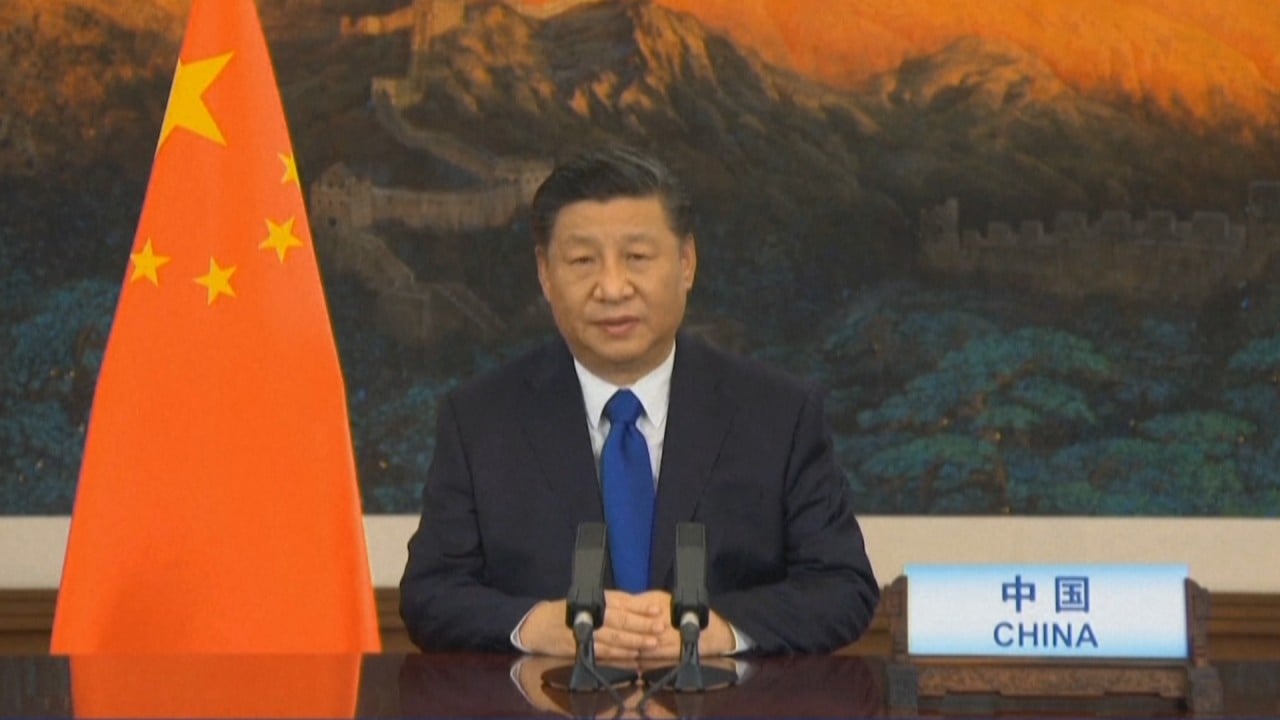

01:24

China to reduce carbon emissions by over 65 per cent, Xi Jinping says

Meanwhile, Sinopec Engineering, which builds refineries and petrochemical plants, on Monday posted a 6.9 per cent year-on-year increase in net profit to 1.34 billion yuan (US$206.4 million) for the year’s first half, as revenue grew 12.8 per cent to 26.85 billion yuan.

The company expected a substantial rise in new contracts from the domestic market in the second half, but prospects in overseas markets were clouded by delays in projects in the Middle East and South Asia amid the coronavirus pandemic, said Jiang Dejun, its president.

Sinopec Engineering signed new contracts worth 36.6 billion yuan in the first half of 2021, compared to 63 billion yuan’s worth in the whole of last year. It has signed overseas contracts worth US$1.05 billion in the first half, and is targeting a full-year total of US$1.5 billion.