Easing of cooling measures is not a cure-all for Hong Kong’s struggling property market, say analysts

- Any relaxation of the government’s cooling measures will only slow down the decline in homes prices but not reverse the trend, says DBS Bank analyst Jeff Yau

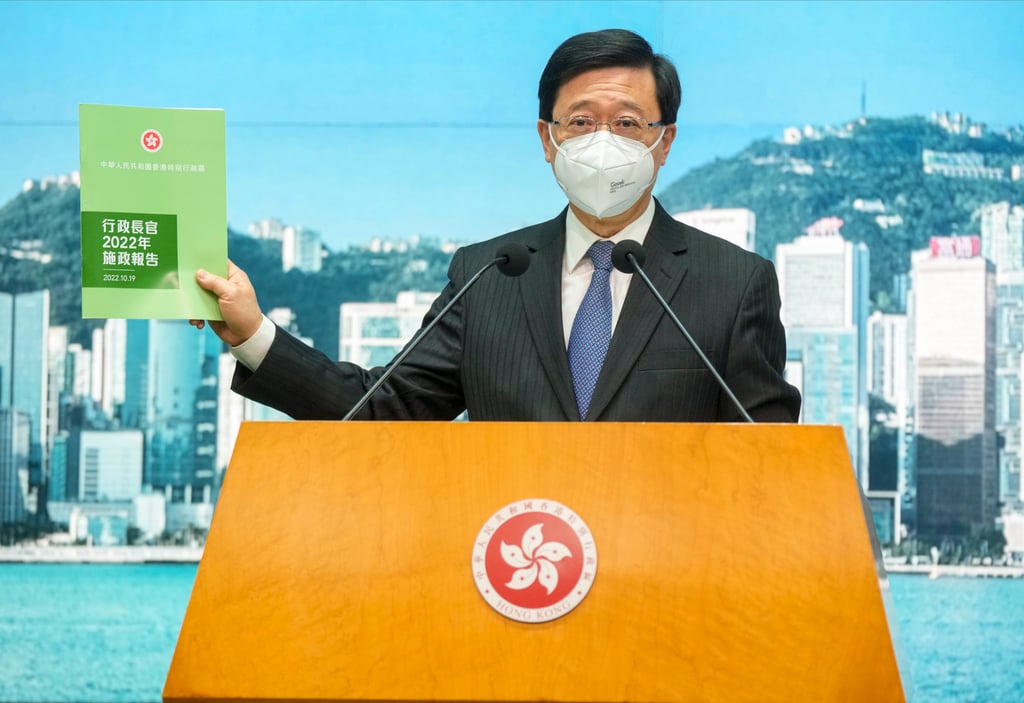

- Chief Executive John Lee is expected to unveil many measures in his inaugural Policy Address to revive Hong Kong’s struggling economy

Lee is expected to announce several groundbreaking measures in his address on Wednesday, aimed at reviving the city’s battered economy. Property developers and agents have been lobbying the government to scrap legacy stamp duties.

Analysts have not ruled out the possibility of the government relaxing some of its measures to cool the property market in the event of a sharp correction. However, its impact on steadying prices will be felt gradually, they added.

“After the relaxation, it does not mean the housing market will rebound tomorrow,” said Jeff Yau, group research executive director at DBS Bank (Hong Kong). “I believe the extent of the decline will slow down.”

If the cooling measures are dropped, the price decline may slow down but the trend will not be immediately reversed, he added.