Climate finance: China says 193 green bonds worth US$35 billion meet EU standards, enhancing lure for overseas investors

- The previously issued bonds comply with the common-ground taxonomy (CGT) for climate-mitigation projects, says China’s Green Finance Committee

- CGT stamp of approval expands pool of investible green bonds and removes risk of greenwashing accusations, experts say

China’s main guidelines issuer for green finance has announced that 193 previously issued green bonds meet the standards of both China and the European Union, a stamp of approval that allows more international investors to back Chinese climate-mitigation projects.

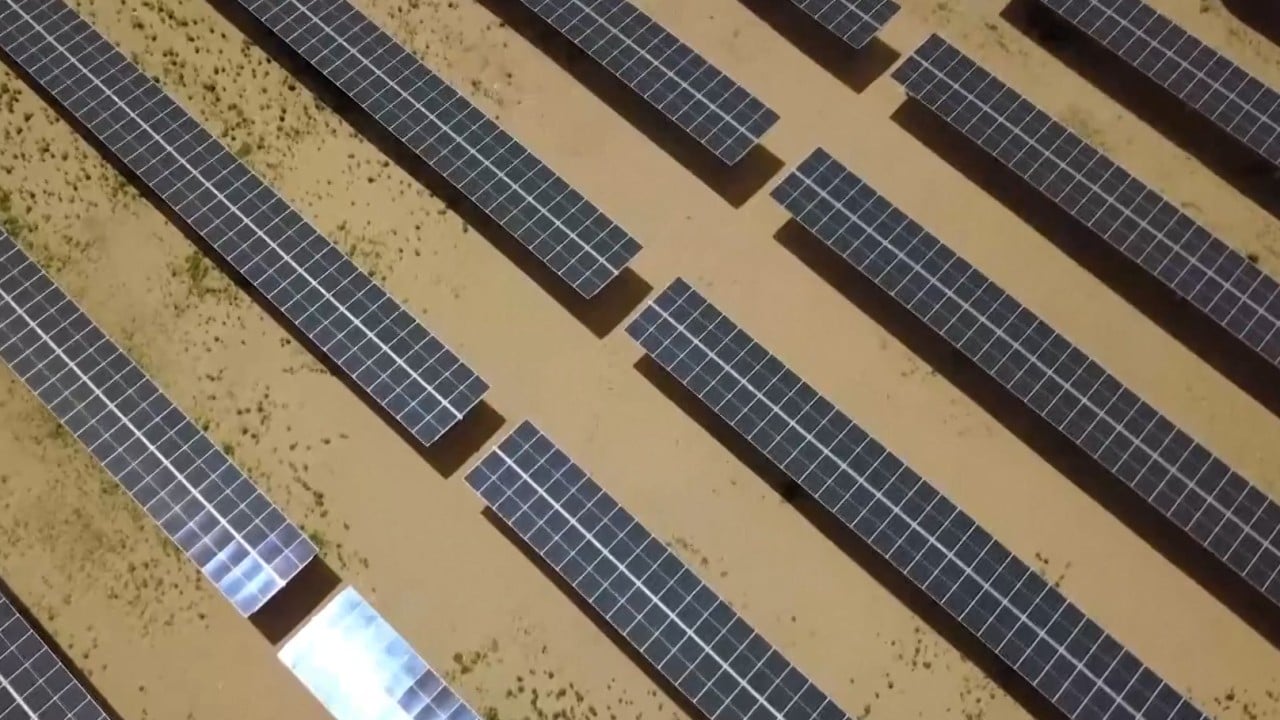

The first batch of 193 bonds, which raised 251.3 billion yuan (US$35 billion) between 2016 and this year for their issuers – primarily state-backed public transport and clean-energy companies – fully comply with the common-ground taxonomy (CGT) announced jointly by China and the EU in June last year, according to the committee.

“The Green Finance Committee expert group’s effort is an important innovation to expand the use cases of the CGT,” said the committee’s chairman Ma Jun in a statement on Friday. “This initiative will also help enhance the openness of China’s green bond market to global investors.”

All 193 bonds are traded in China’s interbank bond market and have maturity dates later than March 31 this year.

Previously, investors supporting projects that only met China’s definition of “green”, were exposed to risk of greenwashing accusations, for investing in projects where claims of environmental benefit could not be substantiated.

Since the CGT’s launch, many Chinese issuers have issued green finance products in the international market using the CGT as a labelling tool.

“As one of the largest green bond markets, China’s initiative to relabel existing green bonds using the CGT is a great innovation,” said Sean Kidney, CEO of Climate Bonds Initiative, a London-based international non-profit organisation. “It will support increased cross-border flows of green capital and encourage more countries and regions to join the CGT.”

The International Platform for Sustainable Finance’s taxonomy working group, co-chaired by China and the EU, developed the CGT.

The working group recently announced its phase two work plan, encompassing a broadening of the CGT’s jurisdictional reach and the expansion of its activity coverage.