China’s 30/60 goals: Beijing unveils ‘transition bonds’ for eight dirty industries, to meet carbon reduction targets

- China to allow a new type of bond financing, specifically widening access for eight ‘dirty industries’ to help drive decarbonisation targets

- Plan to augment the broader US$169 billion domestic green bond market, the second-largest after the US

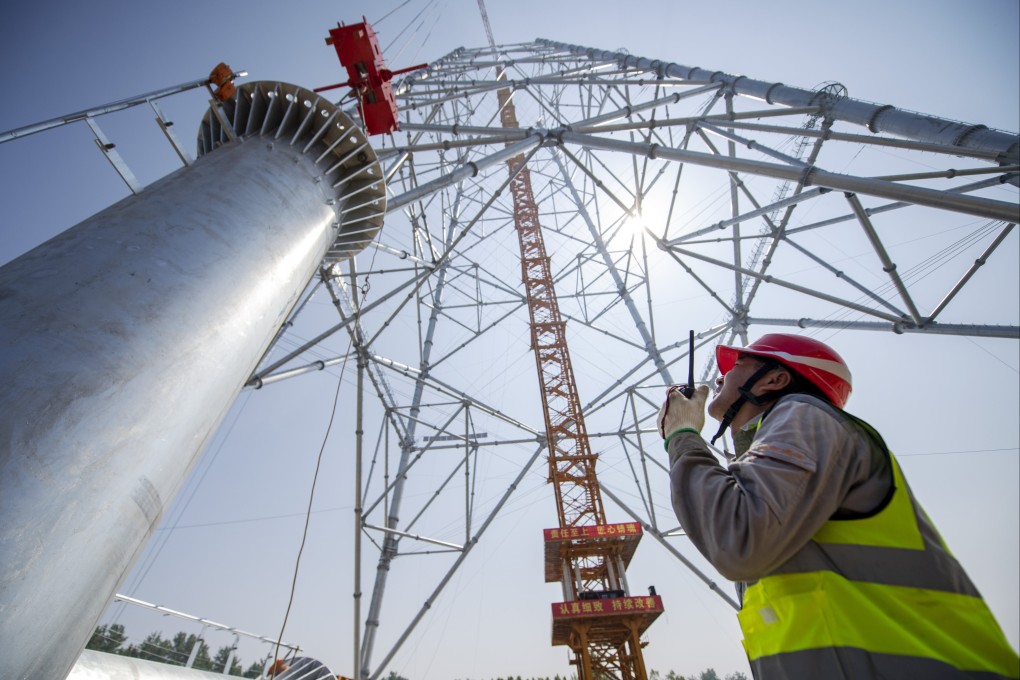

The instruments, known as low-carbon transition bonds, will offer a crucial funding lifeline for companies in the power, construction materials, non-ferrous metals, steel, petrochemicals, chemicals, paper and aviation industries, according to the National Association of Financial Market Institutional Investors.

These so-called dirty industries are currently shut out of the broader green bond financing market because of their environmentally unfriendly projects. The association did not disclose a definitive timeline for the pilot issue under the new programme in a statement late on Monday.

The new financing measure will add to efforts to drive China’s commitments to its goal of peak emissions by 2030 and carbon neutrality by 2060. While these industries have powered China’s economic growth over the past two decades, they have also made the nation the largest carbon dioxide emitter by contributing 30 per cent to global emissions.

“Finding a low-carbon transition pathway for high-emitting sectors will be critical to achieve China’s climate targets,” said Nneka Chike-Obi and Jia Jingwei, analysts at Sustainable Fitch. Coupons on one type of green debt, sustainability-linked bonds, are tied to emissions performance to incentivise issuers to deliver on greenhouse gas abatement promises, they added.

“Under the guidance of the People’s Bank of China, NAFMII will implement the transition concept by rolling out the new type of bond to support traditional industries’ decarbonisation,” the association said.