Advertisement

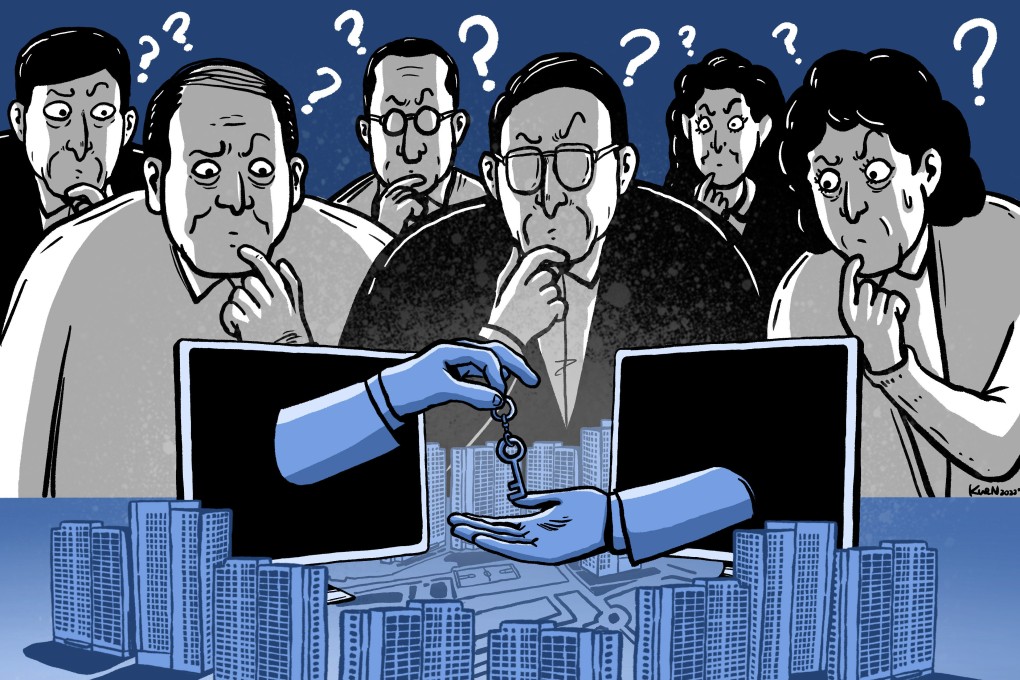

Analysis | Could digital signatures, e-contracts take the costs and hassle out of residential property transactions in Hong Kong?

- Regulations requiring deals to be completed in person make the process time-consuming and expensive – especially during a pandemic

- But allowing digital signatures poses problematic issues such as potential fraud and identity verification, lawyers warn

Reading Time:7 minutes

Why you can trust SCMP

6

Wang On Properties, a mid-tier developer in Hong Kong, typically has to set aside tens of millions of dollars to build an exhibition venue every time it launches a new residential real estate project.

The venue, ideally measuring 5,000 square feet (464 square metres) and costing between HK$300,000 and HK$400,000 (US$51,000) per month in rent, serves several functions: show flat complete with amenities and furnishings for viewing, and an office for completing the sales contracts.

“It adds up to HK$10 million on a two-year leasing term until the whole project sells out,” said the developer’s chief executive Nick Tang Ho-hong.

Advertisement

“Imagine if we could complete the whole process of [selling] homes online. It could save a lot.”

Tang’s wish is nowhere near coming to fruition, as a litany of laws and regulations in Hong Kong require manual signatures and paper contracts to be presented in any transaction related to land. That renders digital signatures and e-contracts useless in real estate conveyancing, putting a physical barrier in the way of the full digitalisation of the process.

Advertisement

The Electronic Transactions Ordinance, which was enacted in January 2000 and updated in June 2004, excludes any instrument related to land, meaning electronic signatures are not allowed for property transactions.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x