Zombie apocalypse: 1 in 5 Hong Kong-listed companies not earning enough to pay the soaring interest on their debts

- 462 Hong Kong-listed companies qualify as ‘zombies’, and 266 have been in these dire straits for three years running

- Overextended on funding they got at historically low rates in recent years, they must find white knights, sell assets or risk bankruptcy

Some corporate borrowers in particular face a perilous fate. Unable to generate enough cash to pay the interest on their loans, let alone the principal, these firms find themselves branded “zombie” companies.

Last year, 462 of Hong Kong’s 2,500 listed companies fell into the category, with an Ebit-to-interest-expense (earnings before interest and tax) ratio of less than 1, based on Bloomberg’s data.

In the past many zombie companies could shamble on indefinitely, refinancing their debt at historically low interest rates, receiving cash injections from white knights, or getting support from governments that wish to avoid the mess their collapse would entail. However, the current interest-rate situation makes it likely that more of these living-dead firms will succumb, according to analysts.

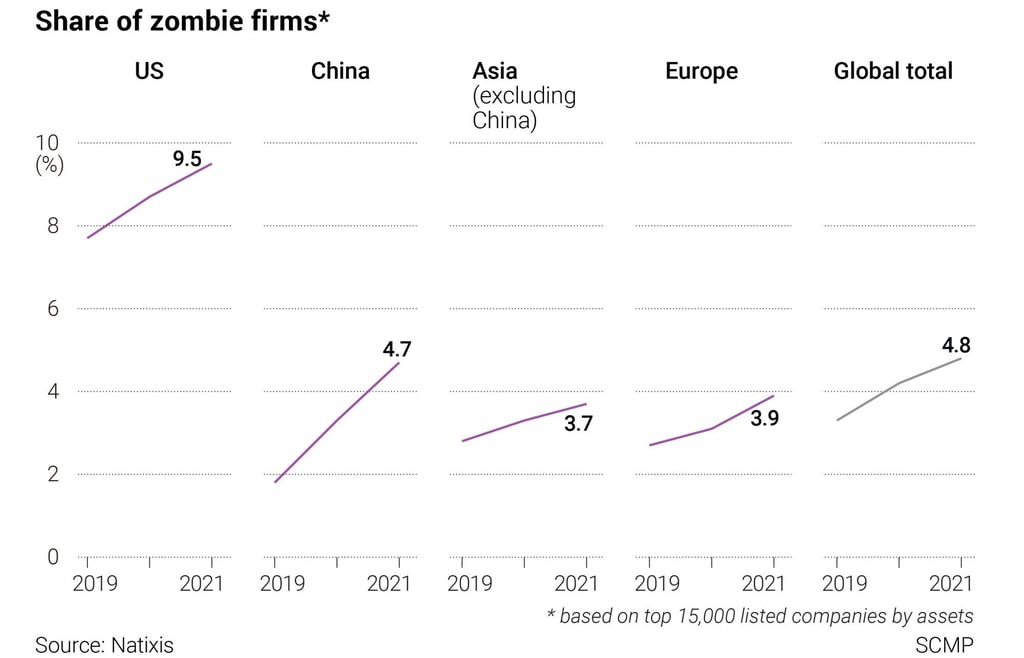

“The rise of the zombie companies since the Covid-19 pandemic is a global phenomenon,” said Natixis CIB’s senior economist Gary Ng, whose research found that the undead throng grew 18 per cent last year to 597 out of 15,000 listed companies worldwide, after a 37 per cent increase in 2020. “It means the risk of zombie companies going bankrupt has increased all over the world.”