Outlook dims on Kai Tak’s waterfront land as Hong Kong’s Northern Metropolis plan and land conversion add to city’s supply glut

- Five plots of housing land at Kai Tak, valued at a combined HK$71.3 billion (US$9.15 billion), may fail to live up to expectations when they go on sale, analysts said

- One of the plots was sold last week at a discount of 10.8 per cent from its purchase price in 2018

A distressed sale last week at Hong Kong’s former Kai Tak airport site has clouded the outlook of the city’s property market, as an expected glut of residential land weighs on prices.

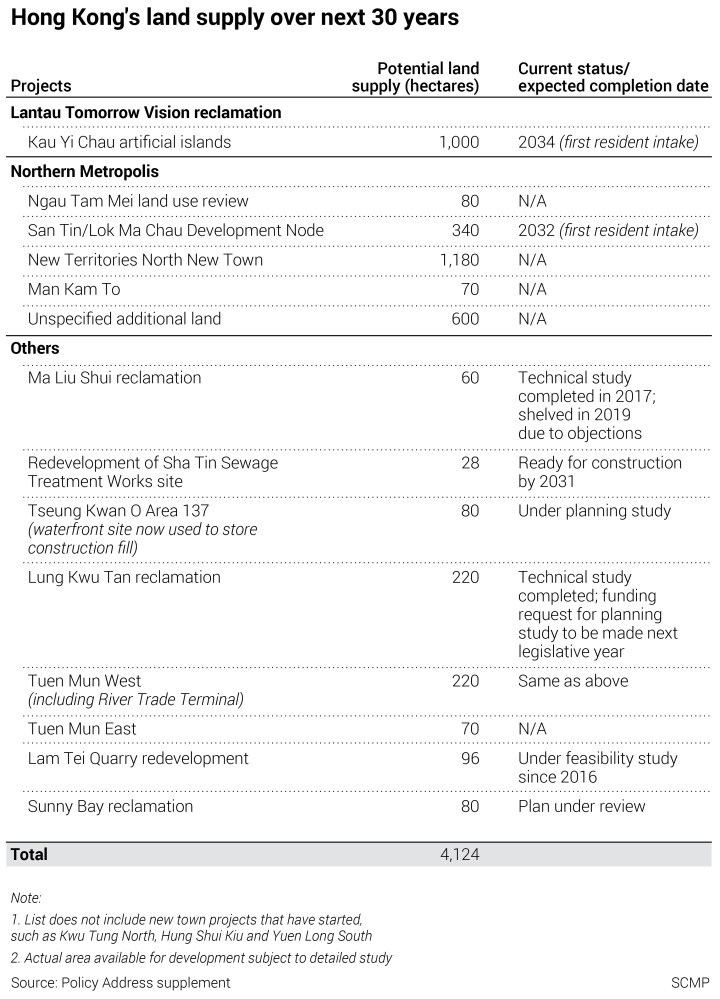

“Land prices may soften, rather than be on the rise,” said Lau Chun-kong, managing director at Colliers International and Chairman of the Land Policy Panel at the Hong Kong Institute of Surveyors (HKIS). “The likely supply in Kai Tak and the Northern Metropolis will relieve upwards pressure. The [slump] in the stock market will also make developers more prudent in making their bids.”

Kai Tak, where Hong Kong’s main airport operated from for more than seven decades until 1998, measures 323 hectares (798 acres). It is an important part of the transformation of eastern Kowloon into a central business district to sustain the city’s development, first outlined in 2011 by former Chief Executive Donald Tsang.

Since then, Kai Tak has grown into an upscale residential area, especially on the narrow strip of land protruding into Victoria Harbour where the former airport runway was, as it offers seafront view on three sides. KWG Group Holdings and Longfor Group have launched their Upper Riverbank apartments, where a four-bedroom ground floor flat with a garden sold in October for HK$79 million.

The former airport’s transformation puts the impetus on Kowloon Bay and Kwun Tong nearby to drive the area’s development as a central business district, said Leo Cheung, adjunct associate professor at the University of Hong Kong.

“If proper provisions of infrastructure have not been sufficiently provided, pressure on land prices is expected,” he said.

Two of the five rezoned housing land face the Victoria Harbour at the end of the former runway, with the most breathtaking view among all other residential parcels in Kai Tak.

“Land prices could be very volatile [in Kai Tak], depending on changes in market condition and sentiment,” and could “easily vary by more than 10 per cent,” Colliers’ Lau said.