Advertisement

Chinese Estates cuts losses, heads for exit after 12 years as Evergrande’s biggest ally and second-largest shareholder

- Chinese Estates posted a loss of HK$1.38 billion after selling 108.9 million Evergrande shares for HK$246.5 million, or HK$2.26 each on average, from August 30 to September 21

- The company said it may sell its remaining stake of 751.09 million shares, or 5.66 per cent of Evergrande

Reading Time:3 minutes

Why you can trust SCMP

10

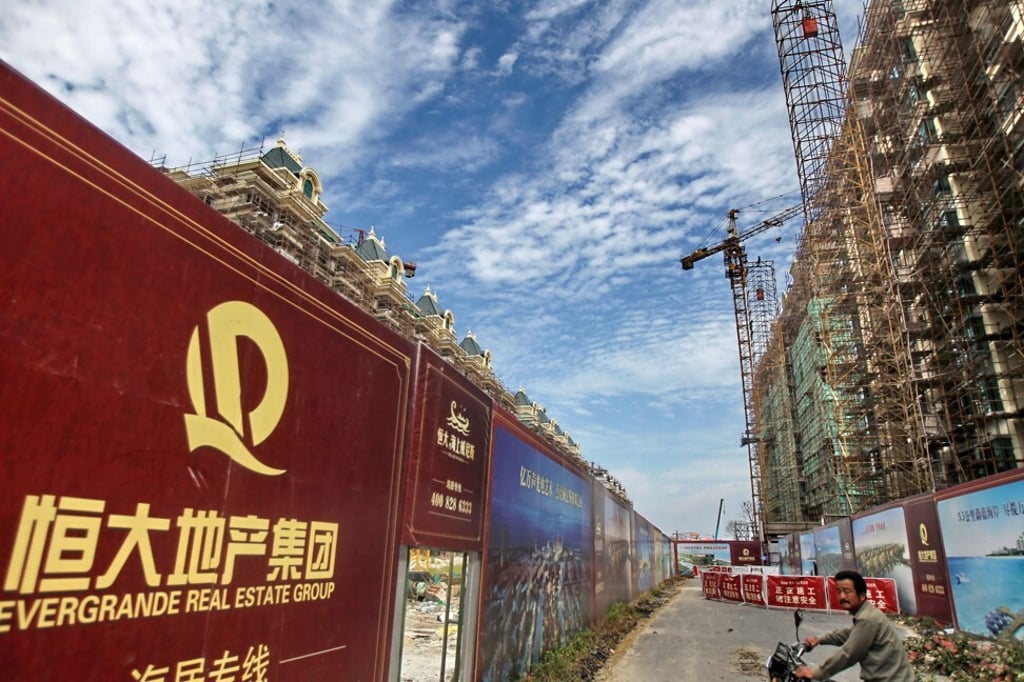

China Evergrande Group’s second-largest shareholder Chinese Estates Holdings has dumped a major chunk of Evergrande shares at a loss and signalled the potential sale of its entire stake, as the staunchest ally that kept the world’s most indebted property developer afloat heads for the exit amid a debt crackdown.

Chinese Estates posted a loss of HK$1.38 billion (US$177.2 million) after selling 108.9 million Evergrande shares in the open market for HK$246.5 million, or HK$2.26 each on average from August 30 to September 21, according to a stock exchange filing. Evergrande’s shares changed hands at HK$3.42 on average during that period, according to Bloomberg's data.

The sole cornerstone investor in Evergrande’s November 2009 initial public offering (IPO), Chinese Estates held 751.09 million Evergrande shares, or 5.66 per cent of the Shenzhen-based developer, as of August 31, a stake which may be sold through block trades, or in one, or a series of transactions “depending on the prevailing market conditions,” according to its filing.

The disposal and possible exit by Chinese Estates, founded by the Hong Kong magnate Joseph Lau Luen-hung, is a significant bookmark in its ties with Evergrande’s chairman Hui Ka-yan, a relationship that spanned more than a decade. Chinese Estates has been either a buyer, or the seller, of every significant financial transaction by Evergrande since it went public 12 years ago.

Advertisement

Chinese Estate bought US$50 million of Evergrande’s shares when Hui took the developer public in 2009, acting as the sole cornerstone investor in the offering.

Advertisement

Chinese Estates, then under the chairmanship of Lau’s son Lau Ming-wai, paid HK$13.59 billion to top up its Evergrande stakes in 2017 and 2018, picking up a total of 860 million Evergrande shares at an average price of HK$15.80 each, according to the filings. The average disposal price in August and this month was an 86 per cent discount to its average purchase price.

Lau and his wife Chan Hoi-wan are the highest-profile investors to be heading for the exit, as Evergrande grapples with finding cash to settle US$300 billion in liabilities. The company partially averted a default when it negotiated an “off-exchange” arrangement with bondholders to settle an interest payment on 4 billion yuan (US$619 million) of onshore bonds, estimated at 232 million yuan. The company has another US$83.5 million in interest payment due today in a dollar-denominated note.

Advertisement

Select Voice

Select Speed

1.00x