Advertisement

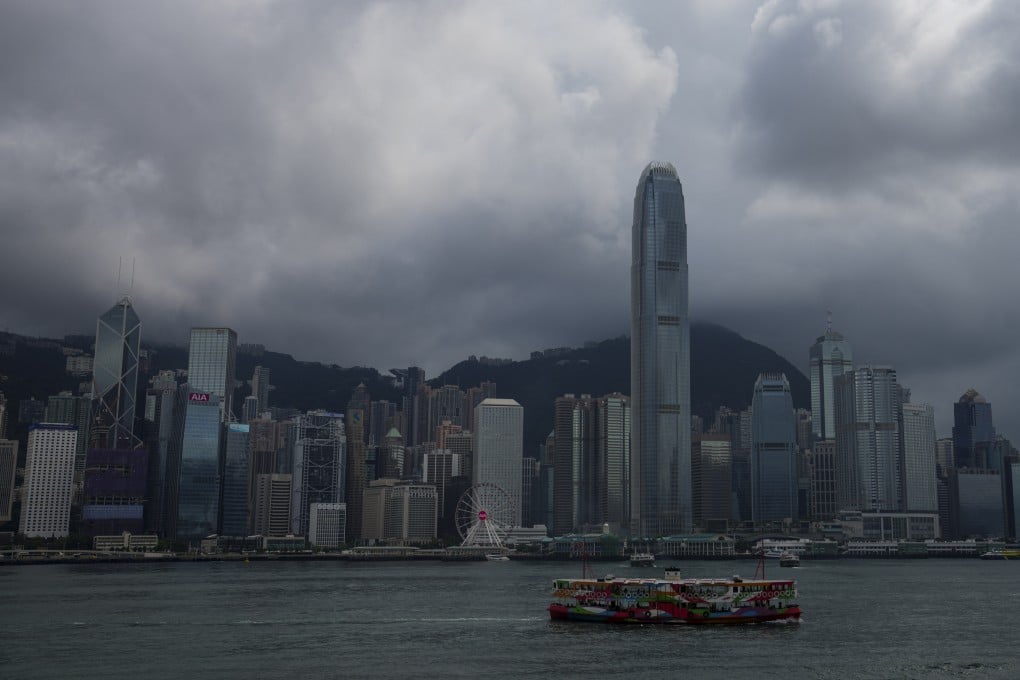

HSBC, Standard Chartered among major Hong Kong banks offering higher deposit rates of up to 3 per cent to attract cash, new customers

- Mox, the virtual bank backed by Standard Chartered, is offering a saving deposit rate of 3 per cent to new customers

- Standard Chartered is offering 2.8 per cent for 12-month time deposits and 2.4 per cent for six-month time deposits above HK$10,000

Reading Time:3 minutes

Why you can trust SCMP

Major Hong Kong banks are offering high rates for long-term deposits in a bid to secure funds from retail clients to offset a substantial rise in the cost of borrowing from the interbank market.

Lenders including HSBC, Standard Chartered and Bank of China (Hong Kong) (BOCHK), the city’s three currency-issuing banks, as well as smaller players, are offering up to 3 per cent for long-term time deposits. This is several times higher than the beginning of the year, and the banks also hope to attract new customers.

Standard Chartered is offering 2.8 per cent for 12-month time deposits and 2.4 per cent for six-month time deposits above HK$10,000 (US$1,274). These rates are available only to those who apply for time deposits through the bank’s online channels.

Advertisement

“The adjustment of the long-term deposit rates reflects the rise in Hibor [Hong Kong Interbank Offered Rate] and market expectations of [further] interest-rate hikes in the near future,” said Mona Sengupta, head of mortgages and deposits, consumer, private and business banking at Standard Chartered Hong Kong.

The one-month Hibor, a benchmark for mortgage loans – rose to 2.01 per cent on Friday, a 29-month high, according to mortgage broker mReferral. The three-month Hibor, the benchmark for corporate loans, climbed to 2.79 per cent, nearing a 14-year high. The one-month interbank rate stood at only 0.15 per cent at the beginning of this year, while the three-month rate was at 0.25 per cent.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x