Exclusive | Hong Kong central banker Eddie Yue says domestic consumption can drive economic growth, counter high borrowing costs

- The recent relaxation of Covid-19 rules could help boost domestic consumption, which has been suppressed in the past year, Yue says

- HKMA CEO expects banks’ bad-debt ratios will rise but will be ‘manageable’

Hong Kong’s retail consumption is likely to pick up in the coming months as easier social-distancing rules open the way for business and leisure travel to resume, delivering a much-needed boost to help the services-dependent economy offset the pain of rising borrowing costs, the city’s de facto central banker said.

“Because the monetary policy in Hong Kong is not to be used for purposes other than exchange-rate stability, that means if the government needs to provide some support to the economy, or some support to individual sectors of the economy, like SMEs [small and medium-sized enterprises], then it will have to use fiscal policy,” Eddie Yue Wai-man, the HKMA’s CEO, said in an interview with the Post.

“It is either in terms of investing in infrastructure, or like what the Hong Kong government did in the past few years – by giving out consumption vouchers.”

“I do hope that our economy will come back stronger, especially if consumption can go back up,” he said. “The sentiment to consume and the sentiment to invest might go up.”

Hong Kong slipped into recession this year, with its economy shrinking by 3.9 per cent in the first quarter and 1.4 per cent in the second three-month period.

Moreover, 10 major lenders – including note-issuing banks HSBC, Standard Chartered and Bank of China (Hong Kong) – last Friday and this week raised their best lending rates by 12.5 basis points, the first rate increases by commercial banks in four years.

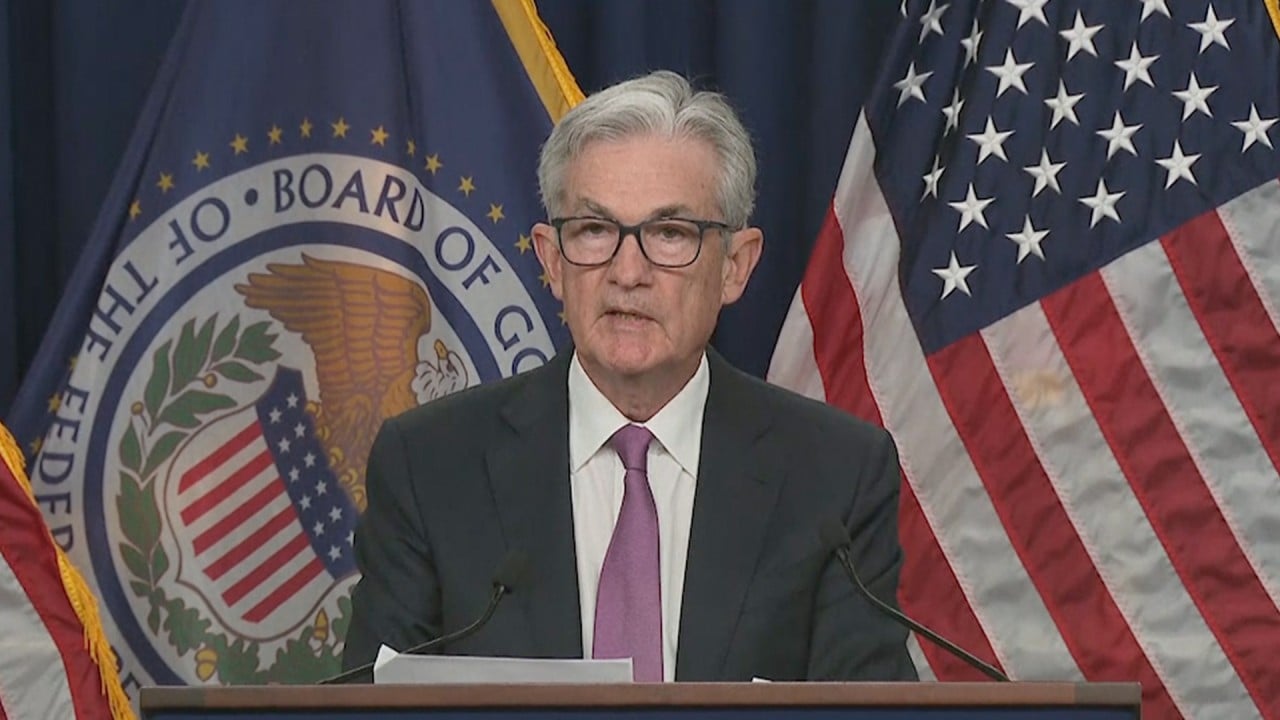

This came after the HKMA raised its base rate to a 14-year high of 3.5 per cent last week, in lockstep with the US Federal Reserve, which raised its funds target rate by 75 basis points to between 3 and 3.25 per cent last Thursday. Hong Kong’s currency peg means it must follow the Fed’s interest rate moves regardless of the local situation.

The second phase of the government’s consumption voucher scheme should also boost domestic consumption. The authorities began handing out a total of HK$5,000 (US$637) to each qualified resident from August to encourage spending locally.

Yue, who attended the Jackson Hole gathering of the world’s central bankers from August 25 to 27, said the Fed has made it clear it will continue to raise rates until inflation is suppressed in the United States.

The US central bank has raised rates five times by a total of 300 basis points since March this year to tame inflation that is at a four-decade high. Analysts have forecast rates will rise to 4.4 per cent by the end of this year, indicating another increase of about 125 basis points.

The impact of higher rates in the US and a strong US dollar has been felt across the world. The pound Sterling has slumped against the American currency, and Asia has seen outflows of capital.

The HKMA intervened on Wednesday in the foreign-exchange market for the first time in seven weeks to defend the peg, following carry trades, where traders sell Hong Kong dollars to buy US dollar assets for higher yields.

“We all should expect that Hong Kong’s interest rate path will be going up in the near future,” Yue added. “For people who want to make investments, who want to take out mortgages or making borrowing decisions, they need to be fully aware and take into account interest rate risks.”

As interest rates continue to rise, they will add to the cost of borrowing and will lead to more debt restructurings or even liquidations, particularly at so-called zombie companies that are heavily in debt and do not have strong cash flows, said Wilson Pang, a senior partner at KPMG Advisory and CPA Australia’s councillor in its Greater China division.

“The corporate borrowers who rely on short-term lending to finance their long-term projects will also be affected by interest rates,” Pang said. “They will need the government to offer support to overcome the challenges they might be facing under during an economic downturn and in an high interest rate environment.”

The HKMA this month asked banks to further extend a loan-repayment holiday programme until January next year, allowing SMEs to repay only interest for the time being. The government has also extended an SME financing guarantee scheme.

“This kind of temporary support for SMEs will be needed to get them through this [difficult time], when the economy is still not recovering yet and the interest rate burden is rising,” Yue said.

He said he expected bad-debt ratios would rise but would be “manageable”. Yue said that the bad-debt ratio for Hong Kong banks had only gone up slightly from 0.98 per cent at the beginning of the year to 1.1 per cent as of the end of June.

“It is actually quite low,” he said. “When you compare that with the same ratio in other financial centres, or compare that with our own historical levels, it remains quite low.”

The global economy is slowing, said Yue, who completes three years of his five-year term this weekend. “There will be pressure on the classified loan amount, not just in Hong Kong, but around the world.”

His whole team at the HKMA has been through these tough times and knows the importance of teamwork, Yue said.

“During rough times, we need to keep the financial stability of Hong Kong and we need to keep the markets developing, so that we can continue to be competitive as an international financial centre,” he added.