Asia-Pacific commercial real estate deals set for another record year as companies seek cash buffer after Covid crisis

- Commercial real estate transaction volumes are likely to grow by as much as 10 per cent this year, from US$44.4 billion in 2021, CBRE says

- Mainland Chinese companies accounted for 40 per cent of the asset disposals last year

Real estate deals in Asia-Pacific are expected to hit yet another record this year, as companies seek to strengthen their balance sheets amid a host of uncertainties brought about by the Covid-19 pandemic, according to CBRE.

After 762 transactions worth a record US$44.4 billion were concluded in the region last year, transaction volumes were likely to grow between 5 per cent and 10 per cent this year, the property consultancy predicted.

“It’s a combination of factors that relate to each individual corporate’s objectives, and reasons can vary,” said Tom Fowke, director of corporate capital markets for Asia-Pacific at CBRE. “Some groups are monetising their assets for cash while others are doing short-term leasebacks to facilitate a move elsewhere.”

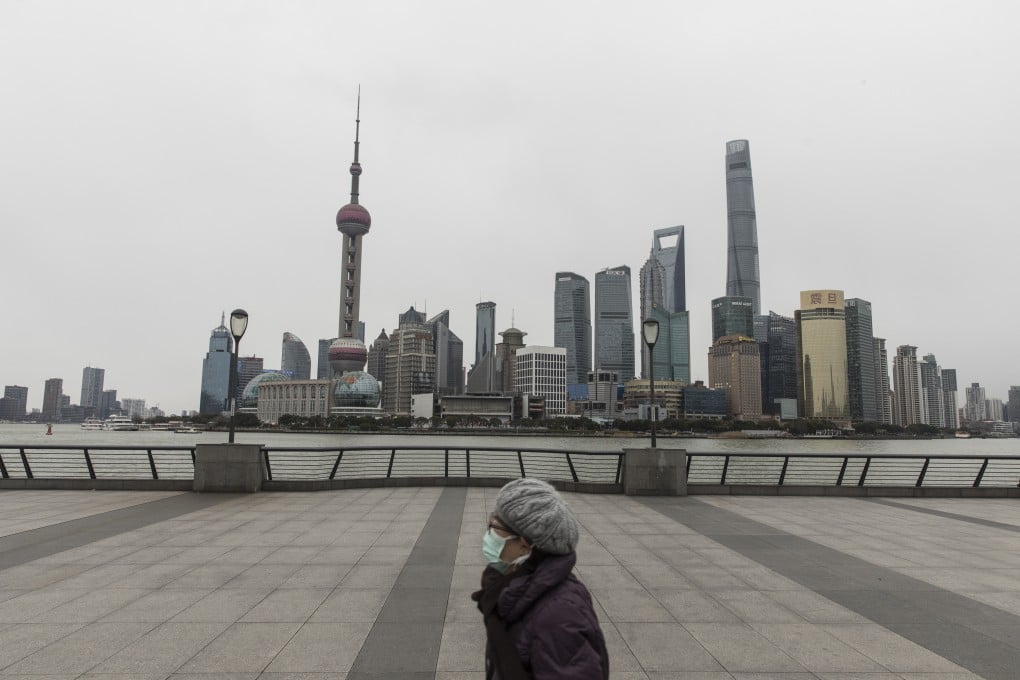

Mainland Chinese companies accounted for 40 per cent of the disposals last year, “primarily due to the sale of numerous development sites and older assets for redevelopment”, CBRE said.

The following month, home-furnishing manufacturer Keysheen Industry sold its industrial premises in Shanghai for US$223 million to TusCity Group.