Hong Kong analysts reverse bullish forecasts in U-turn for property market as home sales plunge to near zero amid worsening Covid-19 outbreak

- Home prices may fall by 5 per cent in 2022, according to the property consultant Colliers, the most dramatic change among analysts surveyed by the Post

- Home prices will remain under pressure at least in the near term, according to the consensus of respondents, even if most of them kept their forecasts for the full year

Hong Kong’s home prices could drop 10 per cent in the first half, as the city’s worsening Covid-19 outbreak caused the first three months to be a washout for property sales, forcing analysts to reverse their forecasts.

Home prices may fall by 5 per cent in 2022, according to the property consultant Colliers, as it reversed its earlier forecast of a 3-per cent gain in mass-market homes, and a 5-per cent increase in the luxury market.

Collier’s reversal is the most dramatic change among four property consultants, three real estate agencies, a mortgage referral agency and an academic researcher surveyed by South China Morning Post, as the Omicron variant of Covid-19 debilitated most business and retail operations in the city’s so-called fifth infection wave.

Home prices will remain under pressure at least in the near term, according to the consensus of the respondents, even if most of them maintained their optimistic forecasts for the full year.

“With more projects competing for buyers in the second half, builders have to price their new projects at attractive prices to drum up sales,” Wong said, predicting home prices to tumble by up to 10 per cent in the first half of the year. “This will add further pressure to downward price adjustments.”

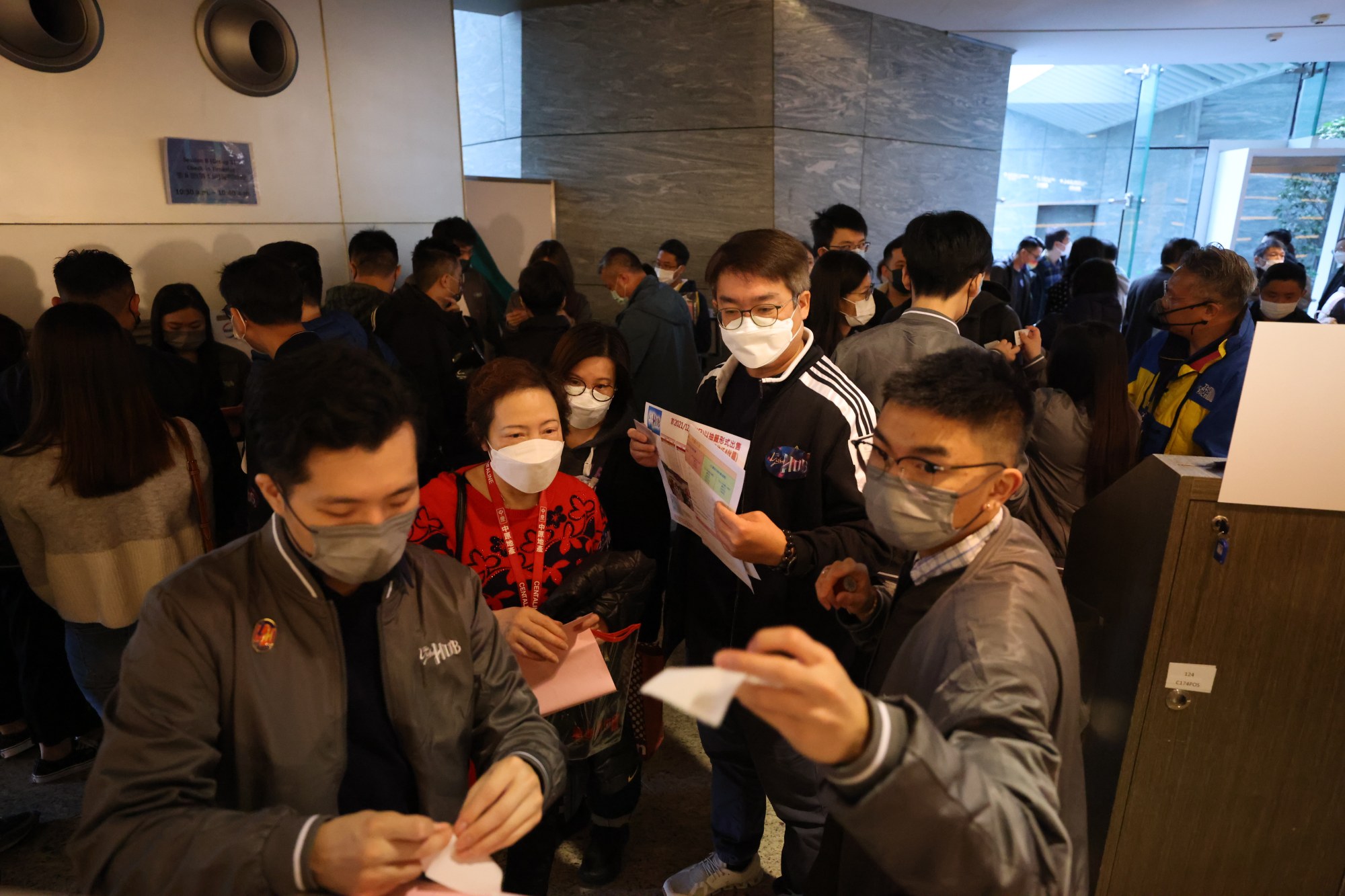

February was the worst month for new home sales since April 2013, with only 119 newly built apartments worth HK$2.5 billion (US$319.3 million) finding buyers, according to Dataelements, a data provider that tracks new residential properties in Hong Kong.

“Owners who bought homes two or three years ago will sit on a paper loss, as home prices have retreated to the level of 2018,” said Wong, a former deputy chairman of the real estate company Midland Holdings. He said home prices have been driven to unreasonable levels by the high selling prices of tiny flats in the past two years.

The impact of Covid-19 and a looming interest rate hike could dampen buying desires and deflate the price of assets, Wong said.

“A healthy correction of at least 20 per cent over the next two years will bring home prices to a more realistic level,” he said.

Hong Kong property agency temporarily closes offices amid Omicron outbreak

Hong Kong has been ranked as the world’s least affordable housing market for a 12th consecutive year, according to Demographia’s International Housing Affordability survey for 2022. Units in the city cost 23.2 times the gross annual median income, followed by those in Sydney at 15.3 times.

The report also said there had been “an unprecedented deterioration in housing affordability during the pandemic”.

Maggie Hu, assistant professor of real estate and finance at the Chinese University of Hong Kong (CUHK), said that the city will experience a decline of about 5 to 10 per cent in residential property prices because of the “unexpected shock from the fifth wave and the resulting economic contraction.”

Home prices were previously projected to slowly recover, as analysts had expected the city’s border with mainland China to reopen this year, Hu said.

Hong Kong’s residential market sentiment is also hampered by unfavourable external factors.

“In addition to Covid-19, other market uncertainties including geopolitical tension and inflation risks are delaying investors’ decision-making process,” said Hannah Jeong, Colliers Hong Kong’s head of valuation and advisory services.

If the Covid-19 situation improves before July, Colliers still believes the market could achieve mild growth of about 3 per cent.

Real estate agency Ricacorp Properties lowered its previous full-year forecast from a 10 per cent increase in prices to a growth of between 5 and 8 per cent. The severe impact of Covid-19 on the residential market in the first and second quarters would be the main drag on growth, said chief executive Willy Liu.

Joseph Tsang, chairman of JLL Hong Kong, said some owners were selling their homes in desperation, worried that the escalation in infections may harm buying confidence.

He predicted the value of flats could drop at least five per cent in the first quarter because of the worsening Covid-19 crisis.

Property consultancy Knight Frank said not many homes have been changing hands.

“Currently, many owners refuse to entertain potential buyers for flat viewing. It is hard to conclude a deal at this moment,” said Martin Wong, director of research and consultancy for Greater China.

Real estate agencies Midland Realty and Centaline, believed the relaxation of mortgage lending could speed up the release of pent-up purchasing power in the second half.

“Once the pandemic comes under control, there will be an immediate rebound,” said Louis Chan, Asia-Pacific vice-chairman and chief executive of the residential division at Centaline.