Advertisement

In Hong Kong’s property market, HK$10 million no longer buys what it did in 1997

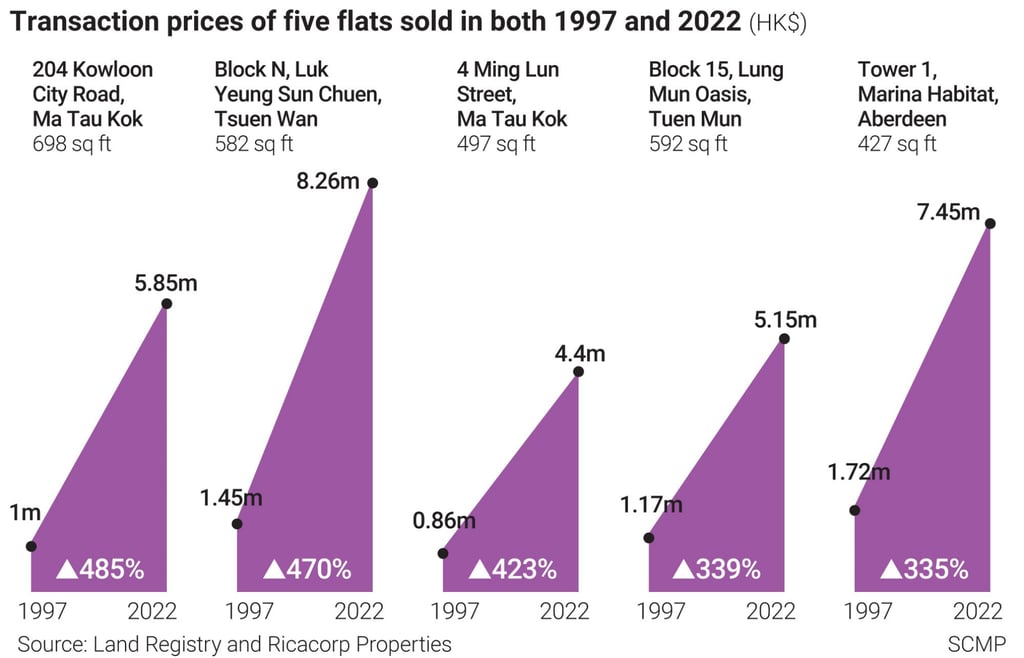

- Average prices for lived-in homes increased 2.4 times between 1997 and now, and some individual flats have appreciated by more than 450 per cent over that span

- The year of the handover proved to be a high-water mark at the time, with the price index plunging 62 per cent between 1997 and 2003 before a steady rise

Reading Time:3 minutes

Why you can trust SCMP

7

Hongkongers’ spending power in terms of homebuying has shrunk dramatically since 1997. After a significant trough in the years after the handover, home prices have climbed to new peak levels over the last decade while riding a 13-year rise, pricing many buyers out of the market and squeezing people who can afford to buy into ‘shoebox’ flats.

Comparing 1997 to 2021, Hong Kong’s overall price index for lived-in homes – an economic bellwether tracked by the government’s Rating and Valuation Department – rose 140 per cent, from 163.1 to 392.7.

The index has hit a series of records over the past few years, peaking at 398.1 in September 2021 before some softness amid the fifth wave of Covid-19 infections this year.

Advertisement

Values for the vast majority of properties have surged since the handover, and some have achieved eye-popping levels of appreciation. As a result the city has in the past decade repeatedly been crowned with dubious titles such as “the most unaffordable” and “the most expensive” housing market.

Comparing 1997 to today does not tell the whole story of Hong Kong’s residential property market, however, as the appreciation in home prices has been anything but smooth and steady – especially for individual buyers.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x