Analysis | Climate change: is entrepreneurship the magic touch for turning zero-emission planes and ships into commercial reality?

- If left unabated, the aviation industry’s contribution to climate impact could reach 25 to 50 per cent by 2050

- While electric cars are already all the rage, zero-emission ships and planes are mostly research projects, unlikely to be commercially deployed for the next 15 years

ZeroAvia, based in the village of Cranfield north west of London, is aiming to start offering commercial flights by 2024, using aircraft with 10 to 20 seats with a range of 350 nautical miles (648 kilometres). The company plans to fly planes with the capacity for 80 passengers and 500-nautical mile range by 2026, and 100-seat, single-aisle jets by 2030.

ZeroAvia is one of many efforts racing to commercialise zero-emissions power sources for the shipping and aviation industries, as the world grapples with ways to reverse its reliance on fossil fuels. If the current usage is not abated, the aviation industry’s contribution to climate impact could reach 25 to 50 per cent by 2050, Miftakhov said.

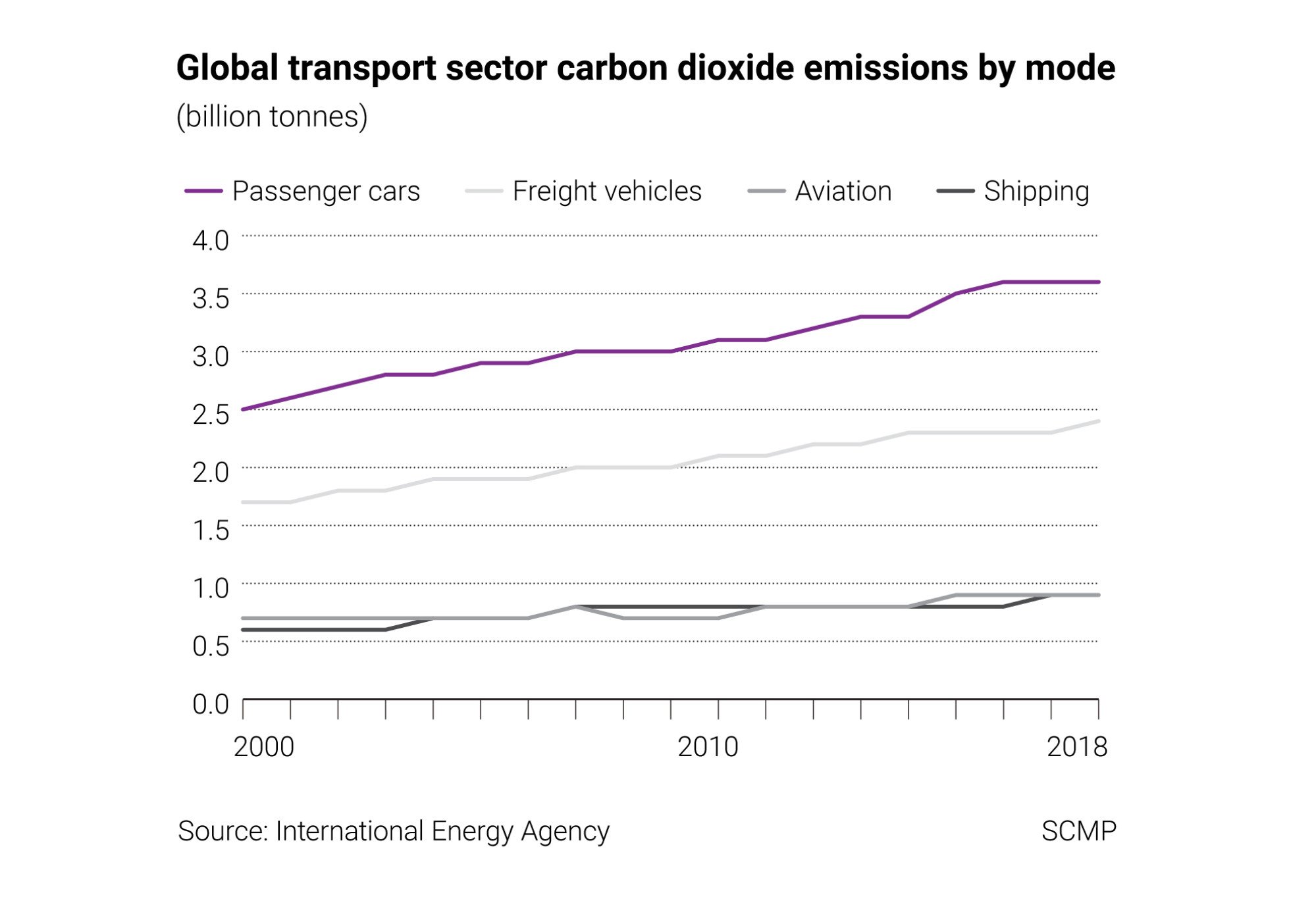

The progress in aviation and shipping to decarbonise, or switch to non-oil power sources, has been slower than electric cars and trucks, even if the industry’s overall carbon footprint is smaller than road transport. Ships and planes generated 900 million tonnes of carbon emissions in 2018, compared with the 6 billion tonnes – 18 per cent of all energy-related emissions – generated by passenger and freight vehicles, according to the International Energy Agency (IEA).

What is the transport sector's contribution to carbon emission?

| % | |

| North Korea | 3.5 |

| China | 8.6 |

| India | 11.5 |

| Hong Kong | 13.7 |

| Singapore | 15.2 |

| World | 20.4 |

| Australia | 24.7 |

| OECD members | 29.0 |

| Euro area | 29.1 |

| United States | 33.4 |

| Sweden | 53.3 |

| Democratic Republic of Congo | 96.8 |

Source: World Bank, 2014

Electric or hydrogen-powered ships and planes are mostly still research projects around the world, and their commercial deployment is not expected for the next 15 to 20 years.

Airbus aims to develop its first zero-emission, hydrogen-powered commercial aircraft by 2035. Its most fuel-efficient plane on long-haul flights is the A350-900, burning 2.39 litres of fuel for every 100 kilometres, while its A319Neo tops the scale on short-haul flights of 1,000 nautical miles (1,900km) at 1.93 litres for every 100km flown.

Boeing is less convinced that hydrogen propulsion technology can be sufficiently mature in the next two decades, due to regulatory requirements and the need to build up infrastructure to ensure sufficient supply. Getting the novel fuel certified for quality and safety will be a big hurdle, said Boeing’s chief sustainability officer Chris Raymond.

“If the fuel doesn’t work in a car, it gets pulled off to the side of the road, [but] that’s not going to be true for aviation,” Raymond said during a November 19 webinar held by McKinsey on the sidelines of the COP26 climate summit in Glasgow. “Then you need to build up the [distribution] infrastructure and drive market adoption.”

To be sure, an interim solution is being used while electric and hydrogen jets and ships are under development.

To serve the needs of the 10 billion people expected to fly in 2050, 21.2 billion tonnes of carbon emissions must be abated if the net-zero goal is to be achieved, according to the International Air Transport Association (IATA). That is twice that of China – the largest emitter – last year.

Sustainable aviation fuel (SAF) produced from biomass, animal oil or municipal wastes may have to do the heavy lifting to meet the world’s ambitious emissions goal, IATA said. Fuel producer Royal Dutch Shell concurred.

“The effective application of low carbon technologies, such as electric and hydrogen propulsion, are unlikely to be in widespread use until 2040 or later,” Shell said on its website. “This means that SAF provides the only viable way to reduce aviation emissions significantly in the short to medium-term.”

SAF is a safe and proven replacement for fossil fuel, and can be used without changing existing storage, delivery and fuelling systems, Shell said. If mixed in equal portions with conventional jet fuel, it can reduce carbon emission by up to 40 per cent, provided the SAF is produced from plant materials, it said.

With government support, SAF production has the potential to meet 2 per cent of the industry’s requirement by 2025, rising to 5.2 per cent by 2030, 39 per cent by 2040 and 65 per cent by 2050, IATA said. SAF accounts for just 0.1 per cent of the current jet fuel market.

The IATA also hoped that clean-burning hydrogen aircraft would be commercially available by 2035 to serve short-haul flights of 30-90 minutes in aircraft with 50-100 seats, expanding by 2040 to 45-120 minutes flights in planes with 100-150 seats. This could see new zero emission propulsion technology take care of 13 per cent of the industry’s carbon reduction needs by 2050.

The remaining carbon emissions from jet fuel will be dealt with by carbon capture, storage facilities and offsets deals that require airlines to buy carbon credits earned from decarbonisation projects in other industries.

Demand for carbon offsets is expected to rise from 2027, when a UN-brokered deal called Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) makes it mandatory for airlines on international routes to buy carbon credits to offset the rise in carbon dioxide emissions above 2019 levels.

Global governments are coming around to support SAF in recent months. Some 21 policies have been adopted worldwide to support the use of SAF, according to the International Civil Aviation Organisation, a UN agency.

The latest move is a tax credit announced in September in the United States that aims to raise SAF output so that aviation emissions would drop 20 per cent by 2030. The US government will also provide up to US$4.3 billion of funding to support SAF projects and their producers. This followed the European Commission’s instruction in July for SAF to make up at least 2 per cent of jet fuel used in the 27-nation European Union by 2025, rising to 63 per cent by 2050.

As many as 43 airports are already distributing SAF, nearly all of them in Europe and North America.

Cathay Pacific’s 2050 net zero emission target relies on using SAF in 10 per cent of its total fuel consumption by 2030.

A pilot plan will kick off in 2022 for SAF producers to deliver blended aviation fuel to Singapore’s Changi airport. Shell will build a facility in Singapore that can produce 550,000 tonnes of biofuel a year, where renewable resources including used cooking oil and animal fats can be turned into low-carbon fuels such as SAF and renewable diesel.

Hong Kong’s Airport Authority said it too is supportive of using SAF. The airport operator will “work with airlines wishing to drop SAF into the HKIA fuelling infrastructure to provide the SAF that meets the relevant international standards,” a spokesperson said in reply to queries by the Post.

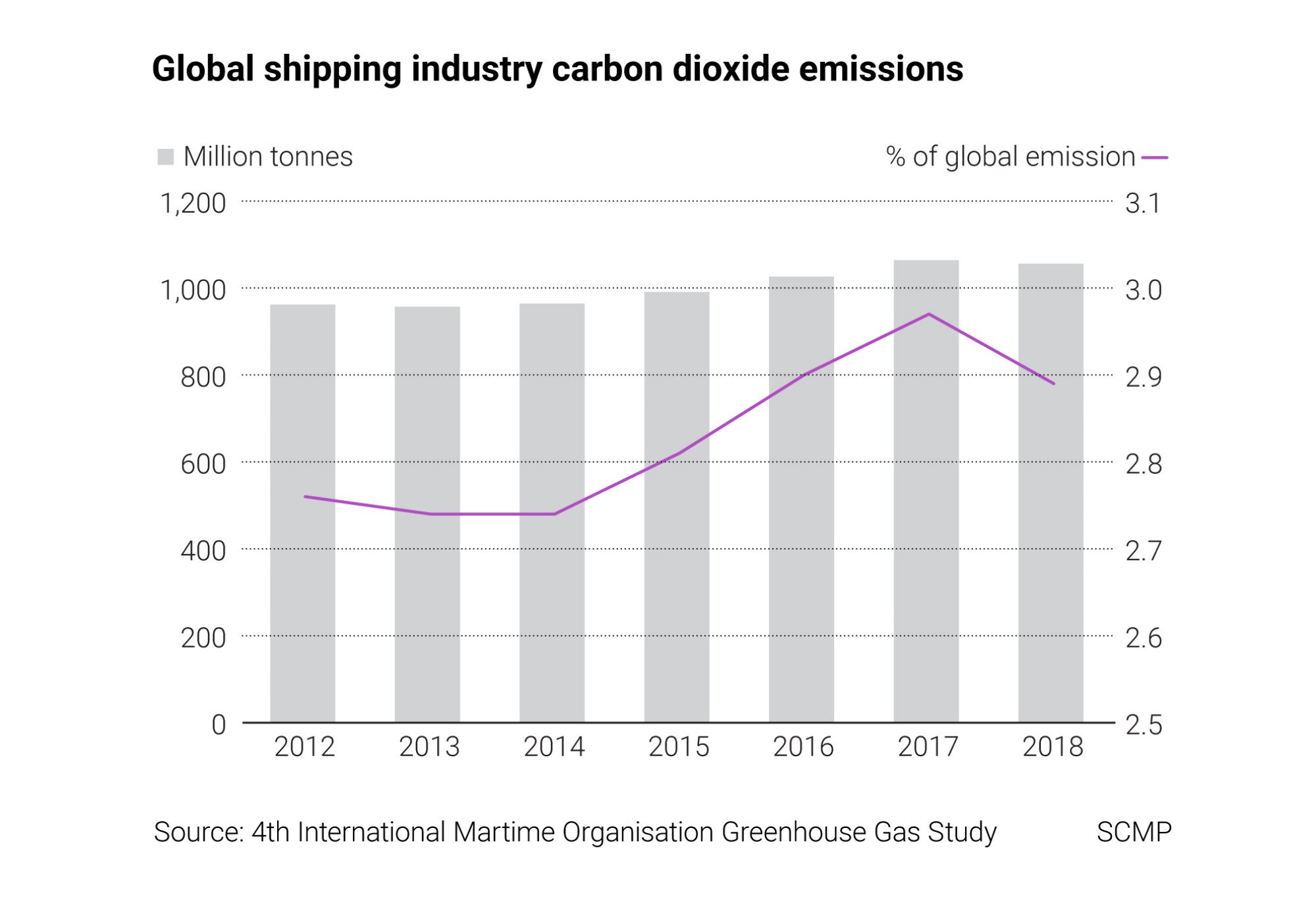

The maritime shipping industry, which carries 80 per cent of global commerce, is expected to make limited progress in decarbonisation, because the tepid growth in international merchandise trade is too small to offset any benefit from fuel efficiency. The industry’s 2050 emissions may be between 90 and 130 per cent of 2008 levels, the United Nation International Maritime Organisation said last year.

“It will be difficult to achieve IMO’s 2050 [carbon] reduction ambition only through energy-saving technologies and speed reduction of ships,” the IMO’s secretary general Kitack Lim said in the report. “Therefore, under all projected scenarios, in 2050, a large share of the total amount of carbon reduction will have to come from the use of low-carbon alternative fuels.”

The methanol vessels will cost 10 to 15 per cent more than conventional ships that burn bunker fuel. because their engines must be fitted to burn both methanol and low-sulphur bunker. This transition is needed to overcome the challenges of sourcing low carbon e-methanol or bio-methanol when the ships are first deployed.

“The main barrier to renewable methanol uptake is its higher cost compared to fossil fuel-based alternatives, and that cost differential will persist for some time to come,” the International Renewable Energy Agency (IRENA) said in January. “With the right support mechanisms, and with the best production conditions, renewable methanol could approach the current cost and price of methanol from fossil fuels.”

The International Chamber of Shipping (ICS), representing the operators of over 80 per cent of the world’s merchant shipping fleet, proposed in September a mandatory levy on each tonne of carbon dioxide emitted by ships exceeding 5,000 tonnes of cargo carrying capacity. The tariff would help close the price gap between zero-carbon and conventional fuels, and spur the construction of bunkering infrastructure in ports to supply carbon emission-free fuels such as hydrogen and ammonia.

Still, it takes time to develop new engines, build the infrastructure and set the regulations and safety standards for zero-emission fuels like hydrogen and ammonia to be widely used in ships, said Kenta Matsuzaka, senior managing executive officer of Mitsui OSK Lines, which has one of the world’s largest merchant fleets.

“It is also essential that society bear the increasing cost of decarbonisation,” he said during the Asian Logistics, Maritime and Aviation Conference on November 2.

“Society is very schizophrenic about this. What most people want, despite all the emotions, is zero carbon at zero cost to themselves,” Stopford said. “If you are running a shipping business you’ve got to take a long-term view. We need people who have the money to take the long term view and take a chance. I am confident we’ll find a few good Elon Musks kicking around somewhere.”