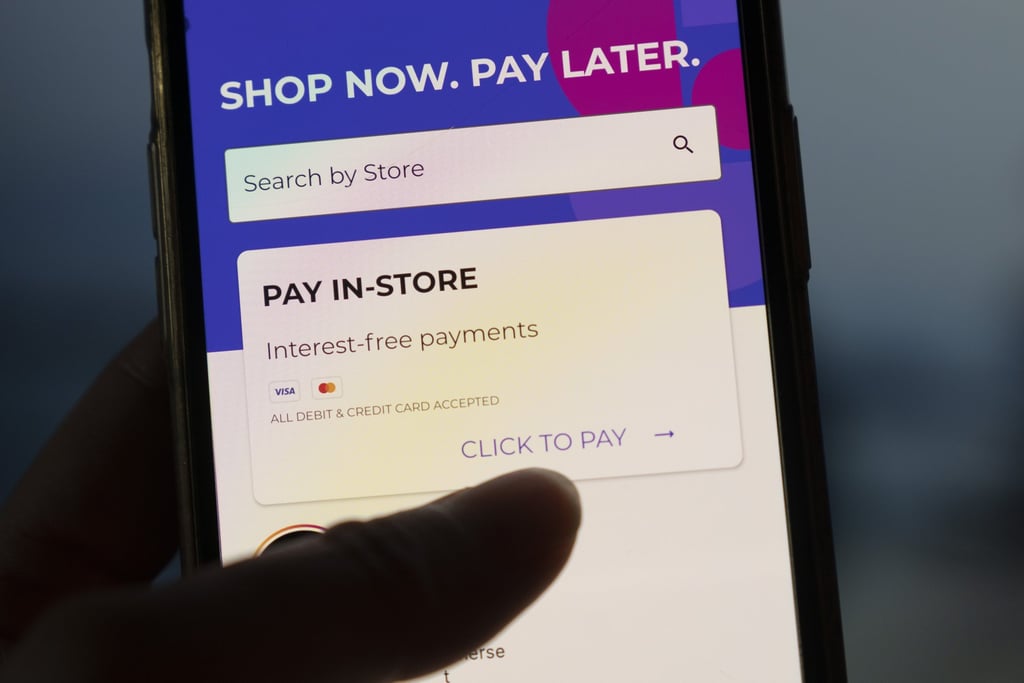

Micro loans are Asia’s hottest fintech products as Gen Z and millennial online shoppers prefer to buy now, pay later

- Buy now, pay later (BNPL) services may double their share of Asia’s e-commerce payments market from 0.6 per cent to 1.3 per cent, according to forecasts

- Chinese fintech firms have invested in Southeast Asia’s BNPL services: Ant Group owns 6.3 per cent of India’s Paytm and 39 per cent of South Korea’s Kakao Pay

For Marcus Khoo, perfumes and oil diffusers were never high on his shopping list. They would have sat idling in his online shopping cart, were it not for a hire-purchase instalment payment option that tipped the balance in his decision.

“I like it because you pay less for the item at the start and there is no interest, unlike a credit card,” said Khoo, a 26-year-old social media executive who has used the option three times this year. “You still pay the full price, except it is split across different time periods. The pain of your money departing from your wallet is delayed, compared to paying it off in one shot.”

It is the fastest-growing online payment method in countries including Australia, Japan, Malaysia and Singapore, according to the report, at the expense of credit cards, bank transfers, cash on delivery and prepaid cards, all of which will lose share through 2024.