CCB expects loan quality to remain stable this year

Construction Bank says the worst is behind it, after suffering rising bad loans last year

The worst is over for China Construction Bank (CCB) in terms of piling up bad loans, after the collapse of a slew of manufacturing businesses last year dented the lender's assets.

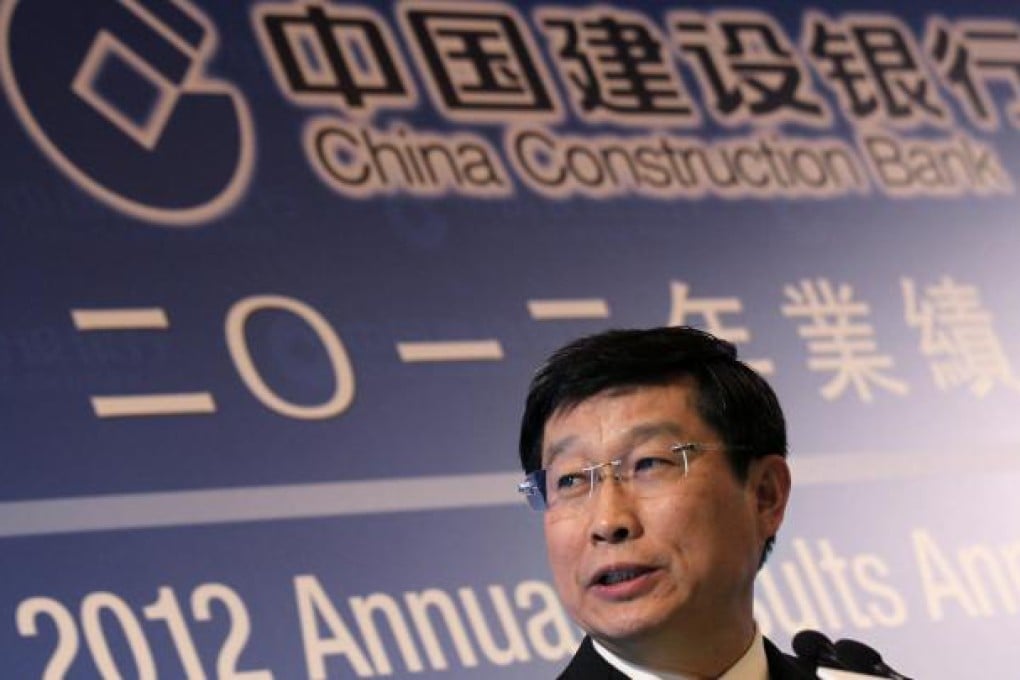

Zhang Jianguo, president of CCB, the mainland's second-largest lender by assets, said he expects asset quality to "remain stable" this year.

"Bad loans rose last year mainly because the economic transformation hit some companies in the Yangtze River Delta, especially those in Zhejiang province. The worst is over now," he said.

Mainland manufacturers were hit hard by sluggish external demand and rising land and labour costs at home. The central government is looking to engineer an economic restructuring to increase the economy's reliance on domestic consumption and shift focus to industries with higher added value.

"As the economy has entered an era of single-digit growth, banks should seek a more prudent development model," Zhang said, after the lender's financial report was released on Sunday showing its net profit grew 14 per cent last year - the slowest since 2006.

"2013 will be a less difficult year compared with 2012." chairman Wang Hongzhang said at a press conference in Hong Kong.