Hong Kong’s property market gathers momentum as pre-owned home prices jump by the most since May 2020

- An index of pre-owned homes rose to a four-month high of 345.9, following a 2.22 per cent increase in prices in February

- Home prices fell 15 per cent last year, the first decline since 2008, as the market was hit by rising mortgage rates and weakening economic sentiment

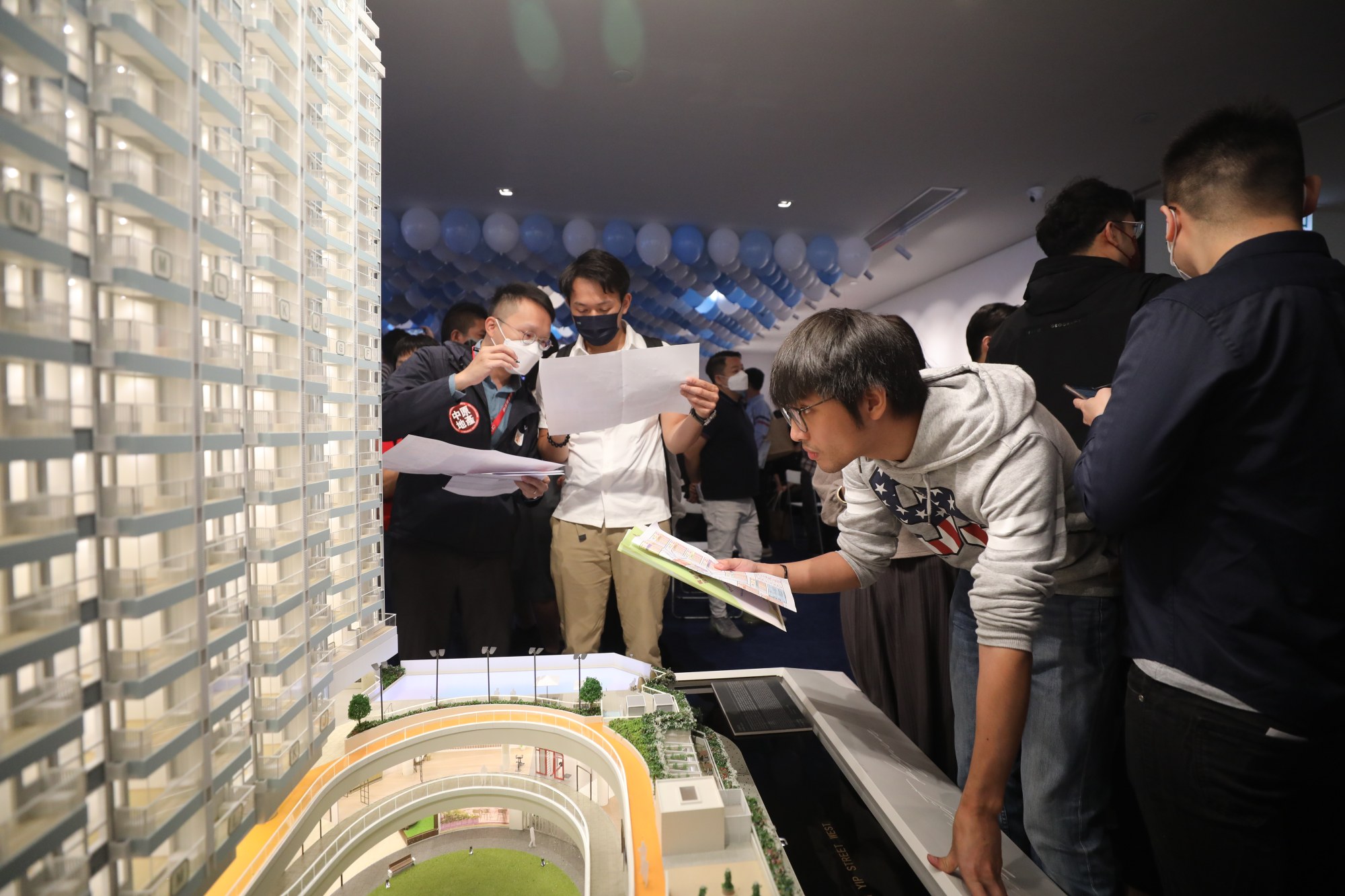

Hong Kong’s pre-owned home prices rose 2.22 per cent in February, the most in 33 months, as home-buying desire recovered on expectations of slower interest rate hikes and an improvement in economic sentiment following the reopening of the city’s borders.

The home price index stood at 345.9, the highest in four months, according to data from the Rating and Valuation Department. Prices rose by 2.28 per cent in May 2020.

“This is the second consecutive monthly increase,” said Derek Chan, head of research at Ricacorp Properties. “The rising momentum will continue if interest rates are stable and the city’s economy improves after the reopening of the borders.”

Chan expects home prices to increase by 6 per cent in the first quarter, recovering some of the losses made last year.

Private home prices in one of the world’s most unaffordable housing markets fell 15 per cent in 2022, the first drop since 2008, hit by the weakening economic outlook because of the Covid 19 pandemic and rising mortgage rates.

The biggest price increase was seen in small and medium-sized units, measuring from 430 square feet to 752 sq ft, which rose 2.24 per cent, the most increase in 46 months, the data showed.

Hong Kong office glut under further pressure in Credit Suisse-UBS merger: analysts

JPMorgan, in a report last week, said that it expects home prices to jump by 10 to 15 per cent in 2023. This is a reversal from its forecast in late November 2022 for a full-year price decline of 8 per cent in 2023, mostly concentrated in the first half of the year.

The bank’s optimism is driven by a combination of a slowing in the pace of interest-rate hikes, a stronger economy post-reopening and non-local buying.

“The significant pickup in high-end residential transactions is a strong vote of buying confidence in the Hong Kong housing market,” JPMorgan said in the report.

S&P Global Ratings, in its report on Tuesday, said that home prices will rebound by 5 to 8 per cent this year, citing an improving economic outlook following the removal of Covid-19 restrictions.

“However, we believe developers will price their projects conservatively in 2023 amid high inventory, a supply spike in 2024, and elevated interest rates,” S&P Global Ratings said.

Outlook for Hong Kong’s property market brightens as end of rate hikes in sight

Given the better-than-expected market sentiment, Colliers is adjusting its mass home price forecast to 8 per cent growth this year, said Kathy Lee, head of research at Colliers. In January, the consultancy said it expected an overall 5 to 10 per cent downward adjustment.

Lee noted that there are external uncertainties looming over the market. “Continued geopolitical tensions affecting China’s export trades and, subsequently, Hong Kong’s import and export market performance, together with the weakened investor confidence in financial markets over the US bank crisis, will potentially slow down Hong Kong’s economic recovery.”

“We are also cautious about this year’s land sales programme results,” Lee said. “If there are more failed tenders or transactions at lower-than-expected bidding prices, property prices will continue to face downward pressure.”

These revised forecasts come after housing transaction volume nosedived close to 40 per cent to 47,217, the lowest since 1996.

Separately, Midland Holdings, the only listed property agency in the city, reported a net loss of HK$533.97 million (US$68.02 million) for last year, compared with a profit of HK$100.21 million a year ago, according to its exchange filing on Tuesday.

The agency said it expects to see a surge in transaction volume as well as a 10 per cent rise in home prices this year.