Advertisement

Evergrande crisis: China’s most indebted developer sells Crystal City in Hangzhou as banks close in to seize its deposits

- China Evergrande Group sold its interest in Crystal City in Hangzhou, for 3.66 billion yuan in cash to two state-owned builders

- Proceeds from the sale will go towards paying 920.7 million yuan of construction costs in Hangzhou, leaving Evergrande with a one-time gain of 216 million yuan

Reading Time:2 minutes

Why you can trust SCMP

1

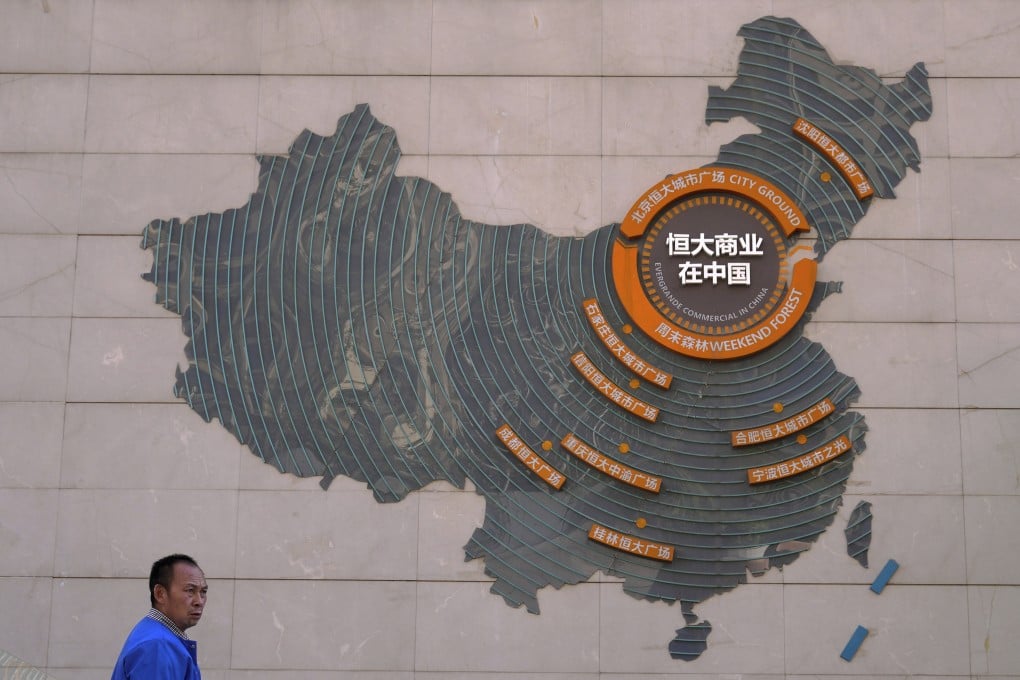

China Evergrande Group sold a project from the country’s second-largest real estate portfolio, notching a much needed win in its asset disposal plan as banks closed in to seize its deposits amid US$300 billion in total liabilities.

The developer sold its interest in Crystal City, a mixed residential and commercial development in the Zhejiang provincial capital of Hangzhou, for 3.66 billion yuan (US$575.45 million) in cash, Evergrande said in a filing to the Hong Kong exchange.

Proceeds from the sale will go towards paying 920.7 million yuan of outstanding construction costs in Hangzhou including Crystal City, leaving Evergrande with a one-time gain of 216 million yuan, the company said.

Advertisement

Liquidity issues had prevented Evergrande from developing Crystal City, forcing it into the disposal, the company said, underscoring its ongoing overhaul to shed its myriad businesses from water bottling to electric vehicles, real estate to even a football team. The Guangzhou-based developer promised last week to roll out its restructuring plan by the end of July.

Evergrande had been struggling to sell its assets, including its waterfront headquarters building in Hong Kong, suffering two setbacks in a week last October as interested buyers balked at overlapping financial ties between its units.

Advertisement

Yuexiu Property dropped its US$1.5 billion bid to buy Evergrande Center on the Wan Chai waterfront on October 15, while a US$2.58 billion sale of the majority stake in Evergrande Property Services to Hopson Development Holdings Limited was scrapped five days later.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x