Advertisement

Hong Kong may roll out the welcome mat for Big Tech IPOs even before they earn a single dollar, in city’s biggest listing reform in four years

- Under Chapter 18C of Hong Kong’s listing rules, pre-revenue Big Tech companies valued at HK$15 billion to HK$20 billion can apply to raise capital

- The valuation can be cut to HK$8 billion if the companies have earned at least HK$250 million in sales, sources said

Reading Time:3 minutes

Why you can trust SCMP

2

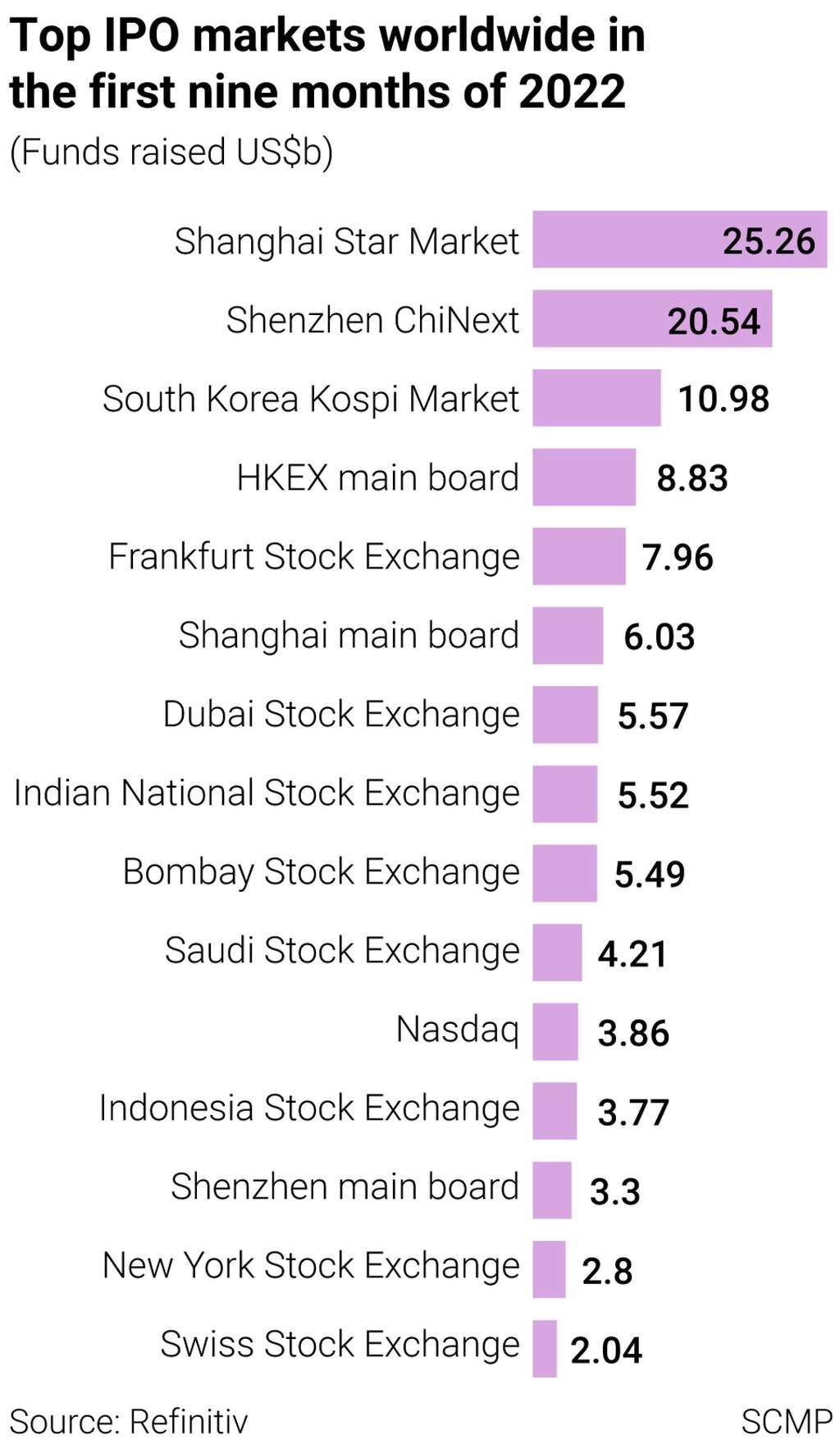

Hong Kong may let Big Tech companies raise funds even before they earn a single dollar, as regulators make the biggest tweaks to their listing rules in four years to help the local bourse reclaim its pole position in hosting initial public offerings (IPOs).

The Securities and Futures Commission (SFC) will soon give its go-ahead for Hong Kong Exchanges and Clearing Limited (HKEX) to seek public feedback for setting up a listing regime for unprofitable or pre-revenue Big Tech companies, according to two sources familiar with the matter.

The HKEX will issue the consultation paper at the end of October or by early November, with the aim of implementing the changes in early 2023, they said.

Advertisement

Under a new Chapter 18C of Hong Kong’s listing regulations, pre-revenue Big Tech companies that are valued at between HK$15 billion and HK$20 billion (US$2.55 billion) can apply to raise capital, the sources said. The valuation can be cut to HK$8 billion if the companies have earned at least HK$250 million in sales, they said.

The preferred industries under the Big Tech label include artificial intelligence (AI), semiconductors and software-as-a-service (SaaS), among others.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x