Climate change: Chinese power producers face US$4.2 billion profit squeeze as coal-fired plants get stranded under 2060 goal

- Hong Kong-listed power utilities are projected to lose US$3.4 billion while the remainder is attributed to Shanghai and Shenzhen-listed peers

- Report offers a warning to global funds that have ploughed US$300 billion of assets into 18 such utilities in mainland and Hong Kong

Hong Kong-listed power utilities are projected to lose US$3.4 billion while the remainder is attributed to Shanghai and Shenzhen-listed peers, according to the report. That is a warning sign for global funds that have ploughed US$300 billion into 18 such companies, it added.

“The stranding risks should be a wake-up call to investors,” said Lee Ray and Lorenzo Sani, co-authors of the report published on Thursday. “Shareholders should push management to provide a road map for retiring their coal fleet in line with the beyond-two-degrees scenario.”

The climate risk and fossil fuel impact researcher said coal-fired power firms in mainland China are particularly susceptible to operating losses in later years as plant utilisation rates fall and carbon emission permit prices surge.

This is because the highly state-owned operators and regulated sector is likely to retain some loss-making power plants for energy security, unlike other economies where market forces would determine their closure much earlier.

CarbonTracker estimates China’s carbon emission permits to surge to US$17 a tonne by 2030 and US$40 a tonne by 2040. They traded at an average of US$7 since the national carbon exchange was launched in Shanghai in July.

03:38

COP26 Glasgow, the UN Climate Change Conference: last chance to save the planet?

Some stock analysts said some Chinese power utilities may still be worth investing, provided they transition into clean-energy businesses fast enough. Many are ramping up their renewable power capacity to offset future coal asset writedowns, rising cost of permits and carbon capture and storage costs.

“While coal-fired power plants will be retired gradually, we still need some of them as baseload supply to ensure energy security,” said Dennis Ip, regional head of utilities research at Daiwa Capital Markets.

Recent reform that gave power generators more room to raise electricity prices to offset coal cost rises will also support “reasonable profitability and robust operating cash flows” for the sector, said Morningstar senior equity analyst Jennifer Song.

02:40

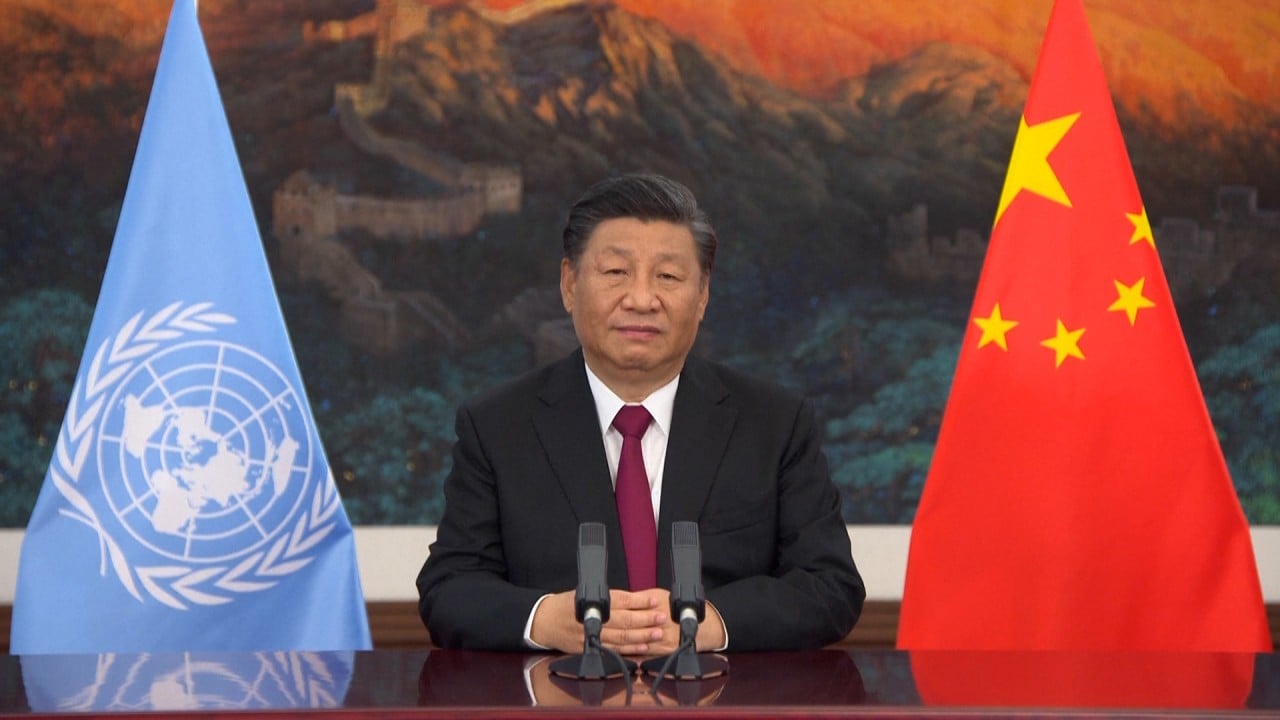

China pledges US$232m to world biodiversity conservation at COP15 conference in Kunming

Global investment managers are watching decarbonisation pledges made by countries during the ongoing COP26 UN climate summit in Glasgow, Scotland for potential impacts on their investment portfolios.

Some 18 nations have agreed for the first time to phase out coal-powered plants and not build new ones, the UK government said. China has pledged earlier this year not to build new ones overseas, and to peak coal usage by 2025. China accounts for half of global coal consumption.

Fidelity International, which manages about US$787 billion of assets, last week committed to phase out exposure to the power-station coal sector in the 38 OECD (Organisation for Economic Co-operation and Development) nations by 2030 and globally by 2040.

BlackRock, the world‘s largest asset manager with US$9.5 trillion, last year pledged that its actively managed portfolios will exclude from their holdings companies that generate more than one fourth of their revenue from power-station coal production.

The money manager had US$85 billion of money invested in coal companies, non-government organisations Reclaim Finance and Urgewald said in a report in January, exposing it to assets likely to be stranded in the global decarbonisation drive.