Hong Kong’s property market gathers momentum as pre-owned home prices jump by the most since May 2020

- An index of pre-owned homes rose to a four-month high of 345.9, following a 2.22 per cent increase in prices in February

- Home prices fell 15 per cent last year, the first decline since 2008, as the market was hit by rising mortgage rates and weakening economic sentiment

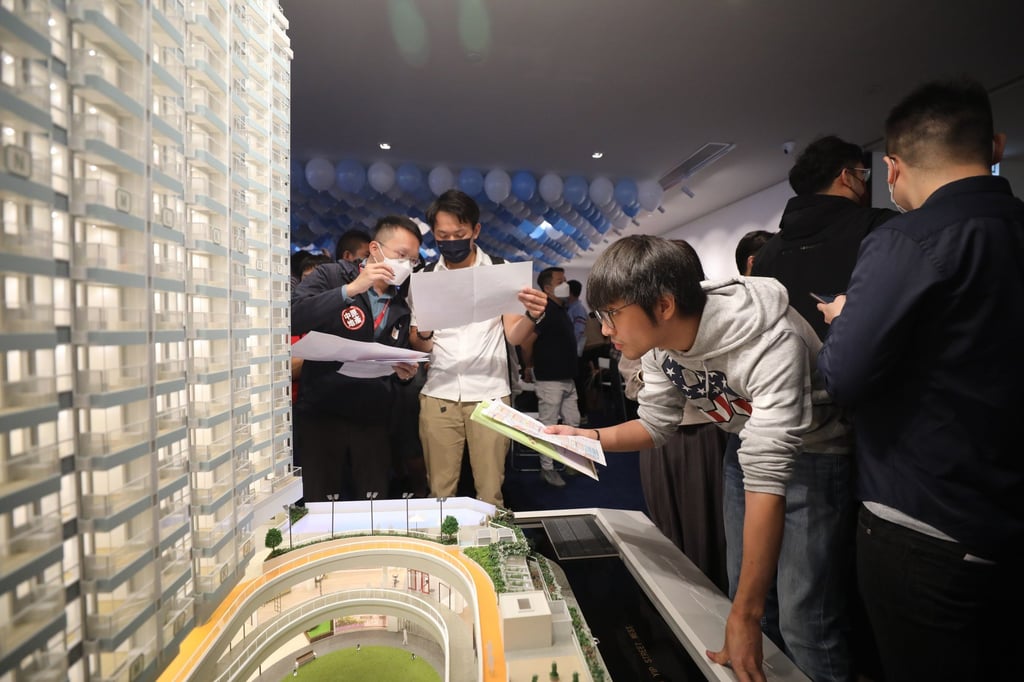

Hong Kong’s pre-owned home prices rose 2.22 per cent in February, the most in 33 months, as home-buying desire recovered on expectations of slower interest rate hikes and an improvement in economic sentiment following the reopening of the city’s borders.

The home price index stood at 345.9, the highest in four months, according to data from the Rating and Valuation Department. Prices rose by 2.28 per cent in May 2020.

“This is the second consecutive monthly increase,” said Derek Chan, head of research at Ricacorp Properties. “The rising momentum will continue if interest rates are stable and the city’s economy improves after the reopening of the borders.”

Chan expects home prices to increase by 6 per cent in the first quarter, recovering some of the losses made last year.

Private home prices in one of the world’s most unaffordable housing markets fell 15 per cent in 2022, the first drop since 2008, hit by the weakening economic outlook because of the Covid 19 pandemic and rising mortgage rates.

The biggest price increase was seen in small and medium-sized units, measuring from 430 square feet to 752 sq ft, which rose 2.24 per cent, the most increase in 46 months, the data showed.