Hong Kong gives first-home buyers a leg-up with trims to ad valorem stamp duty

- Adjustments aimed at ‘easing the burden on ordinary families of purchasing their first residential properties’, Paul Chan says

- Measure effective immediately, will benefit 37,000 buyers and cost the government around HK$1.9 billion a year

“Last year, more than 90 per cent of buyers of residential properties were first-time buyers,” Finance Secretary Paul Chan Mo-po said in his budget announcement on Wednesday. “Having considered that no adjustments have been made to the value bands of the ad valorem stamp duty payable for the sale and purchase or transfer of residential and non‑residential properties since 2010, I have decided to make adjustments in this regard, with a view to easing the burden on ordinary families of purchasing their first residential properties, particularly small and medium residential unit.”

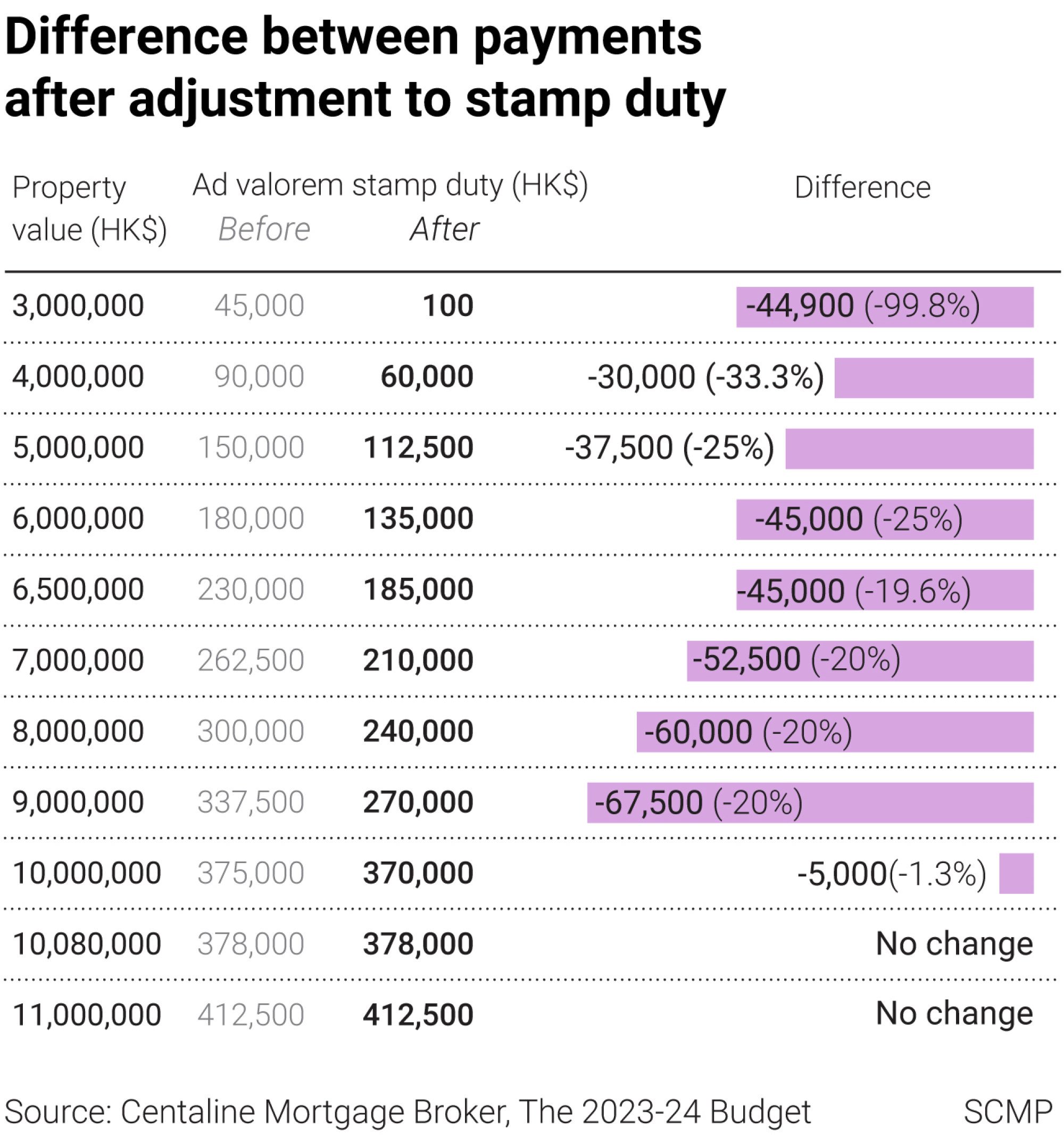

The ad valorem stamp duty will now be HK$100 (US$12.8) for homes worth up to HK$3 million, instead of HK$2 million previously, among other cuts. The changes apply to homes worth HK$10 million or below, with the difference up to HK$67,500 for properties worth HK$9 million ones, according to StarPro Agency.

“We expect this should help reduce the burden of buyers of private properties priced at about HK$4 million to HK$6 million, which is the prevailing price for many first private homes,” said Raymond Cheng, managing director of CGS-CIMB Securities.

Hong Kong property deals hit three-month high in January, may rise this month too

The measure will help relieve the burden of families that are buying their first homes or swapping for a new one, said Dave Ma, CEO at Hong Kong Property. This will boost transactions of small and medium residential units, he said, adding that homes worth less HK$10 million will be more sought after.

A majority of first-time property buyers will benefit from this change, which will most likely attract genuine users looking to acquire their first property, said Polly Wan, tax partner at Deloitte China. “Reducing the stamp duty can relieve some of the financial burden of first-time property buyers,” she said.

The adjustment was “definitely a surprise” and suggest the government listened to the industry’s opinions, said Sammy Po, CEO of Midland Realty’s residential division.

New property stamp duty rebate scheme for non-locals ‘too soft’, analysts say

But the impact might be limited, others said. “Although the government has made minor adjustments to the ad valorem stamp duty, it is expected to have little impact on the market and will not significantly push buyers to enter the market,” said Martin Wong, head of research and consultancy for Greater China at Knight Frank.

The government should completely abolish the outdated special stamp duty and use the Buyer’s Stamp Duty to attract talent to the city, Wong said. The city should take a “tax exemption first, tax recovery later” approach so that the market can resume its due circulation and increase housing supply.

“The measure will not lead to a significant increase in housing demand in the residential market,” said Raymond Chong, founder and CEO of StarPro Agency. He estimated that for a property worth HK$9 million, homebuyers could save up to HK$67,500 after the adjusted stamp duty.

‘Cautiously optimistic’ Sino Land set to launch some 2,100 flats this year

“I believe potential homebuyers will not make a buying decision because of tens of thousands of Hong Kong dollars in stamp duty. Luxury units worth over HK$10 million are not affected by the adjustment so there won’t be an impact on this segment,” he added.

The latest relaxation follows a slew of easing measures introduced over the past few years. For instance, in his first policy address in October 2022, Hong Kong leader John Lee Ka-chiu announced the refund of an extra stamp duty that non-locals paid when buying Hong Kong residential property. Eligible non-local buyers can claim the refund after they remain in the city for seven years and obtain permanent residence.

Non-locals pay the Buyer Stamp Duty and an ad valorem stamp duty, two taxes of 15 per cent, on property purchases. Under the new policy, non-locals can get a refund of the taxes and pay a lower ad valorem rate ranging from HK$100 to 4.25 per cent of the property value.

In the budget announced in February last year, the mortgage amounts available were raised to help buyers, with the loan-to-value ratio of 80 per cent increased to a maximum of HK$12 million from HK$10 million. First-home buyers who qualify for the higher 90 per cent mortgages can now borrow up to HK$10 million from the previous HK$8 million.

“Any adjustment will have a positive effect on weakening market sentiment,” said Donald Choi, CEO of Chinachem Group. The removal of these measures will also not lead to any market speculation, given the city’s slowing economy, he added.

“The proposed changes to the first homebuyer stamp duty is minute,” said Nelson Wong, executive director of research at JLL. “It reduces the stamp duty liability by 0.75 per cent of purchase price for homes under HK$9 million,” he added.

“This is at best a gesture to demonstrate the government is responding, but it will have near zero impact on reviving the market.”

Since the Hong Kong economy has just started to recover, it is understandable that the government may need more time to carefully assess the domestic property market trend before making any adjustments to its “hard measures”, said Paul Ho, financial services tax leader for Hong Kong at EY.

“The adjustment will reduce the burden for first-time homebuyers and small-to-medium size properties, whereas the ‘hard measures’ are really targeted at speculators to manage the demand side.”

Additional reporting by Cheryl Arcibal