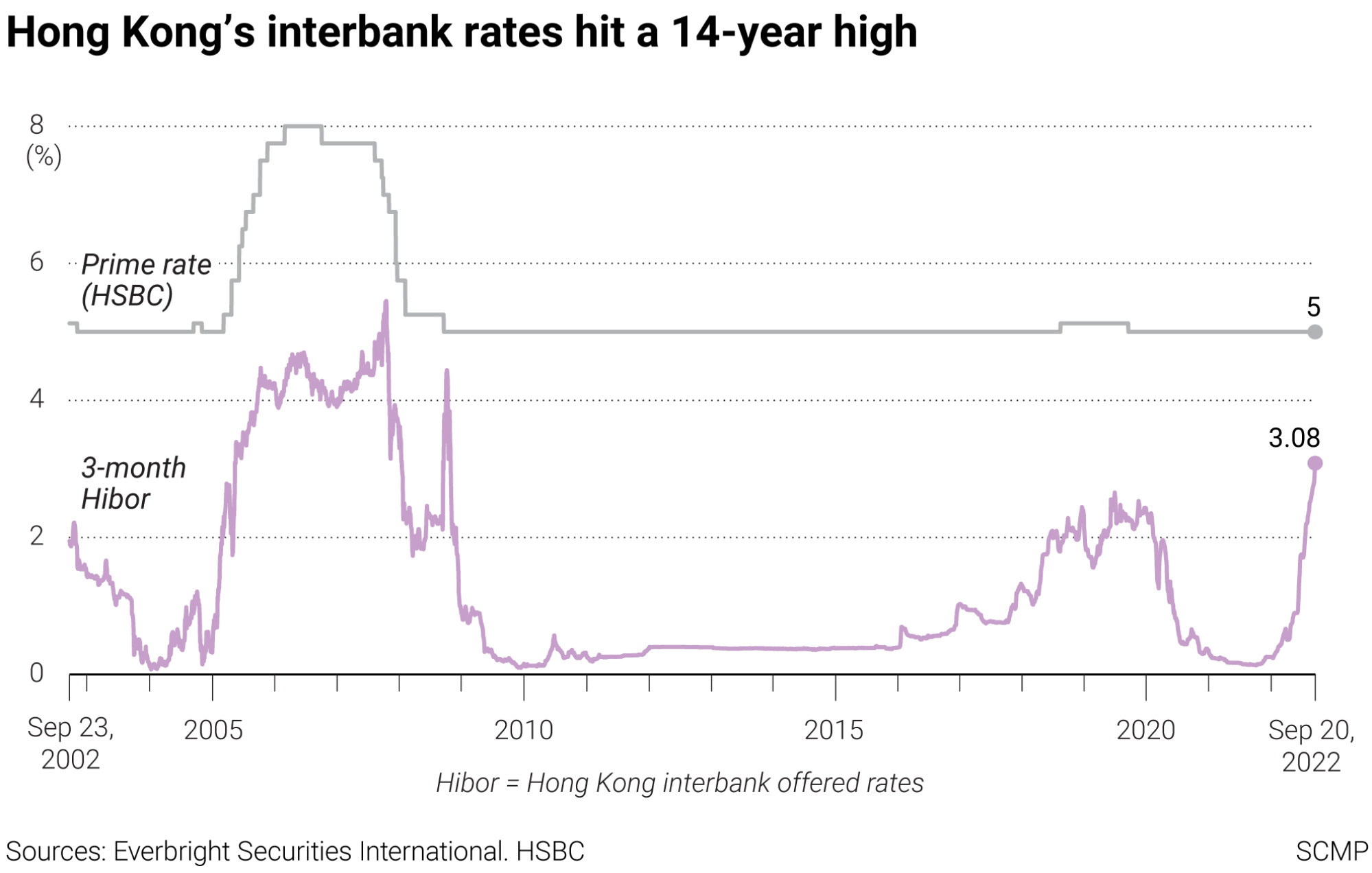

Hong Kong’s banks raise prime rates for the first time in 4 years as cost of money soars to 14-year high

- HSBC, Standard Chartered, Bank of China (Hong Kong), Hang Seng Bank and Bank of East Asia raised their best lending rate for borrowers by 12.5 basis points

- The first increase in prime rates in four years will hurt the property market and Hong Kong’s economy, analysts say

Other banks are expected to follow the lead by Hong Kong’s major banks. The last time the lenders raised their prime rates was a 12.5-basis point increase in September 2018, as they waited through nine rounds of hikes by the monetary authorities between 2015 and 2018 before passing the higher cost of money to their customers.

“Since the economic contraction was significant in the first half, it is highly likely that negative growth will be recorded for the full year,” Financial Secretary Paul Chan Mo-po said after the HKMA’s move, adding that the government will update its full-year economic forecast in November.

Hong Kong’s homebuyers had HK$1.78 trillion (US$227.13 billion) in mortgage loans at the end of July, with the average mortgage at HK$5.07 million, according to the HKMA. Borrowers who tie their loans to the prime rate will face higher payments when the higher rate kicks in.

The payment of a typical HK$5 million, 28-year loan with a 2.75-percentage point discount to the prime rate will increase by 1.6 per cent, or HK$323, to HK$21,029 per month, according to mReferral, a local mortgage broker.

“The prime rate increase with the recent surge of interbank rates will mean higher interest payments for mortgage borrowers,” said Eric Tso Tak-ming, chief vice-president of mReferral. “This will have a negative impact on the property market.”

Hong Kong’s base rate soars 75 basis points to the highest in 14 years

“The US will continue to raise the Fed’s rate until 2023, and Hong Kong has to follow the interest rate rise cycle,” said ANZ’s Greater China chief economist Raymond Yeung. “It will add pressure on the property market and will hurt the weakened economy.”

The cost of funds is now at the highest in Hong Kong since March 2008, when the base rate was at 3.75 per cent during the global financial crisis.

Will interest rate rises dampen Hong Kong’s love affair with property?

Most banks price their mortgage rates at discounts of between 2.5 and 3 percentage points to the prime rate. For personal unsecured overdraft, banks charge about 5 to 7 percentage points on top of the prime rate.

“The impact of a prime rate hike on the local stock and property markets in the near term should be limited, as any responses to higher interest rates should have long been reflected in the market,” said OCBC-Wing Hang Bank’s economist Cindy Keung. “Going forward, in the absence of major changes in Fed’s rate hike trajectory, the stock and property markets will be more sensitive to the oscillating risk sentiment and recession fear.”

This is the main culprit behind the Hong Kong dollar’s slump

The Fed, which raised its rate five times this year, is expected to take the target rate to a 15-year high of 4 per cent by early 2023, from the current range of 3 to 3.25 per cent, according to Schroders’ senior European economist and strategist Azad Zangana.

“Higher interest rates, less generous government spending and higher inflation all work to reduce the spending power of households,” Zangana said in a note. “Companies are likely to respond to weaker demand by slowing production, and reduce [the] demand for labour.”