Zombie apocalypse: 1 in 5 Hong Kong-listed companies not earning enough to pay the soaring interest on their debts

- 462 Hong Kong-listed companies qualify as ‘zombies’, and 266 have been in these dire straits for three years running

- Overextended on funding they got at historically low rates in recent years, they must find white knights, sell assets or risk bankruptcy

Some corporate borrowers in particular face a perilous fate. Unable to generate enough cash to pay the interest on their loans, let alone the principal, these firms find themselves branded “zombie” companies.

Last year, 462 of Hong Kong’s 2,500 listed companies fell into the category, with an Ebit-to-interest-expense (earnings before interest and tax) ratio of less than 1, based on Bloomberg’s data.

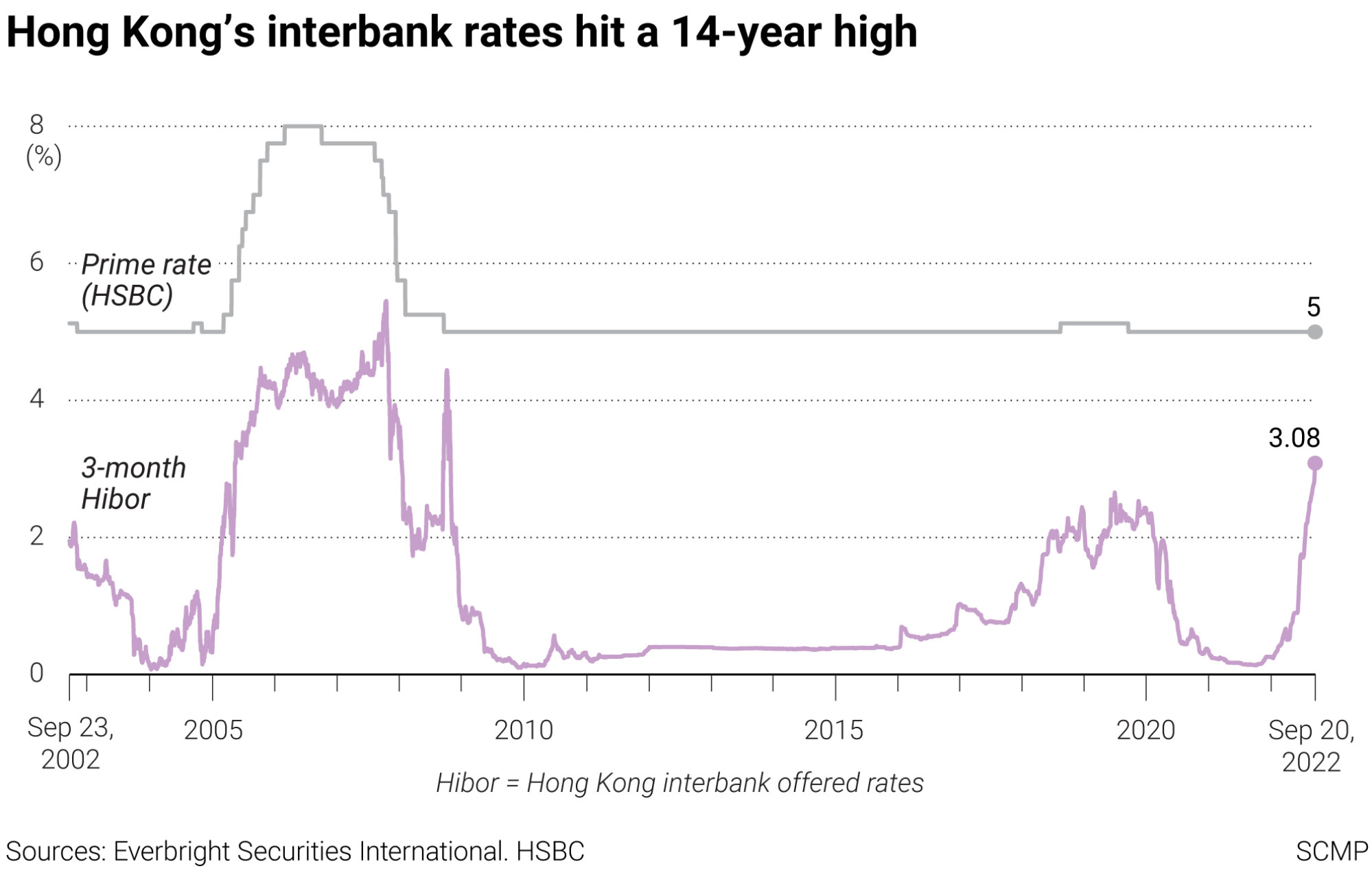

In the past many zombie companies could shamble on indefinitely, refinancing their debt at historically low interest rates, receiving cash injections from white knights, or getting support from governments that wish to avoid the mess their collapse would entail. However, the current interest-rate situation makes it likely that more of these living-dead firms will succumb, according to analysts.

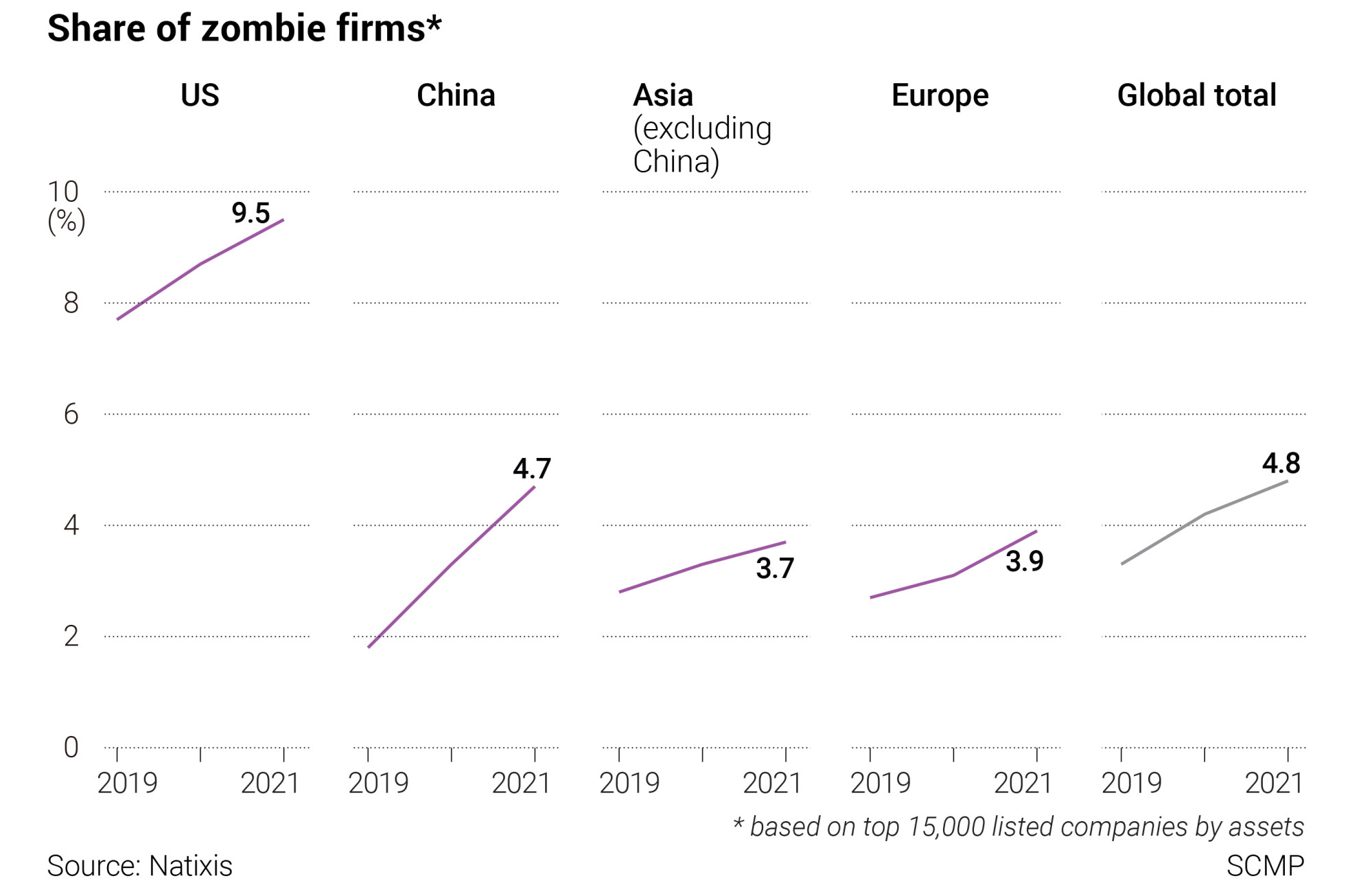

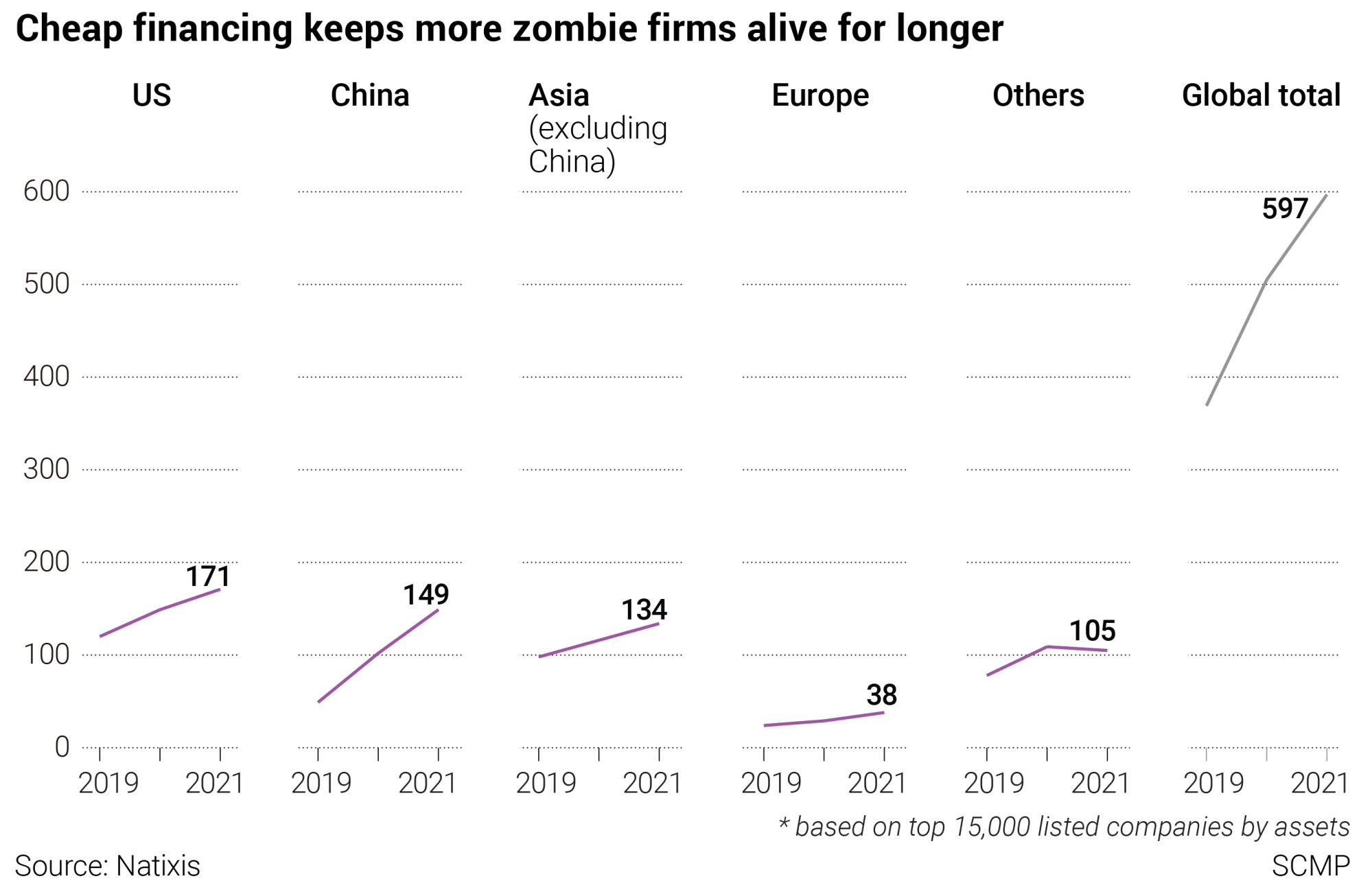

“The rise of the zombie companies since the Covid-19 pandemic is a global phenomenon,” said Natixis CIB’s senior economist Gary Ng, whose research found that the undead throng grew 18 per cent last year to 597 out of 15,000 listed companies worldwide, after a 37 per cent increase in 2020. “It means the risk of zombie companies going bankrupt has increased all over the world.”

As many as 149 China-based companies listed in Hong Kong, Shanghai, Shenzhen and New York have earned less than the interest on their debt for three straight years from 2019 through 2021, according to Natixis’ data. That number is up from 102 in 2020, and has tripled from 49 in 2019, before the pandemic broke out.

China ranks second in the world in terms of its 2021 zombie population; the US had 171 zombies and Asia excluding China had 134.

The current environment makes lengthy sagas such as Sharp’s less likely.

US Fed, with third straight rate rise, signals further aggressive moves

“With the global policy rates adjustment having further room to go and the multiple shocks facing the global economy, zombie companies are feeling the heat,” said Jerome Jean Haegeli, group chief economist of Swiss Re.

The pandemic has conspired with an era of readily accessible funding – at historically low rates until recently – to not only increase the population of zombies but also to make these distressed firms even more vulnerable now that the monetary tables have turned, according to Etienne Ranwez, a senior manager at Sia Partners in Hong Kong.

“Revenues of many companies in Hong Kong and China, just like in most regions globally, were already under pressure with Covid,” he said. “As funding was cheap, these companies have loaded on more debt than usual. Hence, we could indeed expect an increase in bankruptcies.”

This will be true more so in liberal and developing economies than in developed economies with more government intervention, he added.

Many governments offered pandemic relief that helped to sustain some zombies through the last three years. But those sources of sustenance are drying up.

Hongkongers snub new homes in Kai Tak as rising interest rates kill demand

Making life even tougher for zombie companies, borrowing costs in the bond markets are also rising.

“Investors would be more risk-averse and selective in bond markets, meaning the funding costs for high-yield issuers will climb, or some may not even be able to refinance,” said Natixis CIB’s Ng.

In the US, defaults on leveraged loans reached US$6 billion in August, Haegeli said.

“This is still very low, but it is the highest since October 2020 when the pandemic shutdown hit the US economy,” he said. “Europe is much more vulnerable to the energy crisis and stagflationary shock overall.”

Fed hawks push Chinese banks to pay off US$12 billion of perpetual debt

The liquidation is the biggest casualty in Asia’s tourism industry as the Covid-19 pandemic continues to wreak havoc on global travel.

Zombie companies can survive by selling profitable assets or business lines, or by finding white knights to inject new capital, said Derek Lai, vice-chair of Deloitte China.

Asian central banks locked in losing chess match with US Fed

“Many zombie companies can turn into normal companies by restructuring debt and finding new investors to support their business,” Lai told the Post. “Bankruptcies are not the only way out.”

China’s one-year loan prime rate (LPR) was reduced from 3.7 per cent to 3.65 per cent, the People’s Bank of China said on August 22, while the five-year LPR, which is the reference for mortgages, was cut from 4.45 per cent to 4.3 per cent.

“China is a totally different animal, as interest rates are kept low and banks are being asked to support companies,” said Alicia García Herrero, chief Asia-Pacific economist at Natixis CIB.

“Still, bond defaults are as high as in 2020 and 2021, and the ratio should increase after the party Congress and the consequences of a rapid economic deceleration are fully there.”

China has a huge amount of zombie companies, García Herrero said, and that is not going to change soon because China, like some Western governments, tends to prefer the survival of zombie companies to their collapse. Although letting zombies die could be more healthy for overall economic development, it can be politically costly, with knock-on effects on healthy companies, she said.

“If more zombie companies go bankrupt, bank non-performing loans will continue, so the problem is passed to the banks,” García Herrero said. “This is one more reason why governments continue to support zombie companies.”

The Hong Kong Monetary Authority (HKMA), the de facto central bank of the city, considers the credit risk facing the Hong Kong banking sector to be manageable, according to a spokesman.

Based on the latest statistics, the asset quality of banks remains healthy, with an average classified loan ratio of 1.1 per cent at the end of June 2022.

“The HKMA has all along required banks to adopt prudent underwriting standards and carefully assess the financial strength and repayment ability of borrowers,” the spokesman said.

In mainland China, historical state intervention and a relatively lower level of transparency around financial data may have allowed zombie companies to become larger on average than in neighbouring countries, according to Sia Partners’ Ranwez.

However, Beijing’s support seems to have limits.

“More recently, the government seems increasingly reluctant to save non-performing companies such as the Evergrande Group, although probably less so in key strategic sectors like telecoms and even banking,” Ranwez said.

Large companies can raise funds through new share placements or rights issues, but smaller firms may not be able to secure such funding, he said.

Another option is to look for salvation in a merger or acquisition by competitors or private-equity firms.

“Recessions and high-interest-rate environments will eventually ‘clean up’ the weaker participants in the economy,” Ranwez said.

“For the longer term, this will result in a stronger and healthier economic environment, where resources and capital are utilised by firms who are performing well and creating value, rather than by zombie companies that are unproductive and inefficient.”