Guangzhou R&F sells London’s Vauxhall Square at 42 per cent discount to valuation, posting an ‘unheard of’ loss in desperate move to pare debt

- The Vauxhall Square parcel in Vauxhall has been sold for £95.7 million (US$124.8 million), at a discount of about 42 per cent to market valuation, R&F said

- R&F will incur a £68.8-million loss from its Vauxhall Square disposal, the company said.

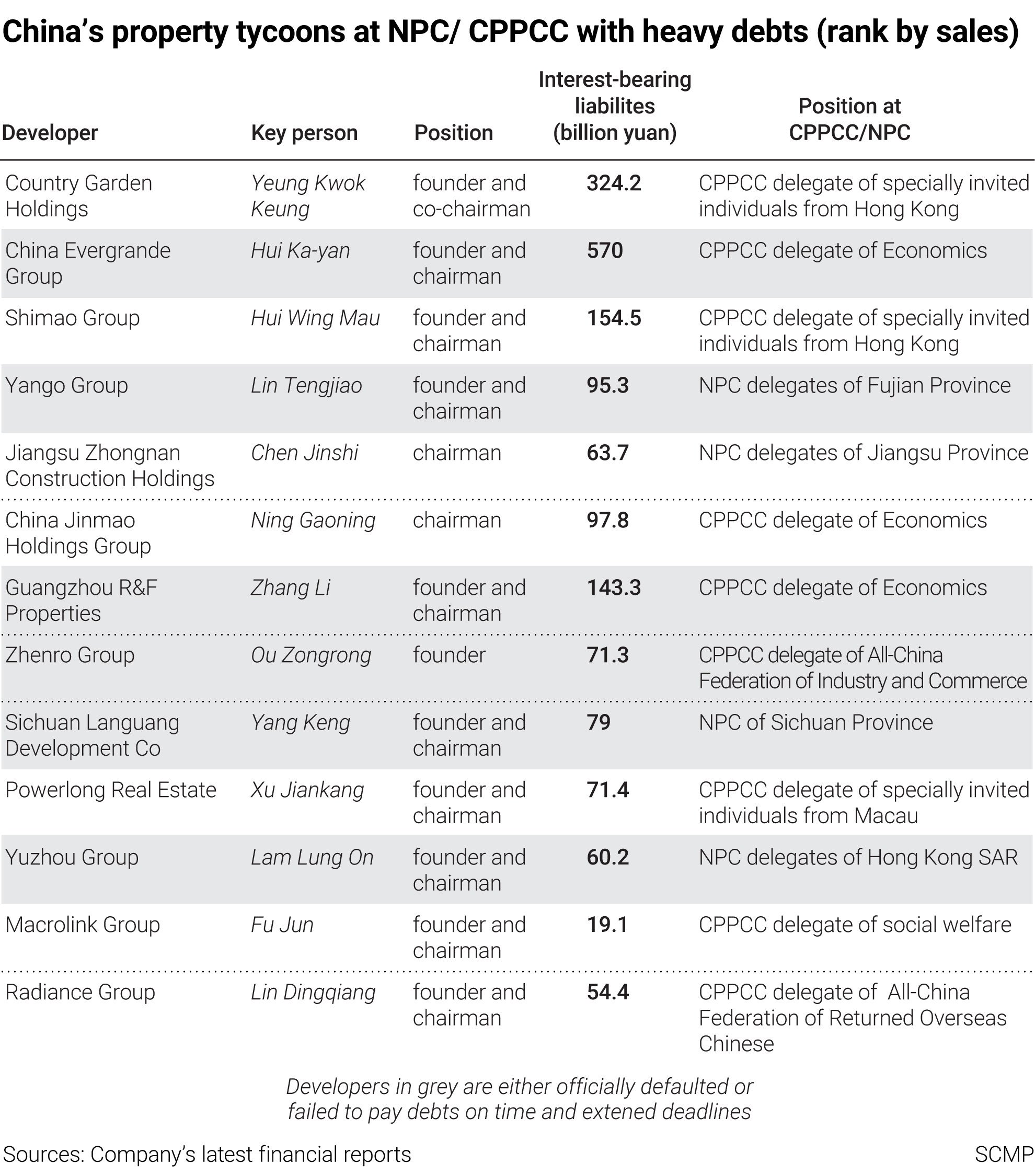

Guangzhou R&F Properties has agreed to sell a plot of mixed-use land in London at a loss to Far East Consortium International, in a move that underscores its haste to raise cash to pare its debts.

The sale is “one of the biggest losses I have ever heard,” which is surprising because “London’s property, particular those for commercial use, are [highly] sought after by investors as there is limited supply in prime areas,” said Martin Wong, director of research and consultancy for Greater China at Knight Frank.

R&F will sell Vauxhall Square for a nominal £1, transferring £95.7 million of its intercompany debt to Far East, according to the terms of their agreement. R&F has a six-month option to repurchase the project from Far East for £106.6 million, according to the terms.

The disposal by the Guangzhou-based R&F may be an “individual” case that doesn’t reflect the overall market condition, since mainland Chinese developers are facing mounting pressure to reduce their debt under the government’s “three red lines” debt limits, Wong said.

Vauxhall Square lies on the southern banks of the River Thames, not far from MI5’s iconic headquarters building. An early proposal showed two tower blocks of 49-storeys each, according to information compiled by the skyscraper.com website. Construction has not commenced on the site, R&F said in its statement.

“The disposal is beneficial to the group in optimising the allocation of resources, increasing its capital reserve and reducing its gearing ratio, which is conducive to its ability to reduce risks and achieve long-term stable and healthy development,” R&F’s chairman Li Sze Lim said in the company’s statement.

China’s 100 largest property developers sold 40 per cent fewer homes in January and February. R&F’s property sales plunged 55 per cent to 9.11 billion yuan during the two months.

R&F continues to face liquidity challenges as a large amount of short-term debt matures in 2022, while its access to funding could remain limited, Fitch Ratings said. Chinese developers face US$33 billion of offshore capital-market maturities and 150 billion yuan of onshore capital-market maturities from March to December this year, according to the credit rating agency.

“The company is planning asset sales to refinance the upcoming maturities, but we believe there is high execution risk due to the challenging macroeconomic environment,” said Fitch.

The company sold 30 per cent of the Guangzhou International Airport R&F Integrated Logistics Park for 7.3 billion yuan last December to shore up its cash flow and cut debt.

If last year was bad for Evergrande, Kaisa and Fantasia, just wait for 2022

R&F is not the sole developer offering fire sales. Soho China offered to dispose of 32,000 square metres of its property portfolios in Shanghai and Beijing at a 30 per cent discount, East Money Information reported last week, citing chairman Pan Shiyi in a presentation to investors.

“All the proceeds will be used to cut debt,” Pan said, according to the financial news portal. To speed up the sales, Soho China offered to increase the sales commission to 4 per cent of the transaction value, he added.

Soho China had 18.5 billion yuan of total debt as of June 30, including 1.2 billion yuan due within 12 months and another 1.6 billion yuan by June 2023. Its net gearing ratio stood at 43 per cent.