Greater Bay Area: Hong Kong wants to add insurance products to ‘Connect’ menu to deepen cross-border links

- Move will be assessed after current efforts to establish after-sales service centres to help residents in Greater Bay Area, lawmaker says

- The city’s insurance industry is keen to have an ‘insurance connect’ of its own to enable companies to cross-sell policies on both sides of the border

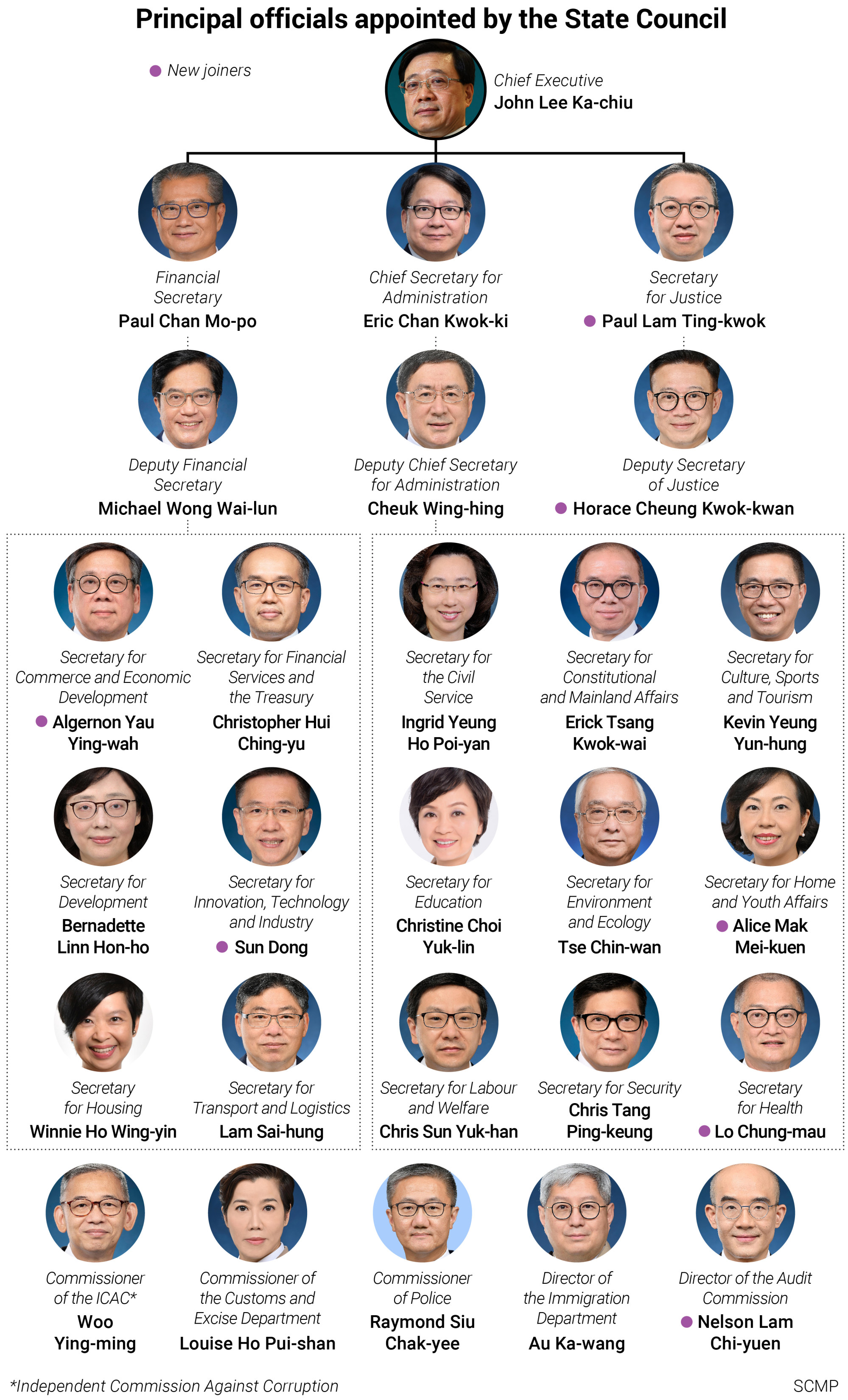

It could be integrated as part of the Wealth Management Connect scheme launched in 2021, or as a stand-alone Insurance Connect scheme to allow cross-border sale of policies within the 11 cities covering the bay area, he said at the monthly Legislative Council financial affairs panel meeting on Monday. No decision has been made.

“We are exploring the two possibilities to see which options would be more advantageous,” he said. The decision would depend on regulatory discussion with mainland Chinese regulators, including on the timeline, the lawmaker added.

The city’s government is keen to push ahead with the long-awaited idea of forming those service centres, such as in Nansha and Qianhai, due to strong demand from insurers, Chief Executive John Lee Ka-chiu said in his policy address in October. They could support residents in the nine mainland Chinese cities within the bay area.

At its peak in 2016, mainland Chinese bought HK$72.68 billion (US$9.26 billion) of policies from insurers based in Hong Kong, representing 39 per cent of the premiums in the city. This slumped to HK$688 million in 2021 or 0.4 per cent of the total, when border closures reduced their mainland arrivals by 98 per cent, according to official data.

The Wealth Management Connect, which marked its first anniversary on October 19, allows commercial lenders in Hong Kong and Macau to sell investment fund products to residents in the bay area via their mainland banking partners.

The government would like to add insurance products to the wealth management menu from these lenders, said Chan Kin-por, a lawmaker with insurance background and who is also a member of the Executive Council, the city’s Cabinet.

The first Connect scheme was started in 2014, linking the stock markets between Hong Kong and Shanghai, before the Shenzhen leg was added two years later. The Bond Connect followed, allowing foreign investors to buy yuan bonds in 2017, and mainland funds to buy bonds in Hong Kong from 2021.

The ETF Connect is the latest cross-border scheme to be added to the basket in July to mark the 25th anniversary of the city’s handover.

Global investors traded 42 million yuan (US$5.8 million) of mainland-listed ETFs per day in September, Hui said, double the volume in July. The amount of Hong Kong-listed ETFs traded by mainland investors also tripled to HK$680 million per day over the same period.

Hui said the government is looking into calls to resume the Capital Investment Entrant Scheme, a programme launched in 2003. It allowed rich foreigners and their families to obtain Hong Kong identity cards with a HK$10 million investment in approved stocks, bonds, insurance and funds.

The scheme attracted HK$206 billion of infusion before its suspension in 2015, partly because of complaints it helped fuel property prices. The scheme could be revived with refinements to rejuvenate a weak economy, said Regina Ip, convenor of the Executive Council.

“The key issue is to prevent the scheme from stoking speculation in the property market and affecting the livelihood of the residents,” she said.