Hong Kong’s July home sales fall for the third month as supply glut defies discount war

- A total of 3,723 homes were sold in the private market in July, a decline of 3.5 per cent from the 3,856 units sold in June

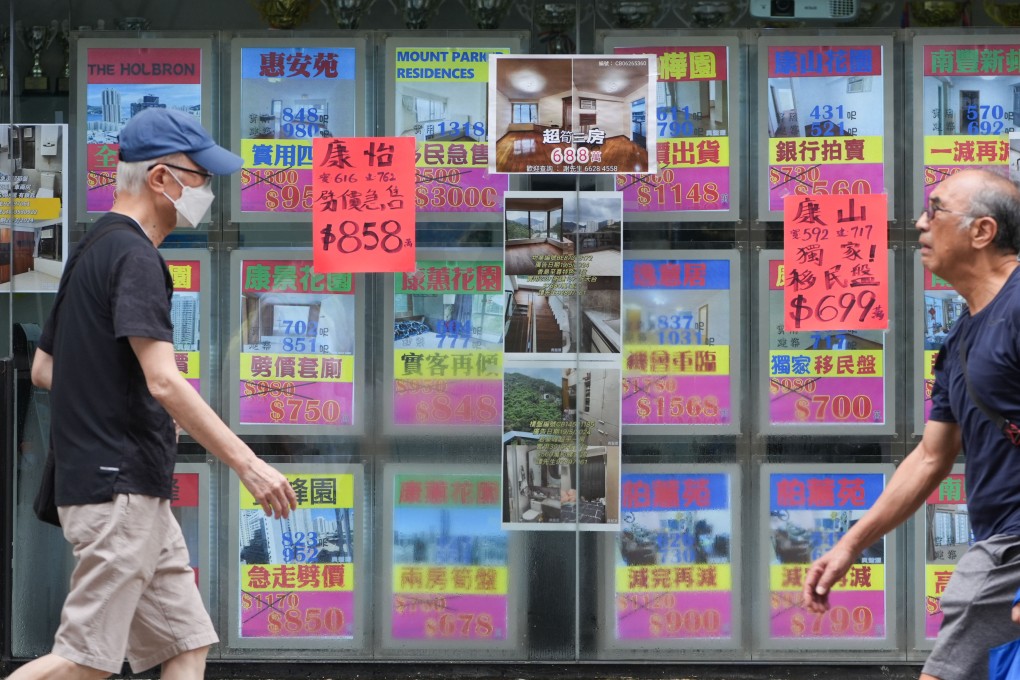

Hong Kong’s home sales fell for the third consecutive month in July, declining by 3.5 per cent from the previous month, as discounts offered by developers failed to attract buyers from the sidelines amid a supply glut.

A total of 3,723 newly built and lived-in homes were transacted in the private market in July, a decline of 3.5 per cent from the 3,856 units sold in June, according to data provided by the Land Registry. The transaction value rose 3.4 per cent to HK$35.67 billion (US$4.56 billion) after the launch of pricier projects such as the Azure Forest flats in Kai Tak, the data showed.

Still, the number of homes sold jumped 21 per cent compared with last year when the city had just emerged from the pandemic, while the sales value surged by 34.2 per cent, the data showed. Total real estate sales, including offices, retail shops, car parks and industrial space, improved by 0.3 per cent, with their combined value rising by 3.8 per cent to about HK$42.67 billion.

Property sales jumped in March and April after the government scrapped some decade-old tariffs, in the form of a Buyer’s Stamp Duty aimed at non-permanent residents and a New Residential Stamp Duty for second-time purchasers. Owners were also spared a special stamp duty if they were to flip their property within two years.

The Hong Kong Monetary Authority followed with its own easing measures. Homes valued at less than HK$30 million are now eligible for 70 per cent mortgage financing, compared with the previous cap of 60 per cent for flats valued between HK$15 million and HK$30 million.