China sovereign wealth fund may cut US debt holdings

China’s sovereign wealth fund, which has more than US$480 billion in assets, could cut holdings of US Treasury Bonds as they are becoming a less attractive investment.

China’s sovereign wealth fund, which has more than US$480 billion in assets, could cut holdings of US Treasury Bonds as they are becoming a less attractive investment, state media said on Tuesday.

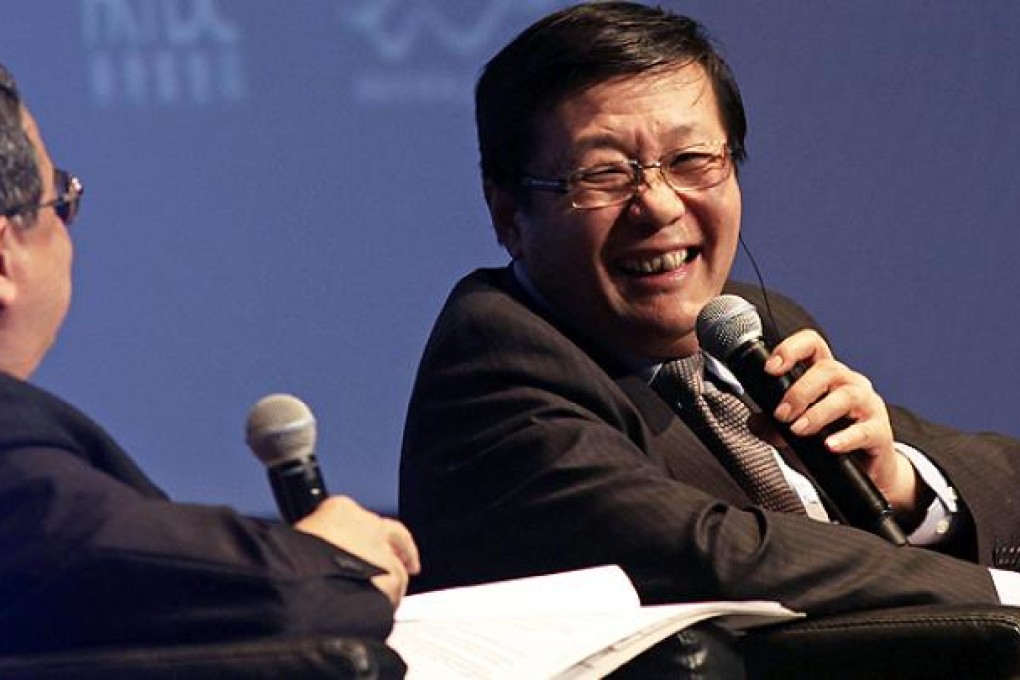

The quoted Lou Jiwei, chairman of sovereign wealth fund manager China Investment Corporation (CIC), as telling a conference in Hong Kong on Monday that the US economic recovery had made other investments appealing.

China has the world’s largest foreign exchange reserves and according to US government figures is the largest foreign holder of US Treasuries with US$1.16 trillion at the end of October last year, the latest available statistic.

“In line with the future US economic recovery, the appeal of US debt is weakening,” Lou said. “From a long-term perspective, it is not a good investment target.”

However, he added that completely stopping buying of US Treasuries could hurt the fund’s ability to manage risk.

“For this reason, CIC’s method is to buy relatively less US debt with hopes of allocating more to stocks and other assets,” Lou said, without specifying whether he was specifically referring to US-dollar assets.