PwC and Grant Thornton quit as auditors for R&F, Kaisa and Shimao as Covid-19 controls gum up accounting work, casting cloud over financial transparency

- PwC resigned as the auditor of Guangzhou R&F on April 28, ceased acting for Shimao Service Holdings, after quitting as Hopson’s auditor on January 27

- Grant Thornton resigned as Kaisa’s auditor on April 29

Three of China’s biggest property developers have lost their audit firms, as Covid-19 quarantines disrupted accounting work, in a collective setback for investors as they would have to wait several months longer to get a glimpse of the financial results of some of the country’s biggest debtors.

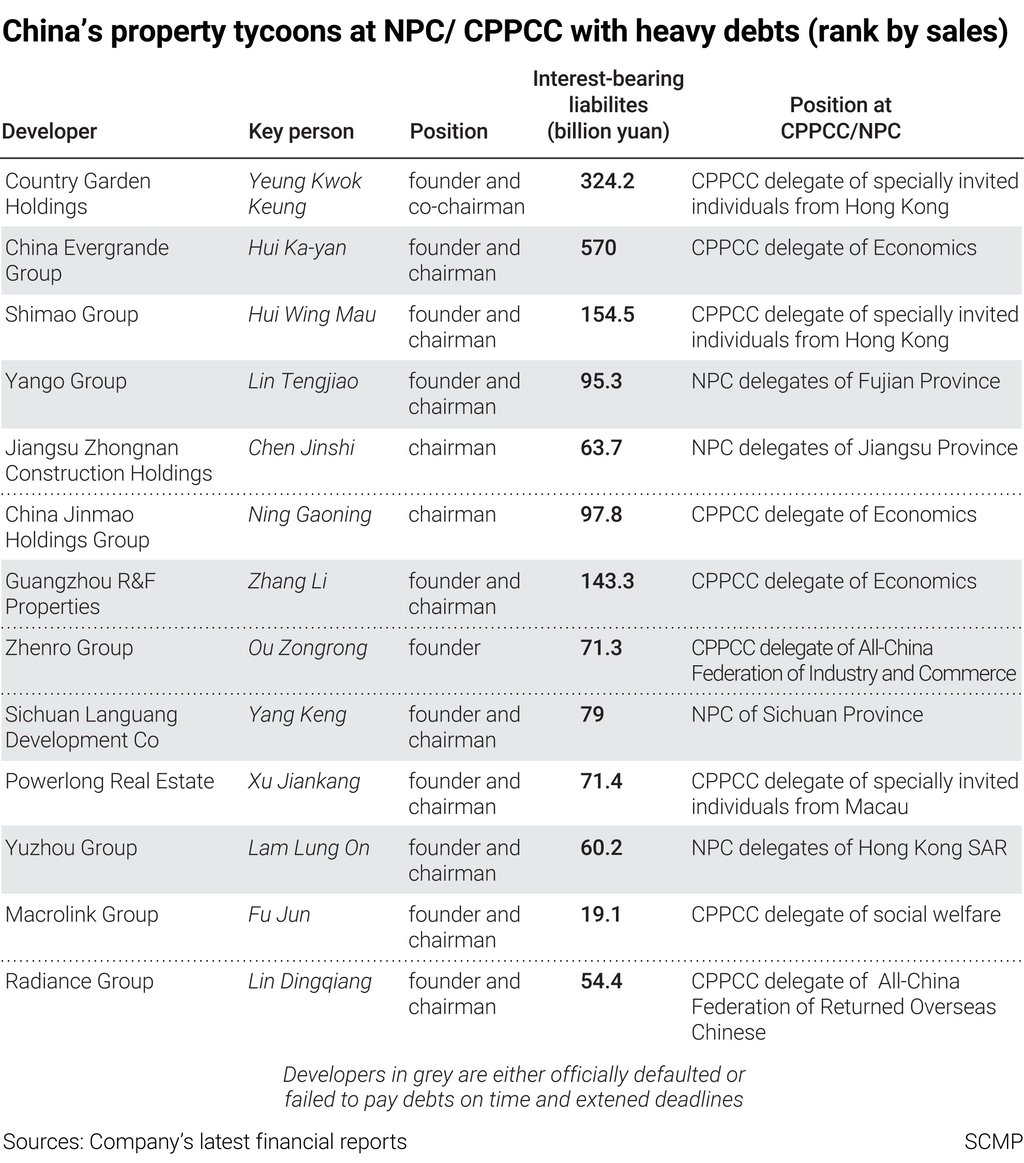

PricewaterhouseCoopers (PwC) resigned as the auditor of Guangzhou R&F Properties on April 28, ceased acting for Shimao Services Holdings a day later, according to separate filings late Friday night to the Hong Kong stock exchange. The firm quit as Hopson Development’s auditor on January 27, citing inadequate access to necessary information.

Grant Thornton resigned from Kaisa Group Holdings on April 29, the Shenzhen-based developer said separately. Deloitte stepped down at China Aoyuan on January 26, exchange filings showed.

The surprise resignations may reignite concerns about the financial transparency and accountability of China’s highly leveraged property developers, with US$33 billion of debt maturing offshore and 150 billion yuan (US$22.7 billion) due onshore from March to December, according to Fitch Ratings.

R&F was unable to agree with PwC on a mutually acceptable timetable to complete the audit for its 2021 financial results, because its management and employees have been quarantined under Covid-19 restrictions in Hong Kong and in mainland China, according to the statement.

“It is in the best interest of the company, its shareholders and creditors to move forward and complete the audit as soon as practicable, and hence the board resolved to suggest that PwC resigned as auditor so that the company might engage another qualified external [firm],” R&F said, adding that it appointed BDO Limited as auditor.