Emperor’s financial struggle mirrors the current state of Hong Kong’s property sector

Group controlled by tycoon Albert Yeung is struggling with debts of HK$16.6 billion, while losses have more than doubled to HK$4.74 billion

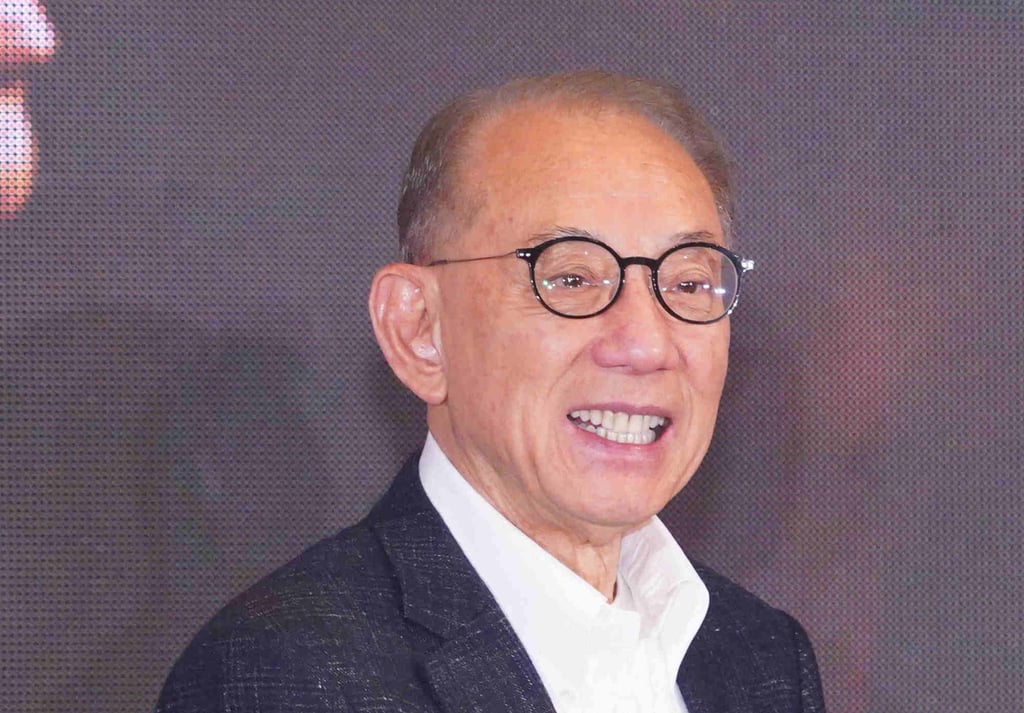

Emperor’s full-year loss of HK$4.74 billion (US$600 million) for the year ended March 2025, more than double the HK$2.04 billion a year earlier, reveals the severity of the crisis facing the sector. The group, controlled by 82-year-old tycoon Albert Yeung Sau-shing, disclosed that bank borrowings totalling HK$16.6 billion were overdue and some associated loan covenants had been breached.

“The broad issues faced by Hong Kong developers in the current environment would be weak property valuation and soft earnings from poor sales,” said Xavier Lee, an equity analyst at Morningstar. Lee did not specifically comment on Emperor’s predicament, but gave a general overview of the challenges developers face in the current environment.