Exclusive | Hong Kong needs art financing ecosystem to complement efforts in luring global family offices to city, industry players say

- Art collections and financing are major priorities for family offices because the richest clans want to develop and protect their legacy, Manulife’s Damien Green says

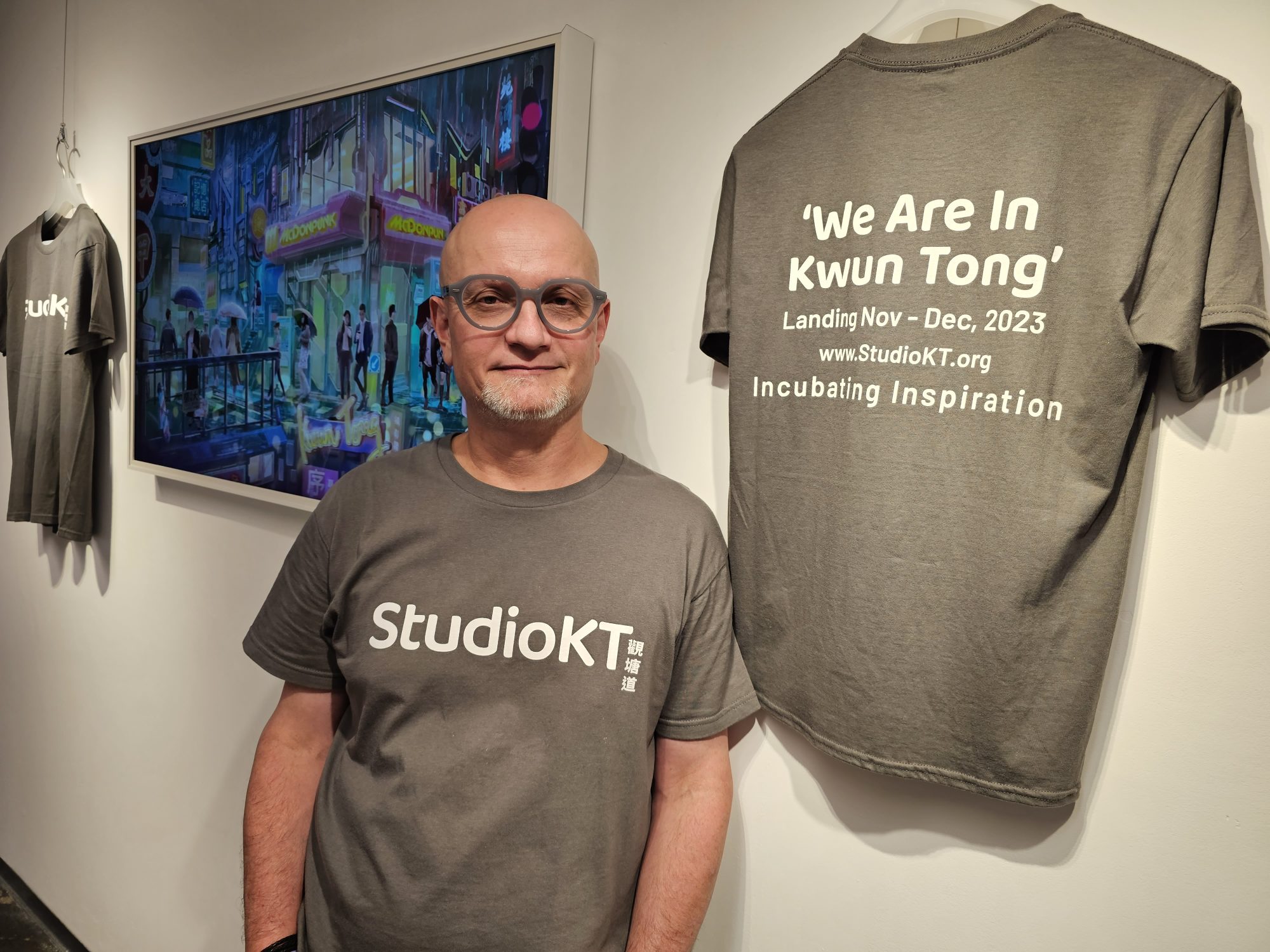

- Green’s StudioKT to open in Kwun Tong on November 25, creating a platform and opportunity for local artists to connect with global family offices

Hong Kong has the potential to become a fundraising hub for arts and entertainment projects to complement its efforts in attracting global family offices to the city, according to industry players.

Art collections and art financing are major priorities for family offices because the world’s richest clans want to develop and protect their legacy, according to Damien Green, non-executive chairman at Manulife Financial Asia.

“Family offices are not just talking about investment in stocks, bonds or real estate, but they also invest their wealth in arts and cultural development as a means of giving,” he said. “What we need in Hong Kong is a complete art financing ecosystem to make the city even more attractive to family offices.”

HSBC, the biggest commercial bank of the city, in March started offering art financing loans. Other private banks including JPMorgan, Citigroup and auction houses such as Sotheby’s and Christie’s also provide art-secured loans.

Promoting arts should be a major part of the plan to turn the city into a regional family office hub, Green said. While there are many large auction houses and art galleries to link elite artists and art investors, Hong Kong does not have many platforms to connect local artists with international family offices.

Green is doing his bit. He will open StudioKT on Saturday, a personally funded 400 sq ft studio in Kwun Tong, to enable hundreds of local artists connect with global family offices and other art investors.

About 25 artists have already signed up as “StudioKT Creators” to exhibit their works for free for companies, investors as well as family-office managers. They can visit the studio in person or host client’s events, said Green, who has also invested in cloud based technology to showcase the artworks online to overseas investors.

“Hong Kong has always been a superconnector between the West and the East, and we want the city to further play this role to link up young artists with art investors worldwide,” he said. “It will help Hong Kong realise its full potential as a creative arts and culture centre” and replicate the success in South Korea, he added.

South Korea had cultural exports worth US$10.3 billion in 2021, ranging from films, music, K-drama and K-pop, or about 2.6 per cent of its overall exports, according to data from OECD. That is 10 times more than similar exports by Hong Kong, according to government data.

South Korean movie “Parasite” won four Academy Awards in 2020, while Korean boy band BTS and girl group Blackpink and K-dramas like Squid Game are some of its most popular “brands” worldwide.

“Hong Kong has all the successful ingredients needed for developing an art and culture export industry like South Korea,” Green said. “What we need is just to build up the ecosystem to nurture the local artists and promote them on the world stage.”

Hong Kong is emerging as an attractive location for family offices to invest in musical talent from the city and across Asia, said Kelvin Avon, co-founder of music management company MAD MoFo and a music producer, songwriter and mix engineer.

MAD MoFo is raising funds in Hong Kong to further develop its artist management business. It has received investment from family offices attracted by some of its successful collaborations with local Cantopop singers including Eason Chan and Sandy Lam.

“Hong Kong is my home. The city is entering a new musical golden age powered by its emerging role as a leading destination for the arts,” Avon said. “We are seeing more and more family offices and other funds investing in arts-related projects, including music and entertainment.”

“We believe we can find the next Taylor Swift in Asia and bring that talent to the world stage, in the same way South Korea promotes K-pop and K-drama globally,” he added.