Why home prices in Hong Kong won’t rebound despite the removal of property curbs

- The measures withdrawn include stamp duties that targeted non-permanent residents and second-time buyers

- Hong Kong’s monetary authority also relaxed the city’s lending policies on Wednesday, offering more mortgage loans to bolster the city’s sluggish real estate industry

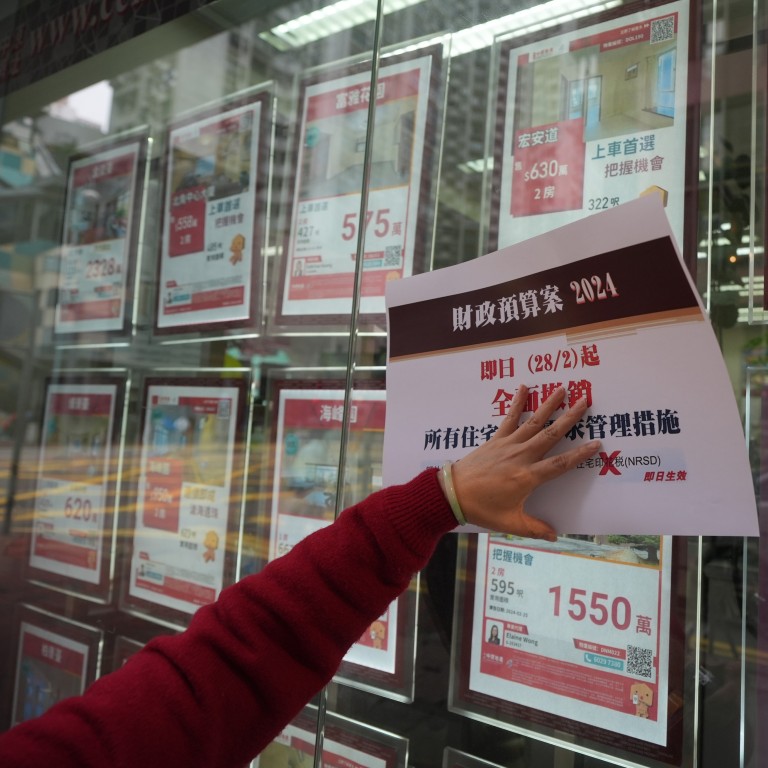

Hong Kong has scrapped all its decade-old property market curbs in a drastic bid to revive the ailing sector, after the city’s home prices fell for nine straight months dragging the official home price index down to a seven-year low.

Analysts say these measures are unlikely to trigger a rebound in prices, as the prevailing weakness has been due to elevated borrowing costs, a sluggish economy, and a bloated supply pipeline. Still, they expect the price decline to slow down and transaction volumes to rise, while encouraging property developers to put more projects on the market as a result of Wednesday’s announcement.

“We have been closely monitoring the situation in the residential property market,” said Financial Secretary Paul Chan Mo-po in his budget speech on Wednesday. “After careful consideration of the current overall situation, we have decided to revoke all residential property demand management measures with immediate effect.

“We consider that the relevant measures are no longer necessary amid the current economic and market conditions.”

The measures withdrawn include Buyer’s Stamp Duty (BSD) that targeted non-permanent residents and a New Residential Stamp Duty (NRSD) for second-time purchasers. Also, homeowners will no longer be required to pay a Special Stamp Duty (SSD) if they sell within two years.

Joseph Tsang, chairman of JLL in Hong Kong, expects home sales to increase significantly by 10 to 15 per cent in 2024 as a result of these measures. He also foresees a slowdown in the pace of decline in property prices leading to market stability.

“The negative factors such as high interest rates and a weak economy still exist and simply withdrawing the measures is not enough to reverse the downward trend,” said Tsang, who expects home prices to fall 10 per cent this year.

Hong Kong relaxes decade-old loans curbs to boost property market

JLL said there was a potential housing supply of 109,000 units in the pipeline and it is expected that developers will accelerate the pace of project launches after the unveiling of the budget.

The Hang Seng Property Index surged as much as 2.6 per cent, before surrendering gains. New World Development jumped 2.9 per cent to HK$10.08, Henderson Land advanced 3.4 per cent to HK$22.95 and Sun Hung Kai added 0.8 per cent to HK$78.10.

“Easing property measures came ahead of our/market expectations,” said Jefferies analyst Sam Wong in a note after the budget. “The move will open the Hong Kong residential market to a much wider group of potential buyers from originally mainly local self-occupying buyers. We have been arguing that consensus is excessively bearish on Hong Kong home prices, given resilient end-user demand. We expect home prices to correct by mid-single digits in the first half of this year, and modestly recover in the second half driven by peaking rates.”

The restrictions, combined with rising interest rates and the economic malaise over the pandemic period, halted the bull run, with median home prices plunging by about 21 per cent from their 2021 peak. Prices fell 7 per cent last year, dropping another 1.6 per cent last month.

Ricky Wong Kwong-yiu, vice-chairman and managing director of Wheelock Properties, said the removal “will directly reduce the tax burden on buyers and help drive increased home demand”.

“This withdrawal can truly reflect the market demand for home ownership, stimulate locals and overseas people to purchase homes for their own use, and attract investors to return to the property investment market,” Wong said.

Lifting all property market curbs will help the transaction volume to rebound gradually back to the level of 4,000-5,000 transactions per month, according to Martin Wong, director and head of research and consultancy for Greater China at Knight Frank.

“But it will not lead to the home prices to rebound immediately,” Wong said. “There is already abundant supply in the market now and with the removal of SSD, it will further boost secondary market supply.”

Some home sellers also raised their asking prices, hours after the announcement. Three units in Tseung Kwan O district have raised their asking prices by HK$100,000 to HK$600,000, according to Centaline Properties.

Hong Kong’s finance chief said there is “now room to make further adjustment to the relevant measures and other supervisory policies pertinent to property lending where appropriate, under the premise of maintaining the stability of the banking system”.

Starting immediately, homes valued at less than HK$30 million (US$3.83 million) will be entitled to 70 per cent mortgage financing, compared with the previous rule that granted only 60 per cent credit to flats valued at between HK$15 million and HK$30 million.

Residential property that are valued at more than HK$35 million, considered luxury homes in Hong Kong, will be entitled to 60 per cent mortgage, from 50 per cent previously. For rental property that are not used by the owners, the maximum loan-to-value ratio will be increased to 60 per cent, from 50 per cent.

“We expect an immediate uptick due to this,” said Victoria Allan, founder and managing director of real estate agency Habitat Property. “We have had many mainland Chinese looking to buy, who either do not own property in Hong Kong or are considering a second purchase, but unable to move forward due to the stamp duty.”