More Hong Kong owners are selling homes at losses as emigration and rising interest rates turn city into buyers’ market

- The number of loss-making lived-in home transactions surpassed 100 from March to June, much higher than a year earlier

- Leftover stock of new flats rose for three consecutive months to about 13,446 units in June, the most since records started in 2013

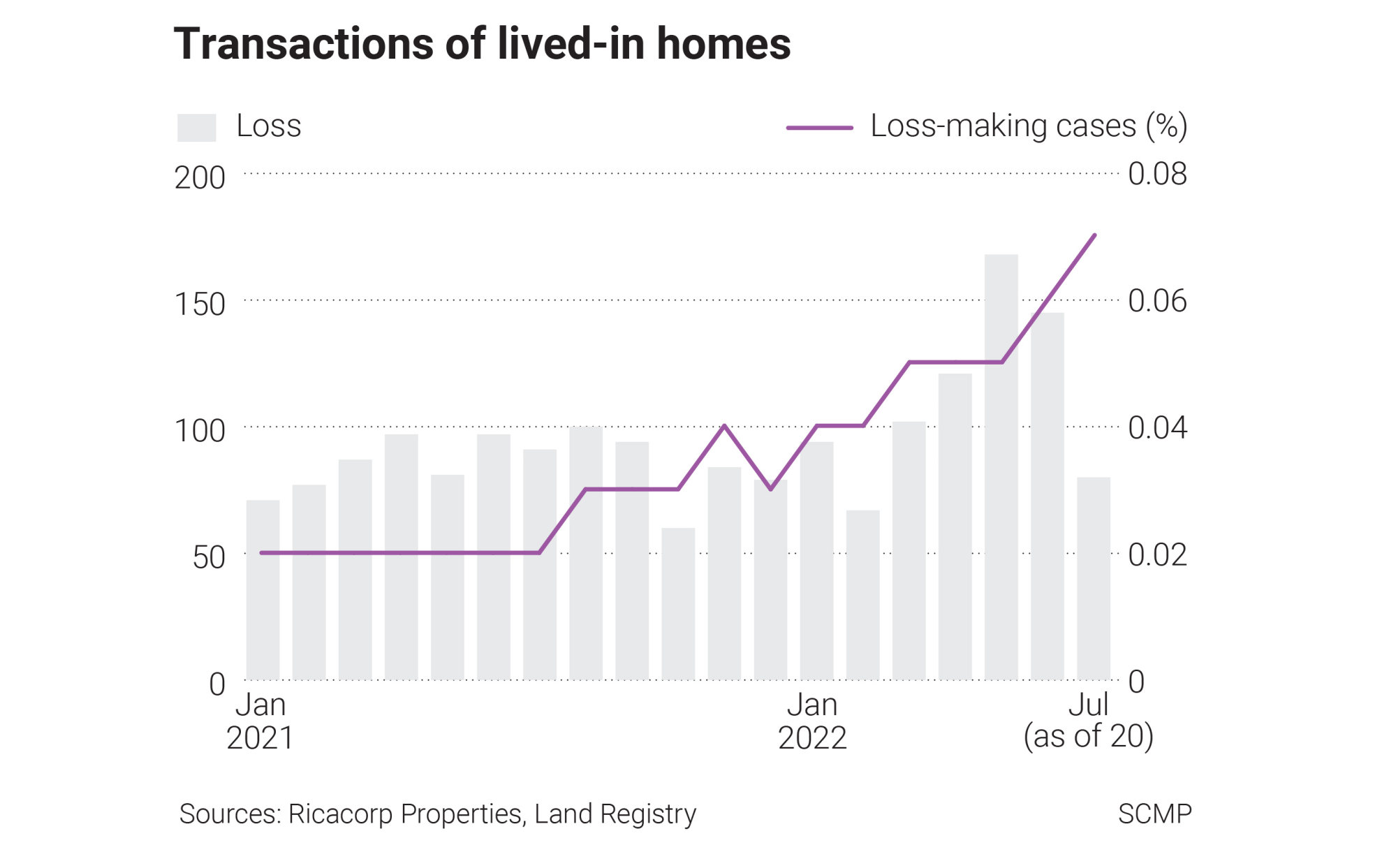

The first six months saw more loss-making transactions compared with last year, except in February, according to data compiled by Ricacorp Properties from official records. The number of loss-making transactions surpassed 100 from March to June.

“The recent [increase in the frequency] of loss-making cases of second-hand homes may be related to the year-to-date decline in the stock market, which has made some owners eager to cash out and sell their homes to meet their capital needs,” said Derek Chan, Ricacorp Properties’ head of research.

Eighty homes changed hands at a loss this month as of July 20. Chan said he expected the number to remain at over 100 in July and August.

“Some owners who are emigrating believed that the market situation was not clear, but they were eager to sell, so they were willing to offer higher discounts to offload the stock, which led to the increase in loss-making transactions,” Chan said.

Hong Kong’s stock market has also been extremely volatile this year, with several factors including rising rates, geopolitical tension and China’s stuttering economy affecting its performance and in turn the property market sentiment. The benchmark Hang Seng Index has lost nearly 11.5 per cent year to date.

Hong Kong’s slowing property market hits Tseung Kwan O’s Villa Garda

The percentage of loss-making lived-in transactions so far this month has risen to 0.07 per cent, the highest since July 2021 when it stood at 0.02 per cent, according to Ricacorp.

The losses came as Centa-City Leading Index (CCL), the gauge of lived-in homes compiled by Centaline Property Agency, fell 0.67 per cent to 179.85 for the week ended July 17. The index has fallen below the 180 level twice in eight weeks as property prices continue to soften. It may test the 178 level in the short-term, according to Centaline.

“Affected by the recent interest-rate hike in the US and the emigration wave, the second-hand market is relatively quiet, and owners tend to reduce prices to attract buyers,” said Paul Cheng, district sales manager at Centaline.

The total number of loss-making cases in the first half of this year at 695 was the highest since 2011, according to Ricacorp Properties. The percentage of profit-making cases in the first half was 94.6 per cent, the lowest since 2010.

One of the biggest losses incurred this year was HK$2.03 million (US$258,613) for a 721 square feet flat at The Fortune Gardens in West Mid-Levels, brokered by Midland Realty.

Meanwhile, the leftover stock of new flats has risen for three consecutive months to about 13,446 units in June, the highest since records started in 2013, according to data compiled by Century 21 Hong Kong from official records.

Hong Kong lived-in home prices to extend May decline into June

As developers were in a rush to launch projects after suspending sales earlier this year during the peak of the fifth wave of the Covid-19 outbreak, “the volume of launches was significantly higher than the sales in the first half”, said Luke Ng, CEO of Century 21.

In the second half, developers will continue their sales offensive for new project launches even as the overall outlook for the market remains uncertain because of rising interest rates, Ng said.

“The competition in the new property market is fierce. Developers will remain restrained in their pricing.”