Goldman sees end of selling in Chinese stocks, but CCB, Everbright say only volatility is assured

- Goldman says the end of selling in Chinese stocks is near, with policy backstop shoring up confidence in latest rebound

- CCB International and Everbright Securities are more cautious, as China seeks to repair its economy and tone down intensity of regulatory tightening

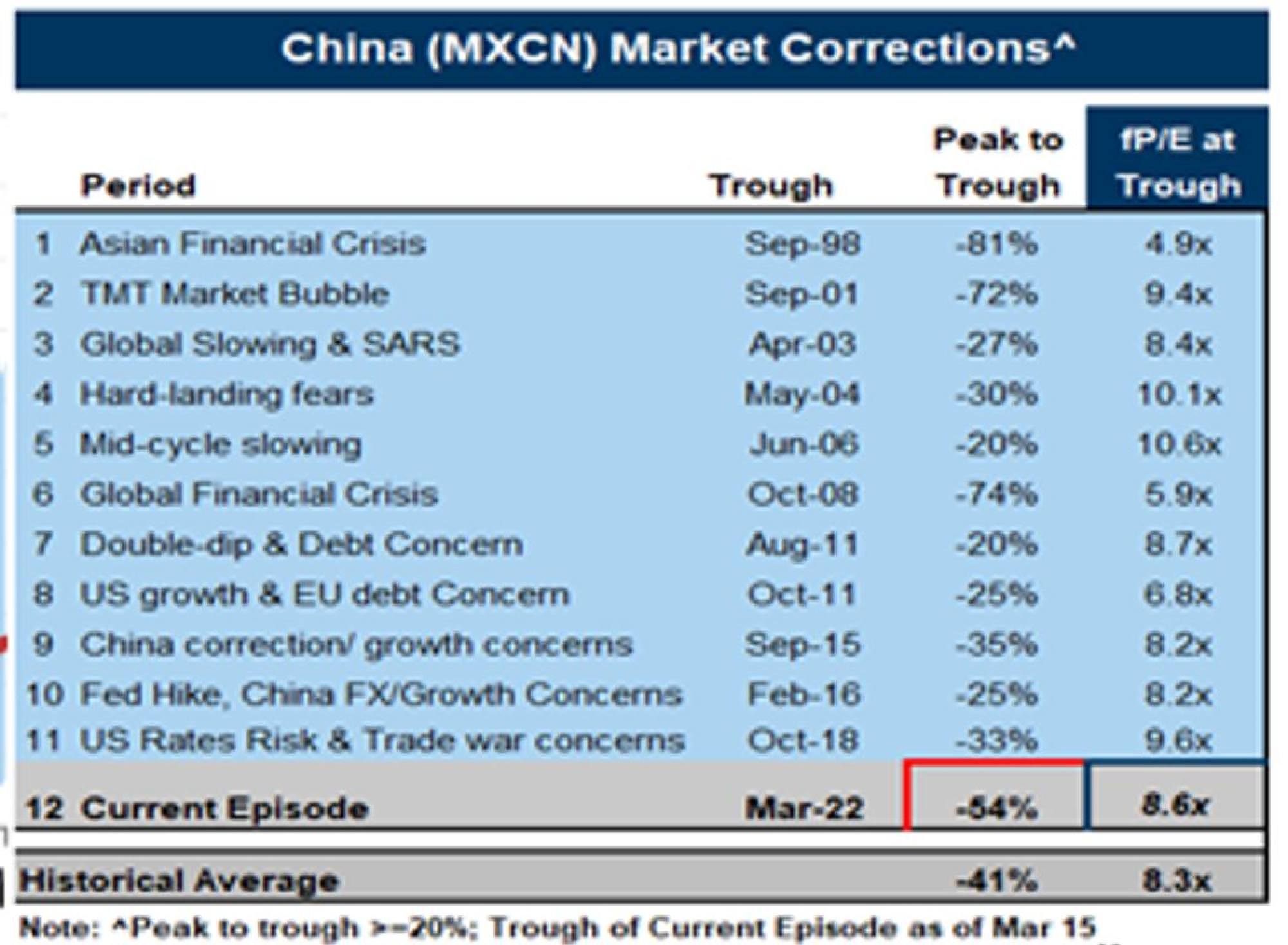

The MSCI China Index, the broadest measure of stocks in mainland and offshore markets, has rallied 25 per cent since a slump on March 15, which Goldman deemed as the market bottom in a year-long correction. The Chinese internet sector capped a 53 per cent surge from that trough, recouping part of the US$2.1 trillion sell-off from a peak in February 2021.

“In the short term, China’s policy concerns Hong Kong stock market more compared to interest rate rise,” said Zhao Wenli, chief strategist in Hong Kong at CCB International Securities, a unit of China Construction Bank. Investors must wait until August and September to assess policy announcements and Federal Reserve momentum, he added.

The Hang Seng Tech Index could trade between 3,800 and 5,800 points in the second half year of 2o22, Zhao said during a webinar on June 10, emphasising the volatile nature of the market due to regulatory undercurrents. The gauge sank 4.7 per cent in Monday trading, having already recovered 34 per cent since a slump in mid-March.

“The regulatory environment may be more stable, but it doesn’t mean the supervision [of technology companies] is over,” said Kenny Ng, an equity strategist in Hong Kong at Everbright Securities International.

Improving confidence could, however, lift the Tech Index to 5,500 points by the end of the year, he predicted. The broader Hang Seng Index could gain by more than 10 per cent to about 25,000 points in the latter half of 2022, he added. Investors may look to growth stocks in petroleum, new energy and infrastructure.

Goldman strategists were relying on the so-called China put to support their bullish view of the market. This policy backstop has helped arrest a slump in economic activity caused by recent lockdowns in 40-odd cities, including areas critical to car and semiconductor manufacturing.

“There is a positive factor in the form of further monetary easing in China, which would support the steady growth of its real economy,” Ng at Everbright Securities said. “Hong Kong equities may also see benefits from China’s additional measures to maintain stability in the financial market.”