Climate Change: Gaps in insurance cover to compound extreme weather misery

- In China, floods caused by summer monsoon rains last year resulted in US$17 billion of losses

- Extreme rainfall and flash floods this year have taken 302 lives and caused US$20.6 billion of losses in Henan province

More frequent extreme weather events and unabated urbanisation in emerging economies including China had led to major underinsurance of climate risks, insurance experts said.

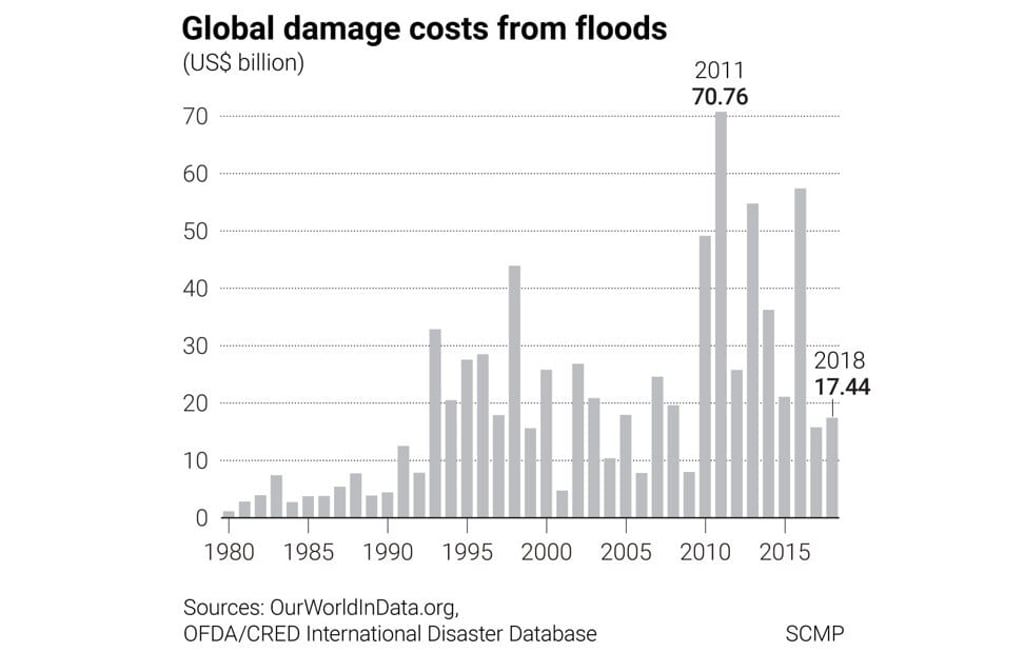

For instance, between 1980 and 2019, flooding accounted for about 40 per cent of all natural catastrophes where losses were incurred globally, but only 12 per cent of the more than US$1 trillion in losses were insured, data from German reinsurer Munich Re shows.

In China, the costliest natural disaster last year was floods caused by summer monsoon rains, which resulted in US$17 billion of losses. Only about 2 per cent were insured, the German reinsurer said. The global insurance gaps were partly due to limited insurance covers in some regions, while much of the losses involved public infrastructure and were uninsured, it said.

Sustained urbanisation in emerging economies was also augmenting concerns about underinsurance. About 64 per cent of China’s population lived in urban areas last year, up from 50 per cent in 2010 and 19.4 per cent in 1980.

“Around 60 per cent of China’s population lives in 12 coastal provinces,” said James Addington-Smith, CEO for South Asia at US-based insurance broking and risk adviser Marsh. “These mega cities’ growth has created a focus on their risk exposures … because of rising urbanisation and overbuilding on land prone to flood risks.”

China was projected to have 450 airports by 2035, up from 241 currently, some of which like the ones in Hong Kong and Pudong, Shanghai are located in low-lying areas, he added. Lack of education about floods and how they occur, as well as underdeveloped monitoring systems were also to blame for overbuilding on flood-prone areas, he added.

“The Thai floods in 2011 were probably the biggest wake-up call in recent memory, where over US$46 billion of losses were reported,” Addington-Smith said. About US$21 billion was attributed to property and infrastructure damages, while US$26 billion were losses from business and supply chain disruptions, according to a recent report by Marsh’s parent firm, Marsh McLennan.